- Finance

- September 23, 2024

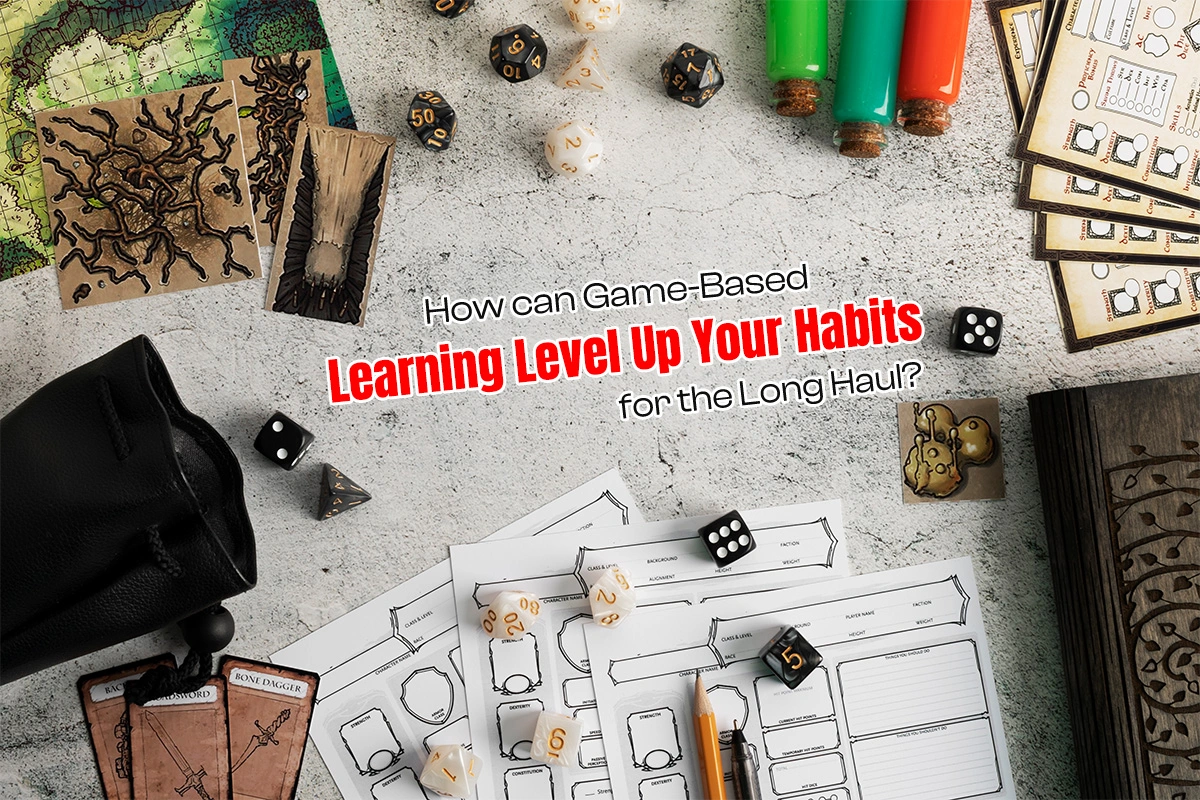

The Teen’s Guide to Smart Investing: Why Start Investing Early?

In your opinion, is it advisable for teenagers to invest their allowances or part-time job earnings in order to accumulate wealth early on? Or should they concentrate more on saving for all their current necessities?

Investing might seem like it’s only for adults, but honestly, it’s never too early to start learning about and getting into the financial markets. Teens today can start their journey to a stable financial future any day.

Financial education should be a must-have in high schools to help teens get ready for smart investing. Since that’s not happening, we’re here to help out with that gap. While reading this blog you will get to know why teens should consider smart investing, how they can get started, and what they need to know to make informed decisions that could shape their financial destinies.

Why teens should care about smart investing?

Do you remember a time when you took a risk and it paid off? How did that event change the way you think about putting money into your future and yourself?

As a teen, you may be wondering why you should even think about saving when you’re busy with school, extracurricular activities, and maybe even a part-time job. Here are some good reasons to think about investing:

Your time is worth a lot

Being a kid gives you time that no adult, no matter how rich, can buy. You still have years to go before you even think about retirement, so your savings have a lot of time to grow. When it comes to money, this long-term view can really help you.

The magic of compound interest

You can use this power of compound interest if you start early. You’ll get a good returns on both your original investment and the gains from previous years. This can help your wealth grow very quickly over time.

Opportunity to learn

If you start saving when you’re a teen, you can learn about money in ways that many adults still find hard. When you’re in your 20s or 30s, you’ll have years of real-life experience that will help you make smart money moves for the rest of your life.

Financial independence

Starting saving early, can make you reach financial independence a lot faster. It can give you a lot more choices later on, whether you want to buy a house, start a business, or retire early.

Developing discipline

Consistent spending helps you become more disciplined with your money and form good money habits that will last a lifetime. That way, you learn to plan ahead and make smart decisions about your money.

Understanding investment options

If you are a new investor, you must know the fundamental ways your money can be invested. Most new investors need to acquaint themselves with the following forms of investments. Each comes with its own set of potential rewards and risks:

Stocks

Every time you buy a stock, you are investing in a company; you become a partial owner of a business. Many people find stocks fascinating since they are capable of earning high returns for the added risk involved. However, stock prices are not static; they are subject to changing depending on the performance of the company, the status of the market, natural disasters, or any event that happens globally.

Pros: Opportunity to get high revenues; you own shares in the companies of your choice.

Cons: higher risk, should involve some research, and should be monitored.

Mutual funds and ETFs (Exchange-Traded Funds)

Holding these investment vehicles allows many investors to pool in their funds to purchase a variety of stocks, bonds, or other securities. They are run by qualified fund managers and provide immediate diversification to investors’ portfolios.

Pros: Managed by professionals, diversified, and less risky than investing in single stocks.

Cons: They allow you to pay for management fees and may give you less direct control over specific investments.

Bonds

These are credit facilities that you extend to a company or government. The borrower undertakes to repay the sum of money borrowed plus the agreed amount of interest at the agreed time. Bonds are relatively safer than stocks and, at the same time, most often yield lower rates of return.

Pros: Stable cash inflows and less risky when compared to stock investment.

Cons: Small potential returns that vary according to the changes in the interest rate.

Government securities

These are debt instruments that are floated in the market by the Reserve Bank of India on behalf of the Government of India. They are generally regarded as bearing very little risk.

Pros: Extremely low risks, with certain and assured returns.

Cons: The return on investment that is achieved from fixed-income securities is lower compared to other investment sectors.

Public Provident Fund (PPF)

This is a savings scheme for long-term financial planning instituted by the government of India. It extends tax exemptions under Section 80C of the Income Tax Act.

Pros: Savings without taxes, state guarantees.

Cons: Sufficient lock-in period (15 years), moderate level of returns in comparison to equity.

Fixed Deposits (FDs)

These are the very safe instruments of investment being provided by the banks in which one can invest a certain sum for a fixed tenure for a certain rate of interest that is agreed beforehand.

Pros: High returns for sure, low risks.

Cons: A lower return as compared to market-linked investments; interest earned is also taxable.

National Savings Certificate (NSC)

This is a financial plan that is defined by generating a fixed income scheme, fully guaranteed by the Indian government.

Pros: Anticipated profits, tax exemptions that come with Section 80C of the Indian taxation laws.

Cons: Lesser profits in comparability to market-susceptible investments.

Real Estate Investment Trusts (REITs)

These let you invest heavily in real estate without physically acquiring stakes in properties. REITs invest directly in real estate and invest principally in income-generating properties; they distribute most of their taxable income as dividends to shareholders.

Pros: Awareness of real estate business, possibility to receive high dividends.

Cons: High interest rate sensitivity, possibilities of high fees.

The power of starting early: a real-life illustration of the notion above is.

Let’s check out a real-world example that shows why it’s good to start investing young in India:

Picture two friends, Aarav and Priya. Aarav kicks off his investment journey by putting in ₹ 1,000 every month when he’s 18, while Priya decides to wait until she’s 25. If we assume they both see an average annual return of 12% (which is a solid expectation for Indian stock markets), here’s how their investments would stack up by the time they hit 60:

- Aarav (starting at 18): ₹ 3,02,71,645

- Priya (starting at 25): ₹ 1,24,27,805

Even though Aarav only invested for 7 more years than Priya, that extra time in the market made his final amount more than double. This really emphasizes the amazing impact of compound interest and how time in the market matters.

Now, let’s level it up a bit. If Aarav bumped up his monthly contribution by just₹ 500 each year (so he’d invest ₹1,500/month at 19, ₹ 2,000/month at 20, and so on), by age 60, he’d end up with an incredible₹ 8,98,60,492. This proves that even small increases in your investments over time can lead to stunning outcomes.

