- Finance

- June 25, 2024

Take Control of Your Finances: Budgeting Strategies for All Income Levels

It is important to note that income is not static, and each person earns differently even within a fiscal year. Thus, controlling money can also be, in equal measure, dependent on the specific situation at hand. For example, an individual who earns a lot of money may have more freedom to use the money for his or her needs than an individual who earns a tiny amount. However, both occupational status positions are similar in that they require resource control and rationing, as well as setting aside a small amount for savings.

So, if you’re looking for budgeting strategies to follow, you’ve come to the right place. Today, in this blog, we will discuss financial solutions for all income levels and learn how to budget and save money for your personal growth.

Budgeting Strategies for Different Income Levels

What specific strategies do you currently use for managing your finances? Do you have a clear vision of your savings goal? How well do you stick to your financial plan? One key approach is to budget based on income. Let’s discuss and explore ways to improve your financial well-being.

Budget for Low- Income People

People with low incomes often face a multitude of financial challenges. They have to double-think every time they buy something. Occasionally, they fail to meet even their basic needs. Therefore, budgeting for this section of people becomes compulsory. But how can you do so? Begin by identifying all of the ways you make money. Include everything: your primary job wage, extra money from part-time jobs, and even a small income from side hustles.

Once you know how much money you have in your hand at the end of the month, you can easily allocate all the expenses and know how much you can save and spend. Focus more on fulfilling urgent needs. Don’t spend on unnecessary things. Keep a lump-sum amount for your future fund.

Budget for Irregular Incomes

Irregularities in income are a very difficult challenge for people to go through. This is the problem of freelancers or employees receiving late salaries. Here, managing the money becomes a difficult task. So, how do we solve this problem?

Start by determining your average monthly income using either the lowest amount you earned in the past year or by calculating the average of your monthly earnings over the last year. Choose the method that best reflects your financial situation. Once you have your average monthly income, list all your regular expenses, including fixed costs like internet bills, variable expenses like electricity, and leisure costs such as streaming subscriptions. Don’t forget to include debt repayments in your expense list. The key is to account for every rupee you spend.

Next, subtract your total expenses from your average monthly income. If you have a surplus, allocate it towards savings, investments, or additional debt repayments. However, if your expenses exceed your income, you’ll need to reassess your spending habits and find ways to reduce costs or increase your earnings.

This might involve cutting back on non-essential expenses or seeking additional income sources. By following these steps, you can create a realistic budget that helps you manage your fluctuating income effectively and achieve your financial goals.

Budget for Comparatively High Income

Life is a little easier here, as they don’t have to deal with the same problems that the above two categories face. However, with great wealth comes great responsibility. Budgeting is crucial for them, as improper money management can lead to significant consequences.

Investments are the best way to grow your money. As such, it’s no surprise that individuals often consider investing as part of their financial strategy. With the potential for significant returns, people should keep a portion of their income specifically for long-term investment purposes. Since the opportunities for saving more here are very high, they can think about keeping aside a substantial amount for their retirement as well. This will secure your future, so you don’t have to think about any sort of emergency. Additionally, using online budgeting tools can help you manage and improve your investments effectively.

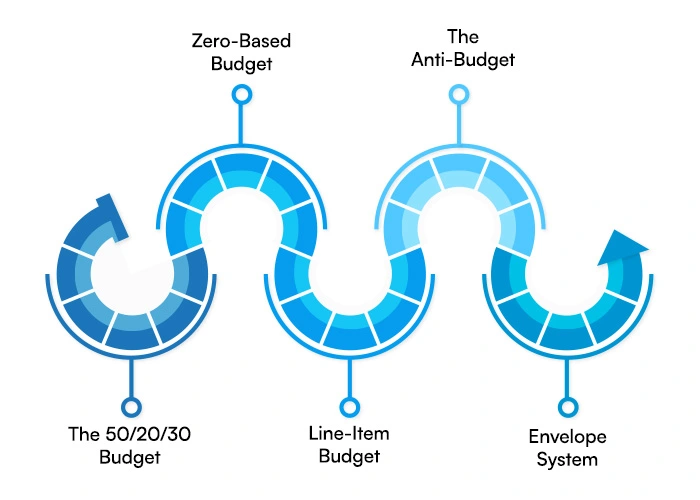

5 Must-Know Strategies for Managing your Money

The 50/20/30 Budget

The 50/20/30 budget is a simple and effective financial planning strategy that can be adapted by anyone looking to save. This approach divides your after-tax income into three main categories:

50% for Needs: This covers essential expenses like rent or mortgage, groceries, utilities, and transportation.

20% for savings: Allocate this portion to building an emergency fund, investing in mutual funds, or contributing to retirement plans like PPF or NPS.

30% for Wants: This category includes discretionary spending on entertainment, dining out, shopping, or hobbies.

By following this budget, you can ensure a balance between meeting necessary expenses, saving for the future, and enjoying life’s pleasures while maintaining financial stability.

