- Finance

- August 5, 2024

The Ultimate Guide to Credit Cards in India

In today’s digital world, digital money is an indispensable part of finance. Therefore, this guide tells you everything you need to know about credit cards in India, from the basics to more advanced ways to use them.

What are Credit Cards?

When faced with surreal specimens of credit cards featuring exquisite designs and various pictures, people often need clarification about the true economic value of these cards.

Credit cards are a type of financial tool that allows an individual to borrow money from a bank or any other financial organization to buy something. They enable you to shop at present and make payment afterwards, unlike debit cards that instantly withdraw cash from your account.

How do credit cards work?

When you use a credit card, you’re essentially taking a short-term loan from the card issuer. At the end of each billing cycle, you will receive a statement that provides a summary of your purchases and the total amount that needs to be paid. You can pay the minimum amount or the full amount. Interest will be added to any sum that is not paid in full.

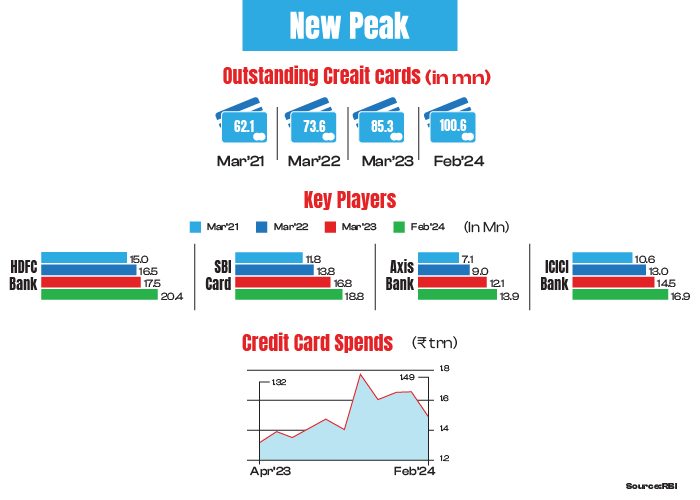

The Credit Card Market in India

In recent years, the credit card industry in India has experienced substantial growth. The Reserve Bank of India (RBI) reported in March 2023 that there were more than 84 million credit cards in use in the country. This number reflects a 20% year-on-year increase, which shows the growing preference for credit cards among Indian consumers.

Types of Credit Cards

There are many types of credit cards, each made to fit a different set of wants and ways of life.

1. Rewards Cards: Reward cards give you points or cash back when you buy things

2. Travel cards: They give passengers perks like air miles and access to airport lounges

3. Fuel cards: Help you save money when you buy gas

4. Shopping cards: Provide exclusive discounts at partner stores

5. Business credit cards: Designed to help businesses pay for corporate expenditures

6. Student credit cards: They have lower credit amounts and are made specifically for college students

7. Credit cards with zero balance: No need to maintain a minimum balance

8. Premium cards: Provide exclusive perks for individuals with substantial incomes

Credit Cards for Students in India

Students in India are preferring credit cards massively these days. Usually, such cards offer:

- Lower credit limits

- No or low annual fees

- Cashback on educational expenses

- Discounts on books and online courses

Many banks in India, including SBI, ICICI, and Axis Bank, offer student credit cards. These cards can be used by college students to establish their credit histories at an early age, and this is quite helpful for them in the long run.

How to Apply for a Credit Card Online

To apply for a credit card online, just follow these steps:

1. Explore various card options

2. Verify your eligibility

3. Collect the required documents, such as identification proof, address proof, and income proof.

4. Check out the bank’s website or a comparison portal.

5. Complete the online application form

6. Submit the necessary documents

7. Submit the application and patiently await approval.

The introduction of completely digitized application procedures has made it easy to apply for an Indian bank account. Customers can apply for an account without any stress in the comfort of their own homes.

Benefits of Using Credit Cards

There are several reasons why one should use a credit card:

- Convenience: Easy and secure way to make purchases

- Build Credit History: Regular use and timely payments help build a good credit score

- Rewards: Earn cashback, points, or miles on purchases

- Interest-Free Credit: Most cards offer a 45- to 50-dday interest-free period

- Insurance: Many cards offer purchase protection and travel insurance

- EMI Options: Convert large purchases into easy monthly installments

Business Credit Card Benefits

Business credit card benefits can be particularly advantageous for entrepreneurs and companies.

- Separate personal and business expenses

- Higher credit limits

- Expense tracking and reporting tools

- Additional cards for employees

- Travel perks for business trips

- Cashback or rewards on business-related purchases

A study by Accenture found that 82% of Indian SMEs believe that digital payments, including credit cards, have had a positive impact on their business growth.

Managing Credit Card Debt

While credit cards offer numerous benefits, they can also lead to debt if not used responsibly. Here are some debt management tips:

- Pay your full balance each month

- If you can’t pay in full, pay more than the minimum due

- Keep your credit utilization below 30% of your limit

- Avoid cash advances, which often have high interest rates

- Set up automatic payments to avoid late fees

- Consider transferring the balance to a lower-interest card if you have high-interest debt

Financial Planning with Credit Cards

Credit cards can be a useful tool in your overall financial planning strategy.

- Use rewards cards strategically to maximize benefits

- Take advantage of 0% APR offers for large purchases

- Use credit card statements to track spending and create a budget

- Build and maintain a good credit score for future loan approvals

- Consider using a credit card for recurring bills to streamline payments

Zero Balance Credit Cards

Zero-balance credit cards are becoming popular in India. These cards:

- Don’t require a minimum balance in a linked savings account

- Often have lower income requirements

- May have lower credit limits initially

- It can be a good option for first-time credit card users

Credit Score and Credit Cards

Your credit score plays a crucial role in your credit card journey.