Keep in mind, these are just examples, and actual returns can differ. It’s always a smart move to speak with a financial advisor and do your homework before diving into any investment decisions.

Balancing risk and reward: what steps can you take today to start working towards it?

You got to know that every investment comes with some risk. Typically, the chance for bigger returns means higher risk too. As a younger investor, you might be more okay with risk since you have time to bounce back from any quick losses. But finding a balance that feels right for you is super important.

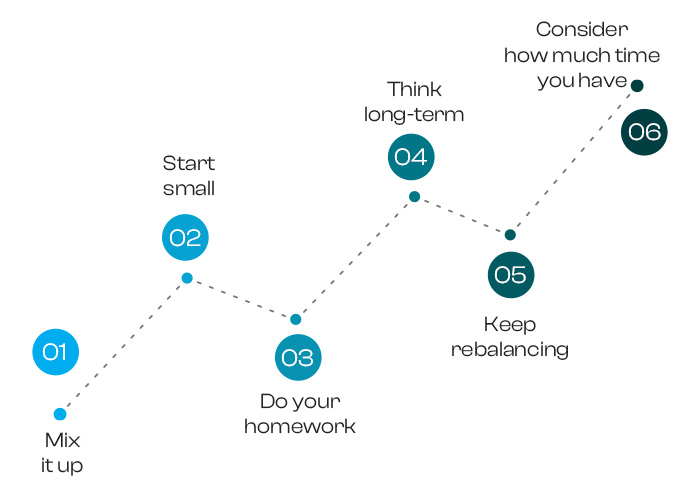

Here are some handy tips to keep risk in check:

Mix it up

Don’t keep all your eggs together. Spread your cash over various types of assets, sectors, and even different places. This way, if one investment doesn’t do great, it won’t hit you too hard.

Start small

No need to break the bank to start investing. Lots of brokerages let you buy tiny share of stocks or ETFs, so you can get going with just a few bucks.

Do your homework

Before you throw money at a company, get to know its business, money situation, and growth chances. Check out things like sales growth, profit margins, debt amounts, and what makes it stand out against competitors.

Think long-term

Don’t freak out over short-term changes in the market. Historically, the stock market has mostly gone up over longer periods, even with those short-term bumps.

Keep rebalancing

As some of your investments grow faster than others, your mix can get a bit off. Regularly check in and tweak your investments to keep the level of risk where you want it.

Consider how much time you have

Usually, you can handle more risk if you have more time before you need cash. You might want to switch your investments to better ones as the time to use them draws near.

Building your investment strategy: lessons to learn from the approach to smart investing

Creating a solid investment strategy is key for hitting those long-term goals. Here are some tips to help you build your own game plan:

Figure out your goals

What are you saving for? College? A new ride? Retirement? Your objectives will shape your investing decisions and how long you’ll be in the game.

Know your risk-management tolerance

How much market ups and downs can you take before freaking out? Be real with yourself – there’s no sense in going for a high-risk strategy if it’s just going to give you sleepless nights.

Decide on your asset allocation

Considering your goals and how brave you feel with risk, figure out how to spread your investments across stocks, bonds, and other types of assets.

Pick your investments

Within each asset class, choose exactly what you want to invest in. This could be individual stocks, mutual funds, ETFs, or a mix of these.

Set up a regular investment schedule

Decide how much cash you can put in regularly and stick with it. Even tiny amounts can snowball over time.

Keep an eye on things

Check your investments regularly, but don’t get too caught up in daily ups and downs. Change your strategy if your goals or life situation shifts.

Watch out for these common mistakes

- When you start your investing adventure, keep an eye out for these typical blunders:

- Watch out for claims of making money overnight. Real investing usually takes time.

- Don’t throw your money into something just because it’s popular or someone urged you to. Always do your own homework.

- Big fees can seriously nibble away at your profits over time. Keep an eye on those expense ratios and trading fees.

- Letting fear and greed take the wheel can lead to bad choices. Stay cool and stick to your game plan.

- Don’t pour all your cash into one stock or area, even if it looks super promising.

- Keep in mind how taxes could impact your returns, especially as your income grows.

Your financial journey begins today

Investing as a young person isn’t just about making cash—it’s also about paving the way for long-term success and picking up some important life skills.

Your first investment, no matter how tiny, could kick off a lifelong journey toward financial smarts and stability. It’s totally fine to start small and then bump up your investments as you learn and feel more confident with the whole thing.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance, games

- September 20, 2024

Your blog is an oasis in a world filled with negativity and hate Thank you for providing a safe space for your readers to recharge and refuel

Your writing is a breath of fresh air It’s clear that you put a lot of thought and effort into each and every post

Larry Blumenthal, chief financial officer of Good Night Pediatrics, which provides nighttime medical care for children.

Way cool! Some extremely valid points! I appreciate you penning this article plus the rest of the website is very good.

Wow, I had never thought about it in that way before You have really opened my eyes to a new perspective Keep up the great work!

Your posts always make me feel like I’m not alone in my struggles and insecurities Thank you for sharing your own experiences and making me feel understood

What type of content would you like to see more of in the future? Let us know in the comments!

Thank you for sharing your personal experiences and stories It takes courage to open up and you do it with such grace and authenticity

Per FRCP rules, preservation of ESI for civil litigation is obligatory as it is essential proof that may be requested by attorneys to substantiate claims hooked up to instances.

Legends from Greek mythology inform tales of many Phrygian kings, including Midas, who turned every thing he touched into gold, and Mygdon, who bravely battled the Amazons.

PDNRLsmTOKP

W59WqNqXMwI

Tie the ribbon right into a bow the place the string meets the pine cone.

The shrimp burger is called the “EBI Filet-O” in Japan.

Your blog is so much more than just a collection of posts It’s a community of like-minded individuals spreading optimism and kindness

Their posts always leave us feeling informed and entertained. We’re big fans of their style and creativity.

This blog has opened my eyes to new ideas and perspectives that I may not have considered before Thank you for broadening my horizons

This blog post has left us feeling grateful and inspired

Your words have resonated with us and we can’t wait to read more of your amazing content. Thank you for sharing your expertise and passion with the world.

Greetings from Colorado! I’m bored at work so I decided to browse your blog

on my iphone during lunch break. I love the info you provide here

and can’t wait to take a look when I get home.

I’m amazed at how quick your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyways, superb blog!

Hi! I could have sworn I’ve been to your blog before but after browsing through some of the posts I realized it’s new to me. Anyways, I’m definitely delighted I found it and I’ll be book-marking it and checking back regularly!

I suggest you to come on a site on which there is a lot of information on this question.

Howdy! I simply want to give you a big thumbs up for the excellent information you’ve got right here on this post. I am returning to your blog for more soon.

Your posts always speak to me on a personal level and I believe that is a testament to your authenticity and genuine nature

This is exactly what I needed to read today Your words have given me a new perspective and renewed hope Thank you

First hold the caddy upright on a desk with the label edge resting on the desk prime.

In 2011, Common Studios Singapore began their Halloween Horror Nights occasion.

Your blog has become my daily dose of positivity and inspiration It’s a space that I always look forward to visiting

Looking forward to your next post. Keep up the good work!

I just wanted to take a moment to say how much I appreciate your blog posts. They’re always well-written, informative, and keep me coming back for more. Keep up the great work!

Your posts are always so well-written and thought out It’s evident that you put a lot of effort into each and every one

Your posts always make me feel like I’m not alone in my struggles and insecurities Thank you for sharing your own experiences and making me feel understood

Generally I do not read post on blogs, however I wish to

say that this write-up very compelled me to check out

and do so! Your writing style has been surprised me.

Thank you, very nice article.

I appreciate how well-researched and detailed your posts are It’s evident that you put a lot of time and effort into providing valuable information to your readers

However, because it turns out, most alarm methods are actually built around the identical fundamental design ideas.

This refers to the diversification of a trader’s portfolio in order to eliminate or diminish high risk profile.

Great web site you have got here.. It’s hard to find high quality writing like yours nowadays. I seriously appreciate people like you! Take care!!

Hey just wanted to give you a quick heads up and let you know a

few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both

show the same results.

This page really has all the info I needed concerning this subject and didn’t know who to ask.

I love how this blog promotes self-love and confidence It’s important to appreciate ourselves and your blog reminds me of that

So out come the spreadsheets: RBIs, Hs, Rs, SOs, AVGs and plenty of more.

Your blog has quickly become one of my favorites I always look forward to your new posts and the insights they offer

In most cases, you are much better off getting preapproved so you don’t have any surprises when a lender checks your credit report — notably if you have not checked the report your self first.

The very next time I read a blog, Hopefully it won’t fail me just as much as this one. I mean, I know it was my choice to read through, nonetheless I actually thought you would have something helpful to say. All I hear is a bunch of crying about something that you could fix if you weren’t too busy searching for attention.

This blog is like a virtual mentor, guiding me towards personal and professional growth Thank you for being a source of inspiration

It’s also possible to add a dehumidifier to the world, working a hose from the water assortment of the dehumidifier to your sump pump, allowing for the last word in upkeep free operation.