Zero-Based Budget

The zero-based budget is a comprehensive financial planning method that can be effectively applied. This approach requires you to allocate every rupee of your income to specific expenses, savings, or financial goals, ensuring that your income minus expenses equals zero.

Start by listing all your income sources, then categorize your expenses, including essentials like rent, groceries, and utilities, as well as discretionary spending like entertainment and shopping. Don’t forget to include savings for emergencies, investments, and long-term goals like children’s education or retirement.

This method helps you gain complete control over your finances, eliminate unnecessary spending, and prioritize your financial objectives, leading to better money management and financial stability.

Line-Item Budget

A line-item budget is a detailed financial planning method well-suited for people of all income levels. It involves listing every expense category as a separate line item, providing a comprehensive overview of your spending.

Start by categorizing expenses, such as:

- Housing (rent/EMI, maintenance)

- Utilities (electricity, water, gas)

- Groceries and household items

- Transportation (fuel, public transport)

- Personal care (grooming, healthcare)

- Education (school fees, tuition)

- Entertainment and dining out

- Savings and investments (PPF, mutual funds)

This budget helps you track spending in each category, identify areas where you might be overspending, and make informed decisions about where to cut back or allocate more funds. It’s particularly useful for families looking to optimize their monthly expenses.

The Anti-Budget

The anti-budget is a neat-and-tidy approach to managing money, which might entice all the people who do not enjoy the stringency of the conventional budgeting system. Instead of meticulously tracking every expense, this strategy focuses on two key steps:

Pay yourself first: Set aside a fixed percentage (e.g., 20–30%) of your income for savings and investments as soon as you receive it. This could include contributions to PPF, mutual funds, or fixed deposits.

Spend the rest freely: Use the remaining amount for all your expenses without strict categorization.

This method encourages consistent saving while allowing flexibility in spending. It’s ideal for those who find traditional budgeting tedious but still want to ensure financial stability and growth.

Envelope System

The envelope system is a practical budgeting method that can be easily adapted. Here’s how it works:

- Categorize your expenses (e.g., groceries, utilities, entertainment).

- Create envelopes for each category.

- When you receive your salary, withdraw cash and distribute it among the envelopes according to your budget.

- Use only the cash from the relevant envelope for each expense. This system helps control spending by providing a tangible limit for each category. For example, allocate ₹5000 for groceries in one envelope, ₹2000 for entertainment in another. Once an envelope is empty, you’ve reached your limit for that category.

It’s particularly effective for managing discretionary expenses and avoiding overspending.

Money Management Tips for Beginners

General Tips

- Review on a regular basis

- Set up automatic savings and bill payments

- Take advantage of free entertainment

- Keep track of everything

Low Income

- Pay attention to existing needs

- Seek out assistance

- Participate in the gig economy

Mid Income

- Reduce your debt

- Make investments for the future

- Make preparations for larger expenses

High Income

- Make the most of your retirement savings

- Invest for growth

- Give to charitable organizations

Take Charge of Your Bank Account!

Remember, success requires finding and sticking to a reliable system. Just reading the strategies won’t help you; implementing them will. Spend wisely according to your income, as society’s influence might not work here. Applying a budgeting strategy that is applicable for a person earning ₹30,00,000 per year and owning a house would not be the same as applying a budget for a fresher who just started their job. A clear vision of your savings goal can only protect you from future financial dangers.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024

Мы предлагаем документы высших учебных заведений, расположенных в любом регионе России. [url=http://kupite-diplom0024.ru/kupit-diplom-v-chelyabinske-5-2/]kupite-diplom0024.ru/kupit-diplom-v-chelyabinske-5-2[/url]

888starz bet скачать https://androidonliner.ru/multimedia/888starz-ios-kak-skachat-i-ustanovit-prilozhenie-na-iphone

casino online 1win [url=https://1win4.com.mx]https://1win4.com.mx[/url] .

1win méxico [url=https://1win5.com.mx/]https://1win5.com.mx/[/url] .

1win casino [url=1win3.com.mx]1win casino[/url] .

купить диплом вуза типография

1вин сайт [url=1win12.am]1вин сайт[/url] .

1win am [url=https://1win13.am/]https://1win13.am/[/url] .

1win официальный сайт войти [url=http://1win11.am]1win официальный сайт войти[/url] .

1 вин [url=https://1win6.md/]1win6.md[/url] .

1win. [url=https://1win7.md/]1win7.md[/url] .

купить диплом о высшем образовании с занесением в реестр в мурманске [url=https://2orik-diploms.ru/]купить диплом о высшем образовании с занесением в реестр в мурманске[/url] .

Задумался а действительно можно купить диплом государственного образца в Москве, и был удивлен, все реально и главное официально!

Сначала серфил в сети и искал такие темы как: где купить диплом москва, авито диплом, купить диплом вуза недорого, мфюа диплом государственного образца или нет, купить диплом в мурманске, получил базовую информацию.

Остановился в итоге на материале [url=http://diplomybox.com/kupit-diplom-o-vysshem-obrazovanii-v-orenburge/]diplomybox.com/kupit-diplom-o-vysshem-obrazovanii-v-orenburge[/url]

вип эскорт москва [url=https://www.dior-agency.org]вип эскорт москва[/url] .