- A good credit score (750+ in India) can help you qualify for better cards

- Regular credit card use and timely payments can improve your score

- Late payments or high credit utilization can negatively impact your score

According to TransUnion CIBIL, as of 2023, the average credit score in India is 715, which is considered “good” but leaves room for improvement.

Credit Card Security

With the rise of digital transactions, credit card security is more important than ever.

- Never share your PIN or CVV

- Enable transaction alerts on your mobile

- Regularly check your statements for unauthorized transactions

- Use secure networks when making online purchases

- Consider virtual credit cards for online shopping

From FY 2021–22, 34.6% of all banking frauds in India were reported by the RBI as being committed using credit cards, highlighting the necessity of being alert.

Future of Credit Cards in India

The credit card industry in India is evolving rapidly.

- Increased integration with UPI and mobile wallets

- rise of contactless payments

- More personalized rewards and offers

- Enhanced security features like biometric authentication

- Growth in co-branded cards with popular brands

A report by Mordor Intelligence projects the Indian credit card market to grow at a CAGR of 25% between 2021 and 2026.

Are you Ready for that Swipe?

Credit cards, when utilized properly, are one of the most effective financial instruments. They are quite useful to consumers because they are easy to obtain, come with benefits in the form of rewards, and help to establish a credit history. Nonetheless, they need to be used wisely, avoiding situations that can lead to debt and other problems.

Raghuram Rajan, former Governor of the Reserve Bank of India, once said, “Credit cards are a great invention, but they can be a curse if not used wisely.” This sentiment encapsulates the essence of credit card usage—a tool that requires knowledge and discipline to be truly beneficial.

There’s a credit card out there for you, no matter whether you’re a student seeking your first one, a professional wanting to maximize rewards, or a business owner aiming to streamline expenses. You can take full advantage of what these financial tools offer by understanding credit cards and making strategic use of them.

Remember, the success of credit card usage is based on informed decisions and responsible monetary behaviour. Start learning continuously when you start using your credit card, be alert throughout its offerings, and use them so that they assist you in attaining your desired financial objectives.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024

3CopdiPe4LA

ラブドール 賢明なシリコーンのセックス人形の運命はあなたが思っている以上に役立つセックス人形はセックス人形と大人のおもちゃの道徳的な批判の違いを認めるべきです

Discover the natural ingredients in Husband Material that promote wellness. Explore our natural ingredients

Corporate trustworthiness cards are the underlying key to the problem. It’s not intuitive, but with the financial self-determination you’re able to open out all unsatisfactory commerce operations rapidly. No personal guarantees are required (if you do it just, anyway). I well-grounded the ropes from https://businesscred.it/en/about-us

and their corporate credit counsultants, fractional CFOs, and AI agents really augmented the interchange formation info and business belief construction mini course.

Long story short, investing in the right SEO tools, like https://seo.aliendb.org, can transform your business from being buried in search results to being a top contender in your niche.

As my father used to say: help with JSON, AI/ML custom solutions, and JSON data science.

I love it. I never could afford this kind of thing until I expanded my small business’ corporate credit with https://businesscred.it

Hello to all, the contents existing at this website are truly remarkable for people knowledge, well, keep up the good work fellows.

Ahaa, its fastidious dialogue about this post here at

this website, I have read all that, so now me also commenting at this place.

When someone writes an article he/she keeps the plan of

a user in his/her mind that how a user can know it. Therefore that’s why this post is amazing.

Thanks!

What i don’t understood is in reality how you’re no longer

really a lot more neatly-favored than you may be now.

You’re so intelligent. You know thus considerably relating to

this subject, produced me in my opinion consider

it from a lot of varied angles. Its like women and men don’t seem

to be involved except it’s one thing to do with Girl gaga!

Your personal stuffs outstanding. At all times care for it

up!

Heya this is kinda of off topic but I was wanting to know

if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding expertise so I

wanted to get advice from someone with experience. Any help would be enormously appreciated!

My developer is trying to convince me to move to .net from PHP.

I have always disliked the idea because of the expenses.

But he’s tryiong none the less. I’ve been using WordPress on numerous websites for about a year and am anxious about switching to another

platform. I have heard good things about blogengine.net.

Is there a way I can import all my wordpress content into it?

Any kind of help would be greatly appreciated!

My brother suggested I might like this web site.

He was totally right. This post truly made my day. You can not imagine just how much time I had spent for this info!

Thanks!

Hurrah, that’s what I was searching for, what a data! existing here at this website, thanks admin of this website.

Hello there, You’ve done an excellent job. I will certainly digg it and personally recommend

to my friends. I am confident they’ll be benefited from this website.

This paragraph is actually a pleasant one it helps new web people, who are

wishing in favor of blogging.

This information is priceless. Where can I

find out more?

For most up-to-date information you have to pay a quick

visit world wide web and on the web I found this web page as

a best web site for most up-to-date updates.

I don’t even know how I ended up here, but I thought this post was great.

I do not know who you are but certainly you are going to a famous blogger if you are

not already 😉 Cheers!

I’m not positive the place you are getting your info, but good topic.

I needs to spend some time studying much more or figuring out

more. Thanks for fantastic information I was on the lookout for this info for my mission.

What’s up, its good article regarding media print,

we all be aware of media is a enormous source of data.

After checking out a few of the blog articles on your web page, I honestly like your technique of

writing a blog. I book marked it to my bookmark site list and will be checking back soon.

Take a look at my website too and let me know what you think.

I’m not that much of a online reader to be honest but

your sites really nice, keep it up! I’ll go ahead and bookmark your website to come back later on. Cheers