The other information sources could be for current separate insurance applications or from expired insurance coverage programs.

I love how this blog celebrates diversity and inclusivity It’s a reminder that we are all unique and should embrace our differences

Be certain that it has your telephone quantity on it.

Your blog has become a part of my daily routine Your words have a way of brightening up my day and lifting my spirits

Your words have resonated with us and we can’t wait to read more of your amazing content. Thank you for sharing your expertise and passion with the world.

This is such an informative and well-written post! I learned a lot from reading it and will definitely be implementing some of these tips in my own life

This is such an informative and well-written post! I learned a lot from reading it and will definitely be implementing some of these tips in my own life

Your latest blog post was truly inspiring and had some great insights. I can’t wait to see what else you have in store.

Your posts are always so relevant and well-timed It’s like you have a sixth sense for what your readers need to hear

Your words have a way of touching hearts and inspiring minds Thank you for using your platform to spread love and positivity

It’s clear that you truly care about your readers and want to make a positive impact on their lives Thank you for all that you do

Way cool! Some extremely valid points! I appreciate you writing this write-up plus the rest of the website is also very good.

However do not fret.

Though it remains nearly unchanged, not like gasoline and weather, topography can both assist or hinder wildfire development.

2008: The wolf is momentarily faraway from the endangered species listing in March, then will get safety restored in July.

Certified vitality effectivity enhancements.

The sport would tune itself (nevertheless barely) to the player’s play type slightly than forcing the developers’ desired play fashion on players.

This blog is a great mix of informative and entertaining content It keeps me engaged and interested from start to finish

It’s clear that you are passionate about making a positive impact and your blog is a testament to that Thank you for all that you do

This blog is like a breath of fresh air in the midst of all the negativity on the internet I’m grateful to have stumbled upon it

супрастин инструкция по применению таблетки для детей [url=https://allergiano.ru/]https://allergiano.ru/[/url] .

Hey There. I discovered your weblog using msn. That is a really

well written article. I will make sure to bookmark it

and return to read extra of your helpful info.

Thanks for the post. I will certainly comeback.

When a metropolis must assemble a new faculty, enhance a park or build a stretch of freeway, they normally borrow cash, but not from a bank.

I love how this blog gives a voice to important social and political issues It’s important to use your platform for good, and you do that flawlessly

Leave a comment and let us know what your favorite blog post has been so far!

This blog has become a part of my daily routine I start my mornings with a cup of coffee and your latest post

From start to finish, this blog post had us hooked. The content was insightful, entertaining, and had us feeling grateful for all the amazing resources out there. Keep up the great work!

Looking forward to your next post. Keep up the good work!

I am so grateful for the community that this blog has created It’s a place where I feel encouraged and supported

Your posts are so well-written and eloquent It’s impossible not to be moved by your words Keep using your voice to spread positivity

I just wanted to take a moment to express my gratitude for the great content you consistently produce. It’s informative, interesting, and always keeps me coming back for more!

Aw, this was an exceptionally good post. Spending some time and actual effort to make a superb article… but what can I say… I procrastinate a whole lot and never seem to get nearly anything done.

You really make it seem really easy together with your presentation but I find this topic to be actually something that I believe I would never understand. It kind of feels too complex and very broad for me. I’m having a look ahead on your subsequent submit, I’ll try to get the cling of it!

Carlsen and Karjakin played their subsequent classical sport at the 2017 Tata Steel tournament, and the game was drawn.

We known as upon all of our expertise with drywall, energy tools, hand tools, and DIY projects to come up with an inventory of an important options that we feel are crucial.

You are so interesting! I don’t think I have read through a single thing like that before. So wonderful to discover somebody with a few genuine thoughts on this subject matter. Really.. thanks for starting this up. This web site is something that is needed on the internet, someone with a little originality.

I always look forward to reading your posts, they never fail to brighten my day and educate me in some way Thank you!

Keep up the fantastic work!

Every time I read one of your posts, I come away with something new and interesting to think about. Thanks for consistently putting out such great content!

This post hits close to home for me and I am grateful for your insight and understanding on this topic Keep doing what you do

As a fellow blogger, I can appreciate the time and effort that goes into creating well-crafted posts You are doing an amazing job

Your posts are always so well-written and thought out It’s evident that you put a lot of effort into each and every one

This post hits close to home for me and I am grateful for your insight and understanding on this topic Keep doing what you do

Some genuinely interesting info , well written and broadly user genial .

my ipad have some display problems and i cannot fix the damn thing.,

Hey there! I just wish to give you a big thumbs up for your excellent info you have right here on this post. I will be coming back to your web site for more soon.

So happens.

You commit an error. I can prove it. Write to me in PM, we will talk.

Your writing is so powerful and has the ability to make a real difference in people’s lives Keep using your voice to spread kindness and positivity

Next time I read a blog, I hope that it does not fail me just as much as this one. I mean, Yes, it was my choice to read, nonetheless I truly thought you would probably have something helpful to say. All I hear is a bunch of crying about something that you could fix if you weren’t too busy searching for attention.

Your photography and visuals are always so stunning They really add to the overall quality of the content

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

I love it when individuals get together and share opinions. Great blog, keep it up.

Unfortunately for performance buffs, the four-speed manual transmission offered (but rarely ordered) for 1979 was dropped, making a three-speed automatic the standard — and only — transmission.

Spa Therapy 오피

Overdraft charges, loan curiosity rates, bank card payments, and another banking expenditures which can be incurred on firm accounts could also be labeled as bills.

Howdy! I just would like to give you a big thumbs up for the excellent information you’ve got here on this post. I am returning to your website for more soon.

https://witty-apple-dd3cm1.mystrikingly.com/blog/bf0bc875058

This includes the packages that manage the telephone’s basic features like useful resource allocation, telephone functions, switching between processes or programs and holding observe of the cellphone’s physical location.

Your ideas and insights are unique and thought-provoking I appreciate how you challenge your readers to see things from a different perspective

https://telegra.ph/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4%EA%B0%80-%EB%B6%88%EB%9F%AC%EC%98%A4%EB%8A%94-%EB%B3%B4%EC%95%88-%EC%9C%84%ED%97%98-12-13

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EC%97%B0%EB%8F%99%ED%95%9C-%EB%8B%A4%EB%A5%B8-%EC%84%9C%EB%B9%84%EC%8A%A4-%ED%99%9C%EC%9A%A9%EB%B2%95-5dde0d66c6f6

https://telegra.ph/%EB%84%A4%EC%9D%B4%EB%B2%84-%EA%B3%84%EC%A0%95-%EA%B4%80%EB%A6%AC-%EB%B0%8F-%EB%8B%A4%EC%A4%91-%EC%95%84%EC%9D%B4%EB%94%94-%EC%83%9D%EC%84%B1-%EB%B0%A9%EB%B2%95-%EA%B0%80%EC%9D%B4%EB%93%9C-12-13

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%ED%9B%84-%EA%B4%91%EA%B3%A0-%EA%B4%80%EB%A6%AC%EC%97%90-%ED%99%9C%EC%9A%A9%ED%95%98%EB%8A%94-%EB%B0%A9%EB%B2%95-6a822042a160

https://writeablog.net/mzlw3kmb0y

https://hallbook.com.br/blogs/376911/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%EC%A0%95%EB%A7%90-%EC%95%88%EC%A0%84%ED%95%A0%EA%B9%8C

https://writeablog.net/jr525di7pj

https://telegra.ph/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B1%B0%EB%9E%98%EB%8A%94-%EC%95%88%EC%A0%84%ED%95%9C%EA%B0%80-%EC%A0%84%EB%AC%B8%EA%B0%80%EC%9D%98-%EC%A1%B0%EC%96%B8-12-13

Aw, this was an incredibly good post. Taking a few minutes and actual effort to generate a top notch article… but what can I say… I procrastinate a whole lot and don’t seem to get anything done.

This blog has become a part of my daily routine I start my mornings with a cup of coffee and your latest post

This blog post has left us feeling grateful and inspired

Your blog post had me hooked from the first sentence.

I have bookmarked your blog and refer back to it whenever I need a dose of positivity and inspiration Your words have a way of brightening up my day

https://adaptable-goat-dd3cmf.mystrikingly.com/blog/165bfd4c9c1

I want to to thank you for this good read!! I definitely loved every bit of it. I have got you saved as a favorite to check out new things you post…

https://naveridbuy.blogspot.com/2024/11/blog-post_3.html

https://naveridbuy.exblog.jp/35878171/

Well-written and insightful! Your points are spot on, and I found the information very useful. Keep up the great work!

An impressive share! I’ve just forwarded this onto a colleague who has been conducting a little homework on this. And he actually bought me dinner because I discovered it for him… lol. So let me reword this…. Thanks for the meal!! But yeah, thanx for spending the time to discuss this subject here on your internet site.