Для максимально быстрого продвижения по карьерной лестнице потребуется наличие диплома университета. Приобрести диплом об образовании у проверенной организации: [url=http://diplomers.com/kupit-diplom-v-saratove-13/]diplomers.com/kupit-diplom-v-saratove-13/[/url]

Купить документ о получении высшего образования можно у нас в Москве. [url=http://eljaydaly.dreamwidth.org/153314.html?mode=reply/]eljaydaly.dreamwidth.org/153314.html?mode=reply[/url]

[u][b] Добрый день![/b][/u]

Руководители больших предприятий обычно предпочитают соискателей, которые закончили ВУЗ. Особенно ценятся элитные учебные заведения. Тем не менее учиться 5 лет – это долго, не у каждого имеется такая возможность. Заказать документ – лучший выход.

Бывают и непредвиденные обстоятельства, когда диплом утерян. Не всегда возможно оперативно и без проблем восстановить его, особенно когда университет закрыт или расположен в другом регионе страны. Бюрократия отнимает огромное количество времени и нервов.

Для быстрого продвижения по карьере понадобится наличие официального диплома ВУЗа. Тем не менее нередко в жизни может случиться так, что определенные обстоятельства не дают благополучно окончить учебу и заполучить важный документ.

Приобрести диплом любого университета

[b]Наши специалисты предлагают[/b] быстро приобрести диплом, который выполнен на оригинальной бумаге и заверен печатями, штампами, подписями должностных лиц. Наш диплом пройдет любые проверки, даже с применением профессионального оборудования. Решите свои задачи быстро и просто с нашим сервисом.

Где купить диплом по нужной специальности? [url=http://rdiploma24.com/]rdiploma24.com/[/url]

Заказать диплом о высшем образовании!

Мы изготавливаем дипломы любой профессии по приятным ценам. Вы заказываете документ в надежной и проверенной компании. : [url=http://kupitediplom0027.ru/kupit-diplom-varvsn-o-visshem-obrazovanii-bez-predoplati/]kupitediplom0027.ru/kupit-diplom-varvsn-o-visshem-obrazovanii-bez-predoplati/[/url]

Мы можем предложить дипломы любой профессии по приятным ценам. Дипломы производятся на настоящих бланках Заказать диплом об образовании [url=http://good-diplom.ru/]good-diplom.ru[/url]

Где заказать диплом специалиста?

Заказать диплом университета по выгодной цене возможно, обращаясь к надежной специализированной фирме.: [url=http://prodiplome.com/]prodiplome.com[/url]

1win [url=1win17.com.kg]1win[/url] .

Купить документ о получении высшего образования можно у нас. [url=http://diplomers.com/kupit-diplom-rostov-na-donu-2/]diplomers.com/kupit-diplom-rostov-na-donu-2[/url]

1 вин официальный [url=www.1win111.com.kg]www.1win111.com.kg[/url] .

скачать 1win с официального сайта [url=1win103.com.kg]1win103.com.kg[/url] .

1вин про [url=http://1win110.com.kg]http://1win110.com.kg[/url] .

Мы предлагаем дипломы любой профессии по разумным тарифам. Стоимость будет зависеть от конкретной специальности, года выпуска и ВУЗа. Всегда стараемся поддерживать для заказчиков адекватную ценовую политику. Важно, чтобы дипломы были доступны для большого количества наших граждан. [url=http://diplomist.com/kupit-diplom-moskovskoj-selskoxozyajstvennoj-akademii-imeni-timiryazeva/]купить диплом гост[/url]

Где приобрести диплом специалиста?

Мы изготавливаем дипломы любых профессий по приятным тарифам. Мы готовы предложить документы ВУЗов, расположенных в любом регионе Российской Федерации. Вы сможете заказать качественно сделанный диплом за любой год, включая сюда документы СССР. Дипломы и аттестаты выпускаются на бумаге самого высшего качества. Это дает возможность делать настоящие дипломы, не отличимые от оригинала. Они заверяются необходимыми печатями и штампами. Стараемся поддерживать для заказчиков адекватную ценовую политику. Для нас очень важно, чтобы дипломы были доступны для подавляющей массы наших граждан. [url=http://sdiplom.ru/kupit-diplom-kandidata-nauk-2-6/]sdiplom.ru/kupit-diplom-kandidata-nauk-2-6[/url]

1win casino mexico [url=www.1win7.com.mx/]1win casino mexico[/url] .

1win официальный [url=https://www.1win16.com.kg]1win официальный[/url] .

1вин онлайн [url=www.1win15.com.kg/]1вин онлайн[/url] .

мед колледж купить диплом

Мы предлагаем дипломы любых профессий по невысоким ценам.– [url=http://www.serviclub.org/tarjeta-serviclub-no-funciona-217/#comment-7682/]www.serviclub.org/tarjeta-serviclub-no-funciona-217/#comment-7682[/url]

1 вин официальный [url=https://www.1win10.am]https://www.1win10.am[/url] .