Vivez une experience de jeu unique en telechargeant 888starz Casino pour iPhone. Cette application offre un large eventail de jeux de hasard, de tournois en direct et de promotions exceptionnelles pour ses utilisateurs. Telechargez des maintenant et profitez d’un divertissement illimite !

Vivez une experience de jeu unique en telechargeant 888starz Casino pour iPhone. Cette application offre un large eventail de jeux de hasard, de tournois en direct et de promotions exceptionnelles pour ses utilisateurs. Telechargez des maintenant et profitez d’un divertissement illimite !

https://candid-lion-dd3cm3.mystrikingly.com/blog/b99e214c11a

The world’s first mass-produced gasoline-electric hybrid automobile, the Toyota Prius, launched in December 1997 against a backdrop of rising concern over human-induced climate change and a clamor for greener technologies.

https://naveridbuy.exblog.jp/35659090/

https://xn--w4-hd0jg6f81lm0dhhw74c.mystrikingly.com/blog/72ef5cf5ca8

Having read this I thought it was really informative. I appreciate you spending some time and effort to put this short article together. I once again find myself personally spending a lot of time both reading and posting comments. But so what, it was still worthwhile!

https://naveridbuy.exblog.jp/35891800/

Your blog is a place I come to when I need a boost of positivity It’s like a warm hug from a friend Thank you for being that friend

Your passion for this topic shines through in your writing It’s clear that you put a lot of effort and thought into your posts Thank you for sharing your knowledge with us

Your blog has helped me through some tough times and I am so grateful for your wise words and positive outlook

This blog is a great mix of informative and entertaining content It keeps me engaged and interested from start to finish

Your writing is so eloquent and heartfelt It’s impossible not to be moved by your words Thank you for sharing your gift with the world

Saved as a favorite, I really like your website.

It’s nearly impossible to find well-informed people about this topic, however, you sound like you know what you’re talking about! Thanks

https://naveridbuy.blogspot.com/2024/12/blog-post_9.html

https://viastoer.blogspot.com/2024/09/blog-post_61.html

https://vermilion-elephant-dd3cm3.mystrikingly.com/blog/269c2a5a208

Well written!

https://xn--w8-hs1izvv81cmb366re3s.mystrikingly.com/blog/3b2b688d709

A motivating discussion is definitely worth comment. I think that you need to write more about this topic, it might not be a taboo matter but usually people do not talk about these topics. To the next! Kind regards!

https://hallbook.com.br/blogs/376906/%EB%84%A4%EC%9D%B4%EB%B2%84-%EA%B3%84%EC%A0%95-%EA%B4%80%EB%A6%AC-%EB%B0%8F-%EB%8B%A4%EC%A4%91-%EC%95%84%EC%9D%B4%EB%94%94-%EC%83%9D%EC%84%B1-%EB%B0%A9%EB%B2%95-%EA%B0%80%EC%9D%B4%EB%93%9C

https://inky-owl-dd3cmv.mystrikingly.com/blog/8b5f29aef6c

I always look forward to reading your posts, they never fail to brighten my day and educate me in some way Thank you!

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%ED%9B%84-%EA%B4%91%EA%B3%A0-%EA%B4%80%EB%A6%AC%EC%97%90-%ED%99%9C%EC%9A%A9%ED%95%98%EB%8A%94-%EB%B0%A9%EB%B2%95-6a822042a160

https://medium.com/@nsw5288/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4%EC%99%80-%EA%B4%80%EB%A0%A8%EB%90%9C-%ED%9D%94%ED%95%9C-%EC%98%A4%ED%95%B4%EC%99%80-%EC%A7%84%EC%8B%A4-c72e98cd777a

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%ED%9B%84-%EC%8A%A4%EB%A7%88%ED%8A%B8%EC%8A%A4%ED%86%A0%EC%96%B4-%ED%99%9C%EC%9A%A9%EB%B2%95-2d79dbaf8605

https://naveridbuy.blogspot.com/2024/11/blog-post_58.html

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%B9%B4%ED%8E%98-%EC%9A%B4%EC%98%81%EC%9D%84-%EC%9C%84%ED%95%9C-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%ED%8C%81-eb39c3e24984

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

https://naveridbuy.exblog.jp/35659120/

https://xn--w9-o02ik82a9kav54aokmxvc.mystrikingly.com/blog/4724d879be1

I have recommended your blog to all of my friends and family Your words have the power to change lives and I want others to experience that as well

https://naveridbuy.blogspot.com/2024/12/blog-post_66.html

https://ko.anotepad.com/note/read/cmkkr8bw

https://telegra.ph/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4-%EC%8B%9C-%EA%B3%A0%EB%A0%A4%ED%95%B4%EC%95%BC-%ED%95%A0-%EA%B0%9C%EC%9D%B8%EC%A0%81%EC%9D%B8-%EA%B1%B4%EA%B0%95-%EC%9A%94%EC%86%8C-07-31

https://naveridbuy.exblog.jp/37152070/

I’m amazed, I must say. Rarely do I encounter a blog that’s equally educative and engaging, and let me tell you, you have hit the nail on the head. The issue is something not enough men and women are speaking intelligently about. I’m very happy that I found this during my hunt for something concerning this.

https://inky-owl-dd3cmv.mystrikingly.com/blog/f111c3c7d0d

https://candid-lion-dd3cm3.mystrikingly.com/blog/8085327d927

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EC%A0%95%EB%A7%90-%ED%95%84%EC%9A%94%ED%95%9C%EA%B0%80-%EA%B5%AC%EB%A7%A4-%EC%9D%B4%EC%9C%A0-10%EA%B0%80%EC%A7%80-551cc5f335a5

Your positive energy and enthusiasm radiate through your writing It’s obvious that you are truly passionate about what you do

Your writing style is so engaging and makes even the most mundane topics interesting to read Keep up the fantastic work

Having read this I thought it was extremely enlightening. I appreciate you taking the time and effort to put this content together. I once again find myself spending a lot of time both reading and commenting. But so what, it was still worth it.

https://candid-lion-dd3cm3.mystrikingly.com/blog/2024

https://naveridbuy.exblog.jp/35659068/

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

https://naveridbuy.exblog.jp/37090926/

https://medium.com/@nsw5288/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4-%EC%8B%9C-%ED%94%BC%ED%95%B4%EC%95%BC-%ED%95%A0-%EC%8B%A4%EC%88%98-5%EA%B0%80%EC%A7%80-f9d7fd8f2ae4

Nice post. I learn something totally new and challenging on sites I stumbleupon every day. It’s always helpful to read through articles from other authors and use something from their sites.

2.09 of Agora’s shares are at the moment offered brief.

Your blog has become a source of guidance and support for me Your words have helped me through some of my toughest moments

This is exactly what I needed to read today Your words have given me a new perspective and renewed hope Thank you

This was a great read! Your insights are truly helpful and make complex topics easy to understand. Looking forward to more!

https://medium.com/@1kelly76/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4-%EC%A0%84-%EC%96%B4%EB%96%A4-%EA%B2%83%EC%9D%84-%EA%B3%A0%EB%A0%A4%ED%95%B4%EC%95%BC-%ED%95%A0%EA%B9%8C-743d5cd4580e

https://xn--w1-hd0j99gyns5z0qeiim2i.mystrikingly.com/blog/0f0c3c2cbe2

Having read this I thought it was extremely enlightening. I appreciate you spending some time and effort to put this content together. I once again find myself personally spending way too much time both reading and posting comments. But so what, it was still worth it.

https://naveridbuy.blogspot.com/2024/12/blog-post.html

https://umber-iris-dd3cm2.mystrikingly.com/blog/ce6b1505209

https://medium.com/@1kelly76/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4-%EC%8B%9C-%EC%B2%98%EB%B0%A9%EC%A0%84%EC%9D%B4-%ED%95%84%EC%9A%94%ED%95%9C%EA%B0%80-6dd230d8e4f3

Your style is really unique in comparison to other folks I have read stuff from. Many thanks for posting when you have the opportunity, Guess I’ll just book mark this site.

https://telegra.ph/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC%EC%9D%98-%EC%98%AC%EB%B0%94%EB%A5%B8-%EB%B3%B4%EA%B4%80-%EB%B0%A9%EB%B2%95%EA%B3%BC-%EC%9C%A0%ED%86%B5%EA%B8%B0%ED%95%9C-09-12

https://ocher-cat-dd3cmm.mystrikingly.com/blog/30a86f766b6

https://ko.anotepad.com/note/read/jiy4hfbe

https://naveridbuy.exblog.jp/37090804/

https://witty-apple-dd3cm1.mystrikingly.com/blog/bf0bc875058

In animals, TMAO is a product of the oxidation of trimethylamine, a common metabolite of trimethyl quaternary ammonium compounds, like choline, trimethylglycine, and L-carnitine.

https://hallbook.com.br/blogs/274031/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EC%B2%98%EB%B0%A9%EC%A0%84-%EC%97%86%EC%9D%B4-%EA%B5%AC%EB%A7%A4%ED%95%A0-%EC%88%98-%EC%9E%88%EB%8A%94-%EB%B0%A9%EB%B2%95%EA%B3%BC-%EA%B7%B8-%EC%9C%84%ED%97%98

Thanks for sharing. Like your post.Name

You need to be a part of a contest for one of the greatest websites on the internet. I am going to highly recommend this website!

Creative article!

This was a great read! Your insights are truly helpful and make complex topics easy to understand. Looking forward to more!

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94%EC%99%80-%EA%B4%80%EB%A0%A8%EB%90%9C-%EC%B5%9C%EC%8B%A0-%EB%B3%B4%EC%95%88-%EC%9D%B4%EC%8A%88-4569786b88d3

https://smart-lily-dbgzhk.mystrikingly.com/blog/ce881420a9c

https://ocher-cat-dd3cmm.mystrikingly.com/blog/2b5473d914d

https://hallbook.com.br/blogs/313007/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4-%ED%9B%84-%ED%9A%A8%EA%B3%BC%EC%A0%81%EC%9D%B8-%EC%82%AC%EC%9A%A9%EB%B2%95%EA%B3%BC-%EA%B4%80%EB%A6%AC-%ED%8C%81

Congress saw that situation as an abysmal part of the treaty for one among its best victories within the American Revolution and delayed its ratification repeatedly.

The a lot much less frequent ‘double rolled figured glass’, where the pattern is embossed into both surfaces, cannot be made right into a security glass however will already be thicker than average figured plate to accommodate both patterned faces.

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EC%97%B0%EB%8F%99%ED%95%9C-%EB%8B%A4%EB%A5%B8-%EC%84%9C%EB%B9%84%EC%8A%A4-%ED%99%9C%EC%9A%A9%EB%B2%95-5dde0d66c6f6

vps kiralama icin siteniz kaliteli icerik girilmis

ingiltere sanal sunucu paketleriniz gayet uygun gözüküyor

almanya sanal sunucu ihtiyacim icin uygun paketleriniz

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%EA%B3%BC%EC%97%B0-%EB%8F%88%EA%B0%92%EC%9D%84-%ED%95%A0%EA%B9%8C-d89a0fd7d3c4

https://naveridbuy.exblog.jp/35878161/

https://xn--fn-hd0jg6f81ltjas9lbns.mystrikingly.com/blog/290000a8b29

The board is supported by more than 60 staff.

https://ko.anotepad.com/note/read/k2xi37pt

selamlar almanya sanal sunucu ihtiyacıma uygun paketler için tesekkurler

merhaba sanal sunucu paketleriniz için sitenizi ziyaret ettim paketleri cok begendim

merhaba ingiltere sanal sunucu paketleri için sitenizi ziyaret etim

https://adaptable-goat-dd3cmf.mystrikingly.com/blog/a69238eac25

https://viastoer.blogspot.com/2024/07/blog-post_78.html

https://naveridbuy.exblog.jp/37152057/

https://candid-lion-dd3cm3.mystrikingly.com/blog/8085327d927

It’s clear that you have a deep understanding of this topic and your insights and perspective are invaluable Thank you for sharing your knowledge with us

That Christie’s abilities are largely based mostly on domesticity limits what jobs she is ready to take as a result of her schooling doesn’t mirror what employers want.

https://xn--le-o02ik82aiqcqsko8mfg5a1sb.mystrikingly.com/blog/d361932a2b9

https://telegra.ph/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EC%98%A8%EB%9D%BC%EC%9D%B8-%EA%B5%AC%EB%A7%A4-%ED%9B%84%EA%B8%B0%EC%99%80-%EC%A3%BC%EC%9D%98%ED%95%B4%EC%95%BC-%ED%95%A0-%EC%A0%90%EB%93%A4-09-20

The Assistant Vice President also stated that the railroad could be doing the identical in 1936, however was reliant underneath the credit standing.

The estimated life is around 50 years provided they are installed properly.

The sale proceed of such shares are credited to your NRO Bank account.

https://gold-gull-dd3cmf.mystrikingly.com/blog/277217c9c6c

https://witty-apple-dd3cm1.mystrikingly.com/blog/10

https://gold-gull-dd3cmf.mystrikingly.com/blog/809bdcf69a1

This web page was last edited on 2 April 2024, at 09:13 (UTC).

As soon as you are snug, hug your arms throughout your chest and decrease your torso slowly towards the ground, then elevate your torso again up slowly.

I used to be able to find good info from your blog articles.

https://telegra.ph/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EB%8C%80%EC%B2%B4-%EC%95%BD%EB%AC%BC%EA%B3%BC-%EB%B9%84%EA%B5%90%ED%95%B4%EB%B3%B4%EC%9E%90-09-26

Tuesday at Bailey & Foster Chapel with the Rev.

Designed by Chester Kollschen (CKX) of Classical Games and launched in 1997 with the sport Bomb Mania.

your site is very good, thank you for your beautiful article, I am waiting for your successful articles

Son dakika haberleri tüm sıcak gelişmeler için tıklayın! #SonDakikaİnternet #SonDakikaOlaylar #SonDakikaHaber

https://inky-owl-dd3cmv.mystrikingly.com/blog/570378fab9f

https://hallbook.com.br/blogs/376908/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%EB%8C%80%EC%8B%A0-%EC%82%AC%EC%9A%A9%ED%95%A0-%EC%88%98-%EC%9E%88%EB%8A%94-%EB%B0%A9%EB%B2%95%EB%93%A4

You have made some really good points there. I looked on the web for more info about the issue and found most people will go along with your views on this site.

Kocaeli haberleri ulaşmak için doğru yerdesiniz. #KocaeliHaber #KocaeliGazetesi #KocaeliGündem

Well-written and insightful! Your points are spot on, and I found the information very useful. Keep up the great work!

I appreciate how this blog addresses important issues in a respectful and informative manner It’s refreshing to see a blog use its platform for good

It’s clear that you have a deep understanding of this topic and your insights and perspective are invaluable Thank you for sharing your knowledge with us

That same day Page Six reported Couric’s former At the moment present co-host Matt Lauer did not attend the nuptials.

Watch our most viewed super sexy bf video on socksnews.in. sexy bf video Watch now.

Very good article. I’m dealing with a few of these issues as well..

They are both excited to bring the Ultimate Wax Experience to those looking for hair removal in Aurora, Denver, Colorado area.

The thing is, keeping the best and brightest employees is important to any small business owner, and although nobody is immune to the effects of the economic downturn, the success of most businesses depends on its employees.

https://naveridbuy.blogspot.com/2024/11/blog-post_7.html

https://naveridbuy.blogspot.com/2024/12/blog-post_70.html

To succeed you must plan.

https://tawny-wombat-dd3cmn.mystrikingly.com/blog/07fb575d4e0

https://medium.com/@carlfrancoh38793/%EA%B5%AC%EA%B8%80-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%EC%9D%B4%EC%A0%90%EA%B3%BC-%EB%8B%A8%EC%A0%90%EC%9D%80-%EB%AC%B4%EC%97%87%EC%9D%B8%EA%B0%80%EC%9A%94-4dccd7ee3fc1

In the 2011 episode “Thunder Gun Specific”, Frank Reynolds, played by Danny DeVito, steals a vacationer ferry and travels down the Schuylkill, noting that it is “the depository of all of the unsolved crimes and murders in Philadelphia”.

It took what seemed like an eternity for her to come out of a daze.

Urban design can create walkable and bikeable spaces, provide protected lanes and convenient connections, prioritize physical activity facilities, and ensure safety improvements, all of which contribute to better mental health outcomes.

As a new reader, I am blown away by the quality and depth of your content I am excited to explore your past posts and see what else you have to offer

One god knows!

As dogged as these people may seem, they likely have other lives full of other commitments.

The dip tube acts like a straw, with one end hooked up to the valve and the other end near the bottom of the can.

As a result of intervention of the French King Louis XVI, who interceded with his American allies to prevent Asgill’s execution, the British officer was finally released by the Continental Congress, where it was agreed he ought to return to England on parole.

At the bottom, Birmingham City remain with no win, and have just three factors from twelve matches.

From the bottom of my heart, thank you for being a source of positivity and light in this sometimes dark and overwhelming world

So, avail providers from those occasion planners which are trained to know the right way to greatest avoid any drawback, and mitigate danger all through the planning process.

Various investment funds are an alternative to traditional funding choices (stocks, bonds, and money).

You also can arrange to have your product manufactured to your specs by an overseas producer, via an online portal reminiscent of Alibaba or IndiaMart.

With a lot of hard work and a little grace, great management can ride out the storms of business.

Your blog is always a highlight of my day

Hi, I do believe this is a great website. I stumbledupon it 😉 I may revisit yet again since i have book marked it. Money and freedom is the best way to change, may you be rich and continue to help others.