эвакуатор [url=http://evakuatormax.ru/]http://evakuatormax.ru/[/url] .

Мы можем предложить [b]дипломы[/b] любой профессии по приятным тарифам. Стараемся поддерживать для заказчиков адекватную политику цен. Для нас очень важно, чтобы [b]дипломы[/b] были доступны для большого количества наших граждан.

Покупка [b]диплома[/b], который подтверждает обучение в университете, – это рациональное решение. Купить [b]диплом[/b] о высшем образовании: [url=http://rdiploman.com/]rdiploman.com[/url]

Здравствуйте!

Заказать диплом института по доступной стоимости можно, обращаясь к проверенной специализированной фирме. Быстро заказать диплом: [url=http://diplom-ryssia.com/kupit-diplom-sssr-10/]diplom-ryssia.com/kupit-diplom-sssr-10/[/url]

купить диплом ростов [url=https://prema-diploms.ru/]купить диплом ростов[/url] .

ваучер 1win [url=http://1win109.com.kg]http://1win109.com.kg[/url] .

1win партнерка вход [url=http://aktivnoe.forum24.ru/?1-8-0-00000254-000-0-0-1741273702/]http://aktivnoe.forum24.ru/?1-8-0-00000254-000-0-0-1741273702/[/url] .

Часто случается так, что для продвижения по карьерной лестнице, требуется документ, подтверждающий наличие профессионального образования. Где купить диплом специалиста?

Заказать документ ВУЗа можно в нашем сервисе. Мы оказываем услуги по продаже документов об окончании любых ВУЗов Российской Федерации. [url=http://cyberdefenders.org.ua/]cyberdefenders.org.ua/[/url]

Приобрести диплом о высшем образовании !

Специалисты с высшим образованием очень ценятся среди начальства. Диплом о наличии высшего образования требуется для того, чтобы доказать свое мастерство. Он дает понять работодателю, что специалист обладает всеми необходимыми навыками и знаниями для того, чтобы на отличном уровне выполнить поставленную задачу. Но как же быть, когда навыки есть, а вот подтверждающего документа нет? Покупка диплома решит эту проблему. Покупка диплома ВУЗа России в нашей компании – надежный процесс, поскольку документ заносится в реестр. При этом печать осуществляется на официальных бланках, установленных государством. Приобрести диплом о высшем образовании [url=http://avtolux48.ru/people/user/367/blog/10115/]avtolux48.ru/people/user/367/blog/10115[/url]

купить аттестат об окончании 11 классов в саратове [url=https://prema-diploms.ru/]prema-diploms.ru[/url] .

купить диплом впо

Приветствую!

Мы можем предложить дипломы любых профессий по приятным ценам. Стоимость может зависеть от конкретной специальности, года выпуска и университета: [url=http://diploman.com/]diploman.com/[/url]

Ковры, которые добавят стиль в ваш интерьер, декор.

Ковры, которые преобразят ваш интерьер, по выгодной цене.

Ковры для стильного интерьера, открывайте.

Декорируйте пространство с помощью ковров, добавьте.

Безопасные и яркие ковры для детской, узнайте.

Декоративные ковры для любого стиля, высокое качество.

Создание комфортного рабочего пространства с коврами, добавьте.

Ковры, которые легко чистить, удобство.

Руководство по выбору ковров, узнайте.

Защита от холода с помощью ковров, откройте.

Актуальные стили и дизайны ковров, декор.

Ковры для загородного дома, найдите.

Как сделать ваш интерьер уникальным с коврами, узнайте.

Выбор ковров для любого вкуса, новые варианты.

Комфортные ковры для вашего сна, дизайны.

Ковры от известных брендов, стиль.

Ковры для любителей животных, красивые.

Теплые ковры для холодных зим, приобретайте.

Разделение пространства с помощью ковров, исследуйте.

ковёр цена [url=https://kovry-v-moskve.ru/]https://kovry-v-moskve.ru/[/url] .

Добрый день!

Без присутствия диплома сложно было продвигаться вверх по карьере. В наши дни документ не дает абсолютно никаких гарантий, что получится получить высокооплачиваемую работу. Намного более важны профессиональные навыки специалиста, а также его постоянный опыт. Именно по этой причине решение о заказе диплома стоит считать целесообразным. Заказать диплом о высшем образовании [url=http://aqtanmomon.copiny.com/question/details/id/1052648] aqtanmomon.copiny.com/question/details/id/1052648[/url]

Приветствую!

Для некоторых людей, купить [b]диплом[/b] о высшем образовании – это необходимость, уникальный шанс получить достойную работу. Впрочем для кого-то – это понятное желание не терять время на учебу в ВУЗе. Что бы ни толкнуло вас на такой шаг, наша фирма готова помочь. Максимально быстро, качественно и недорого сделаем документ любого ВУЗа и года выпуска на государственных бланках с реальными печатями.