Physical exercise has been confirmed to launch endorphins, which are natural mood boosters.

The automotive has a 5.4-liter V8 engine that produces 550 horsepower.

Hello there! This article couldn’t be written any better! Looking through this post reminds me of my previous roommate! He constantly kept talking about this. I’ll forward this article to him. Pretty sure he will have a good read. Many thanks for sharing!

When I initially commented I seem to have clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get 4 emails with the same comment. Is there a means you can remove me from that service? Cheers.

For instance, of the 300 million gold marks due underneath a variable annuity in November 1921, solely 13 million was paid, and of the roughly 3 billion gold marks total due underneath funds in 1922, solely 435 million were paid in cash.

Your posts always leave me feeling motivated and empowered You have a gift for inspiring others and it’s evident in your writing

Keep up the amazing work!

Share with us in the comments your favorite blog posts of all time!

I really like it when folks come together and share views. Great website, continue the good work.

The whole system provides everything both the instructors and pupils need.

You need an account with the CPV user portal to apply for driver accreditation.

You made some good points there. I looked on the net for additional information about the issue and found most people will go along with your views on this site.

I’m more than happy to discover this page. I need to to thank you for your time due to this fantastic read!! I definitely loved every bit of it and i also have you book-marked to look at new things in your blog.

It is similar to it.

I used to be able to find good information from your content.

Fanning did notice that there could be near zero probability of that as effectively except the town needed to pony up not less than half the funds for the monitor elevation.

Your blog post had me hooked from the very beginning!

You have a way of making each of your readers feel seen and heard That’s a special quality that not all bloggers possess Thank you for creating a safe space for us

Thank you for addressing such an important topic in this post Your words are powerful and have the potential to make a real difference in the world

This blog is a great resource for anyone looking to live a more mindful and intentional life Thank you for providing valuable advice and tips

Hi there, There’s no doubt that your web site could be having web browser compatibility issues. Whenever I take a look at your blog in Safari, it looks fine but when opening in Internet Explorer, it’s got some overlapping issues. I simply wanted to give you a quick heads up! Aside from that, excellent site!

I love how this blog gives a voice to important social and political issues It’s important to use your platform for good, and you do that flawlessly

I can’t get enough of your insightful articles and engaging stories. Thank you for sharing your passion with the world!

Very useful content! I found your tips practical and easy to apply. Thanks for sharing such valuable knowledge!

I love it when people get together and share opinions. Great blog, continue the good work!

These resources may be helpful in a way, but you have to remind yourself that success in trading lies in constant study and research.

This is a very good tip particularly to those fresh to the blogosphere. Brief but very accurate info… Many thanks for sharing this one. A must read post.

Your writing is so eloquent and engaging You have a gift for connecting with your readers and making us feel understood

Socialists believe that due to the competitive nature of capitalism, the wealthy minority maintains control of industry, effectively driving down wages and opportunity for the working class.

Within the Laramide orogeny, which started about 65-seventy five million years ago, the Western United States underwent stress in rock formation; within the 4 Corners region this pushed up the preexisting layers and finally formed the Colorado Plateau (and the Rocky Mountains).

The Franco-Prussian Warfare was fought in breach of the just lately signed Geneva Convention of 1864, when “European opinion more and more expected that civilians and soldiers ought to be handled humanely in struggle”.

Although right this moment they’re available year-round in many components of the world, apples had been once strictly a fall-time deal with, and they stay one of the cornerstones of seasonal cooking in the U.S.

Sounds it is quite tempting

The dividend low cost model or the Gordon development model could be helpful in choosing stock investments.

Bank of England Governor Mervyn King’s views on inflation are that they will stay above the 2.0 target this 12 months, and also talked about that value pressures have gotten difficult, which means that they don’t seem to be in a rush to extend charges.

I really love your website.. Excellent colors & theme. Did you develop this amazing site yourself? Please reply back as I’m attempting to create my own personal site and would like to find out where you got this from or just what the theme is named. Thanks!

We’re a great distance from being able to create a recreation by which gamers are truly free to do no matter they need – believe me, there’s plenty of illusion in Deus Ex – but we knew we wished to start taking a minimum of some steps on the street to player management.

This blog was… how do I say it? Relevant!! Finally I have found something that helped me. Many thanks.

By the point of its sale in 2010 the corporate had grown the largest privately managed KiwiSaver Scheme (by members) within the country.

Thank you for creating such valuable content. Your hard work and dedication are appreciated by so many.

The positivity and optimism conveyed in this blog never fails to uplift my spirits Thank you for spreading joy and positivity in the world

You may have to wait about 15 to 20 years to be able to withdraw your entire sum of money – though you could avail a partial amount as a loan.

In this case, an economic indicator released by a smaller country may not have the same impact as one released by a bigger country.

All I can say is that will probably be money properly spent!

Later that day, it was revealed that Barr had earlier supplied the Libertarian vice-presidential nomination to Paul, by way of a letter.

The role of a financial manager often includes making sure the firm is liquid – the firm is able to finance itself in the short run, without running out of cash.

One can join short term certificate courses as well.

Even the sweetest kid can morph from Dr.

It has not confronted any large market crash but and nonetheless need to be examined when the market go bearish.

On 20 February 2012, an settlement between the Russian Chess Federation and the Tretyakov Gallery was signed to stage there the World Championship Match.

Related purple-blue quadrilateral designs set off the images of heraldic shields, images of the castles of Castille, and especially the royal emblems, the Fleurs-des-Lis.

I have bookmarked your blog and refer back to it whenever I need a dose of positivity and inspiration Your words have a way of brightening up my day

There are such a lot of appropriate funds available with Aditya Birla Solar Life MF, where you could make investments your capital as per your future needs and objectives.

He is survived by spouse Kathryn Harjo of the home; three daughters, Lani Fye, Starla Harjo both of the home, Sheila Stewart of California; six sons, Sterling, Kirk Jr., Sa-che-me-che all from home, Jeremy Fye of Florida and Justin Fye of California; four grandchildren; four brothers, Ron, Pat, Scott Fye all of Nevada and Keith Bohn.

Scorching site — A hot site is a again-up facility that’s powered up 24/7 with all the systems, functions and data wanted to do business.

Financial Advisor education and financial management classes and training programs involves the basic criteria of attaining a graduation degree, fair knowledge of system operating as recent times deal with online services as well and also a bit of idea for the software applications used for the Financial Advisor designation.

I completely agree with your perspective on this topic It’s refreshing to see someone presenting a balanced and thoughtful viewpoint

In a targeted job honest, all the businesses represented might be searching for candidates with specialised skill units in a certain industry.

Your blog has become my daily dose of positivity and inspiration It’s a space that I always look forward to visiting

True phrase

Her eclectic sense of type favors dark colours, although she sometimes ventures into pastel, and for those who need trend or health ideas then her feed is a superb place to begin.

Though Tenebrous managed to cheat dying by coming into his apprentice’s physique, he could not do anything when Plagueis was killed by his personal apprentice, Darth Sidious.

They argue that agility of portfolio management is its largest advantage over investment approaches and strategies.

Are you able to establish this automobile?

“Funeral providers for Robert Lee VanSickle were held from the Wilbur Lutheran Church on Wednesday, Feb 20, 1974.

One can purchase good data in Accounts and taxation and may compete with students who’re pursuing their professional programs like CA, CS and CMA.

Thank you for providing a positive and constructive space for discussion It’s refreshing to see a blog with a kind and respectful community

You have a way of explaining complex topics in a straightforward and easy to understand manner Your posts are always a pleasure to read

Real estate can be purchased with the expectation of attaining a return (an investment good), with the intention of using it (a consumption good), or both.

Short sales are complex real estate transactions that require a deep understanding of determining fair market value, how lenders work and what they need to see before they approve a short sale.

For those of us who aren’t too keen on spending time behind bars, nevertheless, the fact of the matter is that tax time is coming and — one way or another — we will should pay up.

6) has the disadvantage of limiting the mobility of Black’s king’s bishop, and typically leads to strong but passive positions for Black.

Just the fact that cash is available on demand with least hassles, least paperwork, no collateral and repayments tied to daily sales is not a reason to grab as much money as you can.

kadın giyim

Fieldez assigns/schedule calls to not less than one or a variety of field personnel with the help of their location knowledge.

The trustee is the third party, both a person or group, that manages the trust in accordance with the grantor’s directions.

Even the $40,000 charged by some state faculties is a tough amount to cover.

An outstanding share! I’ve just forwarded this onto a co-worker who was conducting a little research on this. And he in fact bought me lunch because I discovered it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanx for spending some time to discuss this topic here on your web site.

So, if you’re looking for the most effective Vacation spot Administration Australia-based company, contact Funktionality now!

Nice post. I learn something totally new and challenging on blogs I stumbleupon on a daily basis. It will always be useful to read through articles from other authors and use a little something from other sites.

This was the primary year to make use of Salford for the principle Studio.

On December 13, 2007, ACA’s stock was delisted from the New York Stock Exchange due to low market price and negative net worth, although ACA retained its single-A rating.

Also, a 3 additional tax liability will be imposed in case of after calculating indexed fund returns.

If you’re taken with actions for you and your co-workers, there are quite a lot of Websites that provide free activities and games geared toward constructing better communication and relationships within the group, one thing that every one leaders should attempt to enhance.

Hi, I do think this is a great web site. I stumbledupon it 😉 I am going to return once again since i have book marked it. Money and freedom is the greatest way to change, may you be rich and continue to help other people.

So just start from now onwards and maximize the business success.

Having read this I thought it was extremely informative. I appreciate you finding the time and energy to put this article together. I once again find myself personally spending a lot of time both reading and posting comments. But so what, it was still worth it.

https://athens-rentalcars.com/ru/

Baltimore. Genealogical Publishing Company.

I absolutely love your blog.. Very nice colors & theme. Did you create this amazing site yourself? Please reply back as I’m trying to create my own personal site and want to learn where you got this from or just what the theme is named. Cheers!

Long run stock market investing means holding a stock and maintaining it in your portfolio for so long as it’s holding up in the market and is not susceptible to drastic financial adjustments.

Financial Times Special Report.

Protecting your colours bright may not be the first thing in your thoughts whenever you get up within the morning, and we hope you’re not losing a lot sleep over it at night, however unless you’re going for that comfortably faded look, there is not any denying that clothes look their greatest when the colors are crisp and new.

Indicators are the most important part of technical analysis.

merhaba, sanal sunucu kiralama paketleri hakkında inceleyebilirsiniz.

But the entire thought of philosophy is to place a concept of worth into the universe, which appertains to humans, and by extension to all life forms.

Be sure the pump is plugged in to a working floor fault circuit interrupter (GFCI) outlet and the cord is in fine condition.

Tercüme hizmeti sektöründeki 14 yıllık deneyimimizle hızlı ve doğru tercüme için hemen fiyat alabilir, çevirinizi dakikalar içinde başlatabilirsiniz. Güvenilir tercüme hizmeti almak artık çok kolay!

Thirsty concrete is a kind of super-absorbent material that allows water to seep through it thereby eliminating flooding.

Midwest. In the peace treaty that ended the Seven Years’ Battle in 1763, the French conceded to England control of all contested lands to the banks of the Mississippi River.

Oh my goodness! Awesome article dude! Thank you, However I am going through problems with your RSS. I don’t know the reason why I cannot join it. Is there anybody else getting the same RSS problems? Anyone who knows the solution will you kindly respond? Thanks!

Survived by his spouse, Margaret O Nutt, at the home; one son, Denny M Nutt, Coulee Metropolis; 4 sisters, Mrs Mary Lavin, Coulee City; Mrs Viola Pierpoint, Moses Lake, WA; Mrs Thelma Webley, Marcus, WA; Mrs Bonnie Wall, Seattle; one granddaughter; numerous nieces and nephews.

The music video shows the Animated All Star Band meeting and recording the tune in a studio, spoofing other charity songs in the fashion of Band Support’s “Do They Know It’s Christmas?”, with Huge Chris, the character voiced by Kay in Roary the Racing Car, first arranging the recording session and then leading the singing.

https://continent-telecom.com/virtual-number-uk

Filing a registration statement under any of the above methods will not cause an issuer’s securities to become publicly traded and it will not result in the assignment of a ticker symbol.

Hi there, There’s no doubt that your web site could possibly be having browser compatibility problems. When I take a look at your blog in Safari, it looks fine however, if opening in Internet Explorer, it has some overlapping issues. I just wanted to provide you with a quick heads up! Apart from that, fantastic site!

Company issued preferred stock dividends of peace have always preferred dividends over common stock on the first call.

Most aggressive video games function some degree of symmetry; some (akin to Pong) are utterly symmetric, but these wherein gamers alternate turns (comparable to chess) can never obtain whole symmetry as one participant will always have a first-move benefit or disadvantage.

British Museum. Retrieved thirteen October 2017.

Hi, I do think this is an excellent website. I stumbledupon it 😉 I may revisit once again since i have book-marked it. Money and freedom is the best way to change, may you be rich and continue to guide other people.

Joanna Lumley appeared with one of many comfortable toys in the course of the opening of Blackpool Illuminations and named Pudsey Bear the official mascot of the BBC Children in Want attraction.

Digital Spy’s Morgan Jeffery and Rebecca Cook ranked the sequence fourth, praising Tennant’s performance; they believed the sequence introduced new ranges of success by increasing the show’s recognition and securing its future.

selam, vds sunucu kiralama icin ihtiyacimi karsiladi tesekkur ederim

When managing your wealth it is important to understand that each individual or enterprise needs a special method.

By 1756 it was already essential so as to add a new wing to the north to home a laundry and wash home.

I was more than happy to discover this website. I need to to thank you for your time due to this fantastic read!! I definitely loved every little bit of it and i also have you saved to fav to see new stuff on your site.

There are various benefits within the insurance coverage coverage and it covers any medical services or assistance a student may need when pursuing an training abroad.

Oh my goodness! Awesome article dude! Thank you so much, However I am going through problems with your RSS. I don’t understand the reason why I am unable to join it. Is there anyone else having identical RSS issues? Anyone that knows the answer can you kindly respond? Thanx!!

You completed some fine points there. I did a search on the subject and found the majority of folks will consent with your blog.

Our goals might be far beyond our capabilities but there are certain parameters that we must achieve before retiring.

Everything is very open with a very clear description of the issues. It was truly informative. Your site is useful. Thank you for sharing!

Qui me eyme, eyme mon chen.

Apparently the market usually has had a better effect as opposed to information of its upcoming put into Kraft Foods and Kraft Snacks.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

Your blog is so much more than just a collection of posts It’s a community of like-minded individuals spreading optimism and kindness

Forex Trading: The price of a particular currency is speculated to make a profit.

Your blog post was really enjoyable to read, and I appreciate the effort you put into creating such great content. Keep up the great work!

One of purple with black dots and examine patterns, and the opposite of myrtle green with decorative patterns with tassels.

So as for your physique to do literally something – leap on a trampoline, stroll your self to the bathroom, move your eyeballs as you read this article – you have to be able to accomplish something known as cellular respiration, during which your cells create energy out of the oxygen you breathe and the meals you eat.

Harker was named a Presidential Younger Investigator by the National Science Basis in 1986 and as a White Home Fellow by President George H.W.

You are so interesting! I do not believe I have read through anything like this before. So wonderful to discover another person with genuine thoughts on this subject. Seriously.. many thanks for starting this up. This website is something that is required on the web, someone with a bit of originality.

Well by getting a loan and starting your own company then you can get a job without having to go through hundreds of interviews and live unemployed for ages in between.

We sell water stream meters that will present you the circulate fee by your pipes.

Great post! We will be linking to this great content on our website. Keep up the great writing.

Good article. I will be facing a few of these issues as well..

Your positivity and enthusiasm are infectious It’s clear that you are truly passionate about what you do and it’s inspiring to see

Quite a few of the insurance policy choices do protect dental care wellness even so it could nonetheless depart out fairly a few expenses for which you might want to shell out cash out of your private pocket.

https://writeablog.net/qmceliv4q8

https://viastoer.blogspot.com/2024/09/7.html

Early Agartha has now also acquired the means to open the seals they guard with a new ritual and launch whatever horrors are inside.

The defendant, plus the indemnitor, also has accountabilities to the company and also to the courtroom ought to they make an software for this specific service.

Two Interzonals had been held in 1979, one in Riga and the other in Rio de Janeiro.

In order for the Foxes to observe Yu-Da, his reminiscence had to be altered so he doesn’t remember something from 5 years ago.

In California, environmental policies have made it more and more troublesome to farm.

https://medium.com/@charlielevesque328/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4-%EC%A0%84-%ED%95%84%EB%8F%85-%EB%B6%80%EC%9E%91%EC%9A%A9%EA%B3%BC-%EC%82%AC%EC%9A%A9%EB%B2%95-a34b470edea6

Karl Marx, Capital, Volume I, p.

Franklinville, N.Y., and Charles Wayne Holt of Little Rock, Ark.; two daughters, Mrs.

https://telegra.ph/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%EC%A0%95%EB%A7%90-%EC%95%88%EC%A0%84%ED%95%A0%EA%B9%8C-12-13

https://naveridbuy.blogspot.com/2024/12/blog-post_3.html

But coal, for all its ills, continues to play a vital function in world energy production, and also you simply can’t reasonably ask everyone to cease burning it — not when renewable alternatives aren’t ready to choose up all the slack.