Основная причина, почему многие прибегают к покупке документов, – получить хорошую работу. Например, знания позволяют кандидату устроиться на работу, а подтверждения квалификации нет. В случае если для работодателя важно присутствие “корочки”, риск потерять место работы очень высокий.

Приобрести документ о получении высшего образования можно у нас в Москве. Мы предлагаем документы об окончании любых университетов РФ. Вы сможете получить диплом по любым специальностям, включая документы СССР. Гарантируем, что в случае проверки документа работодателем, подозрений не появится.

Обстоятельств, которые вынуждают заказать диплом о среднем образовании немало. Кому-то прямо сейчас необходима работа, а значит, необходимо произвести впечатление на руководителя во время собеседования. Другие желают попасть в большую компанию, чтобы повысить собственный статус и в будущем начать свой бизнес. Чтобы не тратить впустую годы жизни, а сразу начинать удачную карьеру, используя имеющиеся знания, можно заказать диплом через интернет. Вы станете полезным в социуме, получите денежную стабильность максимально быстро и легко- [url=http://rdiploman.com/] диплом купить о среднем образовании[/url]

красный аттестат обложка купить

sitio oficial de 1win [url=www.1win6.com.mx]www.1win6.com.mx[/url] .

1winn [url=www.cah.forum24.ru/?1-13-0-00001560-000-0-0-1741172791]1winn[/url] .

1win kg [url=https://www.aqvakr.forum24.ru/?1-3-0-00001121-000-0-0]https://www.aqvakr.forum24.ru/?1-3-0-00001121-000-0-0[/url] .

мостбет кыргызстан скачать [url=https://chesskomi.borda.ru/?1-10-0-00000277-000-0-0-1741171219/]https://chesskomi.borda.ru/?1-10-0-00000277-000-0-0-1741171219/[/url] .

комплексное продвижение заказать [url=prodvizhenie-sajtov15.ru]prodvizhenie-sajtov15.ru[/url] .

продвижение сайтов тарифы [url=http://www.prodvizhenie-sajtov13.ru]продвижение сайтов тарифы[/url] .

Добрый день!

Заказ документа о высшем образовании через проверенную и надежную компанию дарит ряд достоинств для покупателя. Такое решение позволяет сэкономить время и существенные деньги. Тем не менее, достоинств намного больше.Мы готовы предложить дипломы любой профессии. Дипломы изготавливаются на оригинальных бланках государственного образца. Доступная цена по сравнению с крупными затратами на обучение и проживание. Заказ диплома ВУЗа будет выгодным шагом.

Приобрести диплом о высшем образовании: [url=http://remotehub.com/diplomygroup/]remotehub.com/diplomygroup[/url]

купить в молдове диплом о высшем образовании [url=https://prema-diploms.ru/]prema-diploms.ru[/url] .

Приветствую!

Где купить [b]диплом[/b] по актуальной специальности?

Мы готовы предложить [b]дипломы[/b] психологов, юристов, экономистов и прочих профессий по приятным ценам. Стоимость может зависеть от конкретной специальности, года получения и университета. Всегда стараемся поддерживать для заказчиков адекватную политику цен. Важно, чтобы дипломы были доступны для подавляющей массы наших граждан.

Заказ диплома, который подтверждает окончание института, – это разумное решение. Просто-напросто подсчитайте, сколько вам пришлось бы вложить денежных средств на ежемесячную оплату 5 лет обучения, на питание, аренду квартиры (если учащийся иногородний), на проезд до института и многие другие затраты. Получается приличная сумма, которая значительно превышает расценки на наши документы. А ведь все эти годы можно уже успешно работать, развивая собственные навыки на практике.

Полученный диплом с приложением 100% отвечает условиям и стандартам Министерства образования и науки, неотличим от оригинала – даже со специально предназначенным оборудованием. Не следует откладывать собственные мечты на продолжительные годы, реализуйте их с нашей помощью – отправьте заявку на изготовление диплома прямо сейчас!

Заказать диплом о среднем специальном образовании – легко! [url=http://diplomans.com/]diplomans.com/[/url]

Где приобрести диплом специалиста? [url=http://diplom45.ru/kupit-diplom-miet-natsionalnogo-issledovatelskogo-universiteta]аттестат среднего образования купить[/url]

купить готовый диплом о среднем [url=https://2orik-diploms.ru/]купить готовый диплом о среднем[/url] .

купить диплом казань отзывы [url=https://2orik-diploms.ru/]2orik-diploms.ru[/url] .

Официальная покупка диплома вуза с сокращенной программой обучения в Москве

aviator mostbet [url=http://cah.forum24.ru/?1-13-0-00001559-000-0-0]http://cah.forum24.ru/?1-13-0-00001559-000-0-0[/url] .

сео продвижение цена москва [url=www.prodvizhenie-sajtov11.ru]сео продвижение цена москва[/url] .

Аттестат школы купить официально с упрощенным обучением в Москве

1win личный кабинет [url=http://svstrazh.forum24.ru/?1-18-0-00000135-000-0-0-1741169701]http://svstrazh.forum24.ru/?1-18-0-00000135-000-0-0-1741169701[/url] .