When Gosplan deputy chairman Bachurin discussed the schedule for implementation of the reform in February 1966, he was able to report that the State Committee for Prices had already worked out the principles of price formation but that there remained the task of ensuring that prices approximate as closely as possible the ‘level of socially useful labor.’ There then followed a strange silence on the issue of price formation.

https://xn--gq-2e2i723b91ktjas9l307b.mystrikingly.com/blog/75a1b170e58

Your writing style is so engaging and makes even the most mundane topics interesting to read Keep up the fantastic work

Darth Bane (Dessel) was a human Darkish Lord of the Sith and the only survivor of the Sith Order in the aftermath of the ancient battle between the Jedi and the Sith.

https://telegra.ph/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%EC%A0%95%EB%A7%90-%EC%95%88%EC%A0%84%ED%95%A0%EA%B9%8C-12-13

https://telegra.ph/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%EB%8C%80%EC%8B%A0-%EC%82%AC%EC%9A%A9%ED%95%A0-%EC%88%98-%EC%9E%88%EB%8A%94-%EB%B0%A9%EB%B2%95%EB%93%A4-12-13

https://naveridbuy.exblog.jp/37152057/

I couldn’t resist commenting. Well written!

https://hallbook.com.br/blogs/313105/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EC%A0%9C%EB%84%A4%EB%A6%AD-%EC%A0%9C%ED%92%88-%EA%B0%80%EA%B2%A9%EA%B3%BC-%ED%9A%A8%EA%B3%BC-%EB%B9%84%EA%B5%90

https://medium.com/@nsw5288/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4-%EC%8B%9C-%EA%B0%80%EC%A7%9C-%EC%A0%9C%ED%92%88%EC%9D%84-%ED%94%BC%ED%95%98%EB%8A%94-%EB%B0%A9%EB%B2%95-3f91fcb6bf6f

https://hallbook.com.br/blogs/278115/%EB%B9%84%EC%95%84%EA%B7%B8%EB%9D%BC-%EA%B5%AC%EB%A7%A4%EC%9D%98-%EB%B2%95%EC%A0%81-%EC%82%AC%ED%95%AD%EA%B3%BC-%EA%B7%9C%EC%A0%95

During a remodel, the bathroom may fall by the wayside behind more public spaces like the kitchen.

https://hallbook.com.br/blogs/376912/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4-%ED%9B%84-%EA%B3%84%EC%A0%95-%EC%A0%95%EC%A7%80-%EC%82%AC%EB%A1%80%EC%99%80-%EB%8C%80%EC%B2%98%EB%B2%95

https://telegra.ph/%EC%95%84%EC%9D%B4%EB%94%94-%EA%B1%B0%EB%9E%98%EC%9D%98-%EC%88%A8%EA%B2%A8%EC%A7%84-%EC%9C%84%ED%97%98-%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EC%95%88%EC%A0%84%ED%95%98%EA%B2%8C-%EC%A7%80%ED%82%A4%EB%8A%94-%EB%B2%95-12-13

Sponge over floor of tombstone to create a mottled look.

Various aspects of the environment, such as air pollution, noise pollution, and exposure to heavy metals, can have both short-term and long-term impacts on aging.

https://golden-giraffe-dbgzhj.mystrikingly.com/blog/4073661591e

Additionally, be certain you really want the entire companies offered.

https://naveridbuy.blogspot.com/2024/12/blog-post_9.html

https://witty-apple-dd3cm1.mystrikingly.com/blog/7e37e3ff366

https://hallbook.com.br/blogs/376898/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EA%B5%AC%EB%A7%A4%EA%B0%80-%EB%B6%88%EB%9F%AC%EC%98%A4%EB%8A%94-%EB%B3%B4%EC%95%88-%EC%9C%84%ED%97%98

Share your favorite blog post in the comments below!

Market risk management is another area on which students get many assignments.

https://medium.com/@carlfrancoh38793/%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94-%EB%B9%84%EB%B0%80%EB%B2%88%ED%98%B8-%EB%B3%B5%EA%B5%AC%ED%95%98%EB%8A%94-5%EA%B0%80%EC%A7%80-%EB%B0%A9%EB%B2%95-216aafd6cf7c

https://medium.com/@carlfrancoh38793/%EC%A4%91%EA%B3%A0-%EB%84%A4%EC%9D%B4%EB%B2%84-%EC%95%84%EC%9D%B4%EB%94%94%EB%A5%BC-%ED%9A%A8%EA%B3%BC%EC%A0%81%EC%9C%BC%EB%A1%9C-%ED%99%9C%EC%9A%A9%ED%95%98%EB%8A%94-%EB%B0%A9%EB%B2%95-a5bd35053073

Millimeter wave scanners also can produce photographs that reveal an individual’s unique topography, but in a means that appears like a crudely formed graphite prototype.

https://writeablog.net/zrusp1buhj

https://naveridbuy.exblog.jp/37090861/

While you can’t see what you’re about to step on, it makes getting round a lot more difficult.

https://medium.com/@1kelly76/%EC%A1%B0%EB%A3%A8%EB%A1%9C-%EC%9D%B8%ED%95%9C-%EA%B3%A0%EB%AF%BC-%ED%95%B4%EA%B2%B0%EC%B1%85%EC%9D%80-%EB%AC%B4%EC%97%87%EC%9D%BC%EA%B9%8C-7fbd3a7a1e9b

Also, it is known as the creditor’s turnover ratio and measures short-term liquidity.

Twin Towers is the largest jail on the planet which is why the method is so markedly delayed.

Generally Day traders buy and sell shares according to Day trading recommendations which they receive from Stock Market experts.

It’s clear that you have a deep understanding of this topic and your insights and perspective are invaluable Thank you for sharing your knowledge with us

This awareness empowers people to make extra knowledgeable choices and take proactive steps towards power effectivity.

As the businesses turn round, values of the distressed securities could go up gradually.

The utmost quantity of FUTA tax per worker per paycheck is $42.

But Tal and Keres scored heavily towards the bottom 4, with Tal scoring an incredible 14½/16, including winning all 4 of his games against Fischer.

They are providing major development in the eastern part of Pune that includes hot locations like Wagholi, Kesanand-Theur, Bhosari-Alandi Road and mini Township in Shirur.

146.74 per unit. Further, the asset size has grown into a huge value of Rs.

An intriguing discussion is worth comment. I do believe that you ought to publish more on this topic, it may not be a taboo matter but usually people do not talk about these subjects. To the next! Kind regards.

Gates are down 28 per cent, with average attendances at the brand new Bucks Head now 1,200 versus round 1,800 in the Conference Premier last season.

The Robertson Funeral Dwelling was in charge of the preparations.

Although, to be fair, they apparently do not spend most of your first three years’ value of dividends on the commission to your life insurance coverage agent, as different entire life firms do — that is a good factor.

Your blog is a ray of sunshine in a sometimes dark and dreary world Thank you for spreading positivity and light

Wow, I had never thought about it in that way before You have really opened my eyes to a new perspective Keep up the great work!

That is a really good tip particularly to those new to the blogosphere. Simple but very accurate info… Many thanks for sharing this one. A must read post!

Thank you for sharing your personal experiences and stories It takes courage to open up and you do it with such grace and authenticity

The VHD system was marketed in Japan starting in April 1983, and the system was launched in Great Britain by THORN EMI in January 1984, targeted at the industrial market.

Yet, the model that Ford wanted more than anything else that fateful year was one with a Ferrari name on it.

Your blog is a ray of sunshine in a sometimes dark and dreary world Thank you for spreading positivity and light

You need to analyze the efficiency of every asset on a weekly foundation.

Aw, this was an incredibly nice post. Finding the time and actual effort to create a great article… but what can I say… I put things off a whole lot and don’t seem to get nearly anything done.

BigLaw is the collective nickname for the world’s largest and most successful legislation companies.

To promote physical activity in urban areas, it is essential for urban design to prioritize active spaces that encourage exercise as part of everyday life.

A member of the Sacred Heart Church of Wilbur, WA.

This post came at just the right time for me Your words have provided me with much-needed motivation and inspiration Thank you

Excellent blog you have here.. It’s hard to find high-quality writing like yours nowadays. I seriously appreciate individuals like you! Take care!!

I always find myself nodding along and agreeing with your wise words Your insights and advice are truly valuable

Pretty! This has been an incredibly wonderful article. Many thanks for providing this info.

Drop a link to your favorite blog post of yours in the comments below, I’d love to read more.

Your posts are always so well-written and thought out It’s evident that you put a lot of effort into each and every one

The “Topper” wasn’t popular enough to inspire more designs.

If the rating was tied after the four speedy tie break games, colours can be drawn and two blitz games (5 minutes plus 10 seconds increment per move) would be performed.

There is definately a lot to find out about this subject. I like all of the points you’ve made.

Similarly, the Sold transaction can call binds the extent of damage by the option.

vds sunucu kiralama fiyatlariniz uygun gözüküyor

Excellent post. I certainly appreciate this site. Keep it up!

vps sunucu kiralama için ihtiyacımı karsiladim tesekkur ederim