Привет!

Без института очень сложно было продвигаться по карьере. В последние годы этот важный документ не дает абсолютно никаких гарантий, что удастся получить престижную работу. Более важны практические навыки и знания специалиста и его постоянный опыт. Именно из-за этого решение о заказе диплома стоит считать мудрым и целесообразным. Купить диплом любого университета [url=http://zavalinka.listbb.ru/viewtopic.php?f=3&t=3923] zavalinka.listbb.ru/viewtopic.php?f=3&t=3923[/url]

один вин [url=https://aktivnoe.forum24.ru/?1-8-0-00000252-000-0-0-1741169084]https://aktivnoe.forum24.ru/?1-8-0-00000252-000-0-0-1741169084[/url] .

Приобрести диплом о высшем образовании!

Мы изготавливаем дипломы любой профессии по приятным тарифам. Вы заказываете документ в надежной и проверенной компании. : [url=http://realroleplay.listbb.ru/viewtopic.php?f=40&t=675\]realroleplay.listbb.ru/viewtopic.php?f=40&t=675[/url]

Мы предлагаем дипломы любой профессии по доступным тарифам. Преимущества приобретения документов в нашем сервисе

Вы покупаете документ в надежной и проверенной временем компании. Это решение сэкономит не только много денежных средств, но и ваше время.

На этом преимущества не заканчиваются, их намного больше:

• Документы делаем на фирменных бланках с мокрыми печатями и подписями;

• Дипломы любых учебных заведений РФ;

• Цена во много раз меньше нежели пришлось бы платить на очном и заочном обучении в университете;

• Доставка как по Москве, так и в любые другие регионы РФ.

Приобрести диплом о высшем образовании– [url=http://eruptz.com/read-blog/31161_kupit-diplom-kolledzha.html\]eruptz.com/read-blog/31161_kupit-diplom-kolledzha.html[/url]

[b]Диплом ВУЗа РФ![/b]

Без присутствия диплома очень сложно было продвинуться по карьерной лестнице. Поэтому решение о заказе диплома стоит считать мудрым и рациональным. Купить диплом университета [url=http://russia.forumex.ru/posting.php?mode=post&f=3/] russia.forumex.ru/posting.php?mode=post&f=3[/url]

1win официальный сайт [url=1win42.com.kg]1win42.com.kg[/url] .

1 win официальный сайт [url=http://1win108.com.kg]http://1win108.com.kg[/url] .

1wln [url=http://1win102.com.kg]1wln[/url] .

Мы можем предложить документы университетов, расположенных на территории всей России. [url=http://peoplediplom.ru/kupit-diplom-v-krasnoyarske-8/]peoplediplom.ru/kupit-diplom-v-krasnoyarske-8[/url]

Где купить диплом специалиста?

Приобрести документ ВУЗа можно у нас в Москве. Мы оказываем услуги по производству и продаже документов об окончании любых университетов РФ. [url=http://pesnibardov.ru/f/ucp.php?mode=login/]pesnibardov.ru/f/ucp.php?mode=login[/url]

1вин официальный сайт [url=www.1win100.com.kg]1вин официальный сайт[/url] .

приложение к аттестату о среднем полном общем образовании купить

скачать 1win с официального сайта [url=www.mostbet21.com.kg]www.mostbet21.com.kg[/url] .

ван вин [url=https://www.1win101.com.kg]https://www.1win101.com.kg[/url] .

Покупка школьного аттестата с упрощенной программой: что важно знать

мостбет зеркало [url=https://mostbet20.com.kg/]https://mostbet20.com.kg/[/url] .

диплом врача цена [url=https://prema-diploms.ru/]диплом врача цена[/url] .

Заказать документ института можно у нас в столице. [url=http://diplom-onlinex.com/kupit-diplom-ryazan-3]diplom-onlinex.com/kupit-diplom-ryazan-3[/url]

[u][b] Добрый день![/b][/u]

Руководители больших компаний довольно часто выбирают кандидатов, которые закончили университет. Особенно ценятся престижные заведения. Но учиться 5 лет – это долго и дорого, не у всех имеется такая возможность. Заказать документ становится самым оптимальным решением.

Бывают и непредвиденные обстоятельства, когда диплом ВУЗа потерян. Не всегда удастся оперативно и без проблем восстановить его, особенно если ВУЗ закрыт или расположен в другом регионе России. Бюрократия отнимает огромное количество времени и нервов.

Для максимально быстрого продвижения вверх по карьере понадобится наличие диплома о высшем образовании. Впрочем часто в жизни может случиться так, что некоторые трудности мешают с успехом окончить учебу и заполучить желанный документ.

Заказать диплом ВУЗа

[b]Наша компания предлагает[/b] быстро приобрести диплом, который выполнен на оригинальной бумаге и заверен мокрыми печатями, штампами, подписями. Документ способен пройти любые проверки, даже при использовании специальных приборов. Достигайте цели максимально быстро с нашими дипломами.

[b]Где купить диплом специалиста?[/b] [url=http://rdiplomans.com/]rdiplomans.com/[/url]

1win ru [url=https://1win46.com.kg]1win ru[/url] .

мос бет [url=https://mostbet19.com.kg]мос бет[/url] .

сайт для на почему мостбет выбор чемпионов [url=https://www.mostbet14.com.kg]https://www.mostbet14.com.kg[/url] .

мост бет [url=https://mostbet13.com.kg]мост бет[/url] .

купить диплом окд

купить диплом о средне специальном образовании недорого

мостбет казино вход [url=https://mostbet12.com.kg/]мостбет казино вход[/url] .

мостбет казино официальный сайт [url=www.mostbet11.com.kg]www.mostbet11.com.kg[/url] .

Мы изготавливаем дипломы любой профессии по выгодным ценам. Купить диплом в Майкопе — [url=http://kyc-diplom.com/geography/majkop1.html/]kyc-diplom.com/geography/majkop1.html[/url]

Получить диплом любого ВУЗа поспособствуем. Купить диплом бакалавра в Москве – [url=http://diplomybox.com/kupit-diplom-bakalavra-v-moskve/]diplomybox.com/kupit-diplom-bakalavra-v-moskve[/url]

mostbet регистрация через официальный сайт [url=http://mostbet10.com.kg/]http://mostbet10.com.kg/[/url] .

1c программа купить [url=http://programmy-1s11.ru/]1c программа купить[/url] .

купить силовой трансформатор [url=https://www.silovye-transformatory-kupit11.ru]купить силовой трансформатор[/url] .

1win live [url=https://www.1win41.com.kg]https://www.1win41.com.kg[/url] .

Здравствуйте!

Заказать диплом университета по выгодной стоимости можно, обратившись к проверенной специализированной компании. Заказать диплом: [url=http://diplom4you.com/kupit-diplom-tula-5/]diplom4you.com/kupit-diplom-tula-5/[/url]

1win com [url=http://1win37.com.kg/]http://1win37.com.kg/[/url] .

1win online casino [url=https://1win2.com.mx]https://1win2.com.mx[/url] .

mostvet [url=https://mostbet9.com.kg/]https://mostbet9.com.kg/[/url] .

mostbet uz скачать на компьютер [url=https://mostbet3019.ru/]https://mostbet3019.ru/[/url] .

1 вин вход [url=1win36.com.kg]1win36.com.kg[/url] .

mostbet uz [url=https://www.mostbet3020.ru]https://www.mostbet3020.ru[/url] .

сухие трансформаторы цена [url=https://cah.forum24.ru/?1-12-0-00000014-000-0-0/]сухие трансформаторы цена[/url] .

Мы готовы предложить [b]дипломы[/b] любой профессии по доступным тарифам. — [url=http://linqto.me/about/diplomygroup/]linqto.me/about/diplomygroup[/url]

Приобрести [b]диплом[/b] любого ВУЗа можем помочь- [url=http://diplomybox.com/otzyvy-klientov?start=60/]diplomybox.com/otzyvy-klientov?start=60[/url]

силовые трансформаторы [url=https://superogorod.ucoz.org/forum/2-2766-1/]силовые трансформаторы[/url] .

программы 1с [url=http://snatkina.borda.ru/?1-11-0-00000304-000-0-0/]программы 1с[/url] .

1с купить москва [url=https://belbeer.borda.ru/?1-6-0-00001349-000-0-0]1с купить москва[/url] .

купить диплом менеджера [url=https://diploms-bests.ru/]купить диплом менеджера[/url] .

купить диплом с занесением в реестр в нижнем новгороде

диплом купить мвд [url=https://prema-diploms.ru/]prema-diploms.ru[/url] .

Добрый день!

Покупка диплома ВУЗа через надежную фирму дарит множество преимуществ. Такое решение дает возможность сэкономить время и существенные финансовые средства. Впрочем, преимуществ значительно больше.Мы изготавливаем дипломы любой профессии. Дипломы производятся на настоящих бланках государственного образца. Доступная цена в сравнении с огромными затратами на обучение и проживание в другом городе. Приобретение диплома университета станет рациональным шагом.

Купить диплом: [url=http://pbase.com/diplomygroup/]pbase.com/diplomygroup[/url]

аттестат купить в красноярске

купить диплом об окончании [url=https://2orik-diploms.ru/]купить диплом об окончании[/url] .

купить аттестат в калуге

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Стоимость дипломов высшего и среднего образования и процесс их получения

Добрый день!

Без ВУЗа очень непросто было продвигаться вверх по карьере. Сегодня же документ не дает совершенно никаких гарантий, что удастся найти престижную работу. Более важны профессиональные навыки и знания специалиста и его опыт. Именно из-за этого решение о заказе диплома стоит считать рациональным. Быстро и просто купить диплом о высшем образовании [url=http://ukrom.in.ua/users/327?wid=9310] ukrom.in.ua/users/327?wid=9310[/url]

Привет!

Мы готовы предложить дипломы психологов, юристов, экономистов и прочих профессий по приятным ценам. Стоимость зависит от выбранной специальности, года выпуска и образовательного учреждения: [url=http://diplomanrus.com/]diplomanrus.com/[/url]

Приветствую!

Где заказать [b]диплом[/b] по нужной специальности?

Мы изготавливаем [b]дипломы[/b] любых профессий по разумным ценам. Стоимость будет зависеть от конкретной специальности, года выпуска и образовательного учреждения. Всегда стараемся поддерживать для заказчиков адекватную политику тарифов. Важно, чтобы документы были доступны для подавляющей массы наших граждан.

Покупка документа, который подтверждает обучение в университете, – это рациональное решение. Просто посчитайте, сколько вам пришлось бы вложить денег на оплату 5-летнего обучения, на аренду жилья (если студент из другого города), на проезд до института и другие издержки. Получится приличная сумма, которая значительно превышает цены на нашу услугу. А ведь все эти пять лет можно работать, развивая собственные навыки на практике.

Готовый диплом со всеми печатями и подписями целиком и полностью отвечает запросам и стандартам Министерства образования и науки России, неотличим от оригинала – даже со специально предназначенным оборудованием. Не откладывайте свои мечты на пять лет, реализуйте их с нашей компанией – отправляйте простую заявку на диплом прямо сейчас!

Заказать диплом о высшем образовании – быстро и просто! [url=http://diplomanrussians.com/]diplomanrussians.com/[/url]

[url=http://okdiplom.ru/kupit-diplom-sankt-peterburgskogo-mediko-texnicheskogo-instituta]купить диплом технологического института[/url]

Официальная покупка диплома вуза с сокращенной программой в Москве

Мы предлагаем документы престижных ВУЗов, которые находятся на территории всей России. [url=http://nsk-diplom.com/kupit-attestati-za-11-4-2/]nsk-diplom.com/kupit-attestati-za-11-4-2[/url]

[u]Доброго времени суток! [/u]

Для некоторых людей, купить [b]диплом[/b] о высшем образовании – это острая необходимость, уникальный шанс получить отличную работу. Впрочем для кого-то – это разумное желание не терять множество времени на учебу в ВУЗе. Что бы ни толкнуло вас на это решение, мы готовы помочь. Оперативно, качественно и выгодно изготовим документ любого ВУЗа и любого года выпуска на подлинных бланках со всеми требуемыми подписями и печатями.

Ключевая причина, почему люди покупают документы, – получить определенную работу. Предположим, навыки и опыт позволяют человеку устроиться на желаемую работу, однако документального подтверждения квалификации не имеется. При условии, что работодателю важно присутствие “корочки”, риск потерять место работы достаточно высокий.

Заказать документ университета можно в нашей компании. Мы предлагаем документы об окончании любых университетов России. Вы получите необходимый диплом по любой специальности, включая документы СССР. Гарантируем, что при проверке документа работодателем, каких-либо подозрений не появится.

Ситуаций, которые вынуждают приобрести диплом ВУЗа много. Кому-то прямо сейчас нужна работа, в итоге нужно произвести впечатление на начальника в процессе собеседования. Другие желают попасть в престижную компанию, чтобы повысить собственный статус и в будущем начать свой бизнес. Чтобы не тратить массу времени, а сразу начинать успешную карьеру, применяя врожденные способности и полученные знания, можно заказать диплом в интернете. Вы сможете стать полезным в социуме, обретете денежную стабильность в кратчайший срок- [url=http://rdiploman.com/] диплом купить о среднем образовании[/url]

Быстрая схема покупки диплома старого образца: что важно знать?

реавиз медицинский университет купить его диплом [url=https://prema-diploms.ru/]prema-diploms.ru[/url] .

[u][b] Привет, друзья![/b][/u]

Начальники часто предпочитают принимать претендентов, которые закончили высшее учебное заведение. Особенно ценятся топовые учебные заведения. Но учиться целых пять лет – это долго, далеко не у всех есть такая возможность. Приобрести документ – лучший выход.

Могут быть и непредвиденные обстоятельства, когда диплом утерян. Далеко не всегда можно быстро и беспроблемно восстановить документ, особенно если ВУЗ закрыт или располагается где-то в другом регионе России. Бюрократия отнимает огромное количество времени.

Для удачного продвижения по карьерной лестнице необходимо наличие официального диплома ВУЗа. Однако зачастую в жизни может случиться так, что те или иные трудности не позволяют с успехом окончить учебу, получив желанный документ.

Купить диплом о высшем образовании

[b]Наши специалисты предлагают[/b] быстро заказать диплом, который выполнен на оригинальном бланке и заверен мокрыми печатями, штампами, подписями. Диплом способен пройти лубую проверку, даже при использовании специально предназначенного оборудования. Решайте свои задачи быстро и просто с нашим сервисом.

[b]Где приобрести диплом специалиста?[/b] [url=http://diploman-russian.com/]diploman-russian.com/[/url]

на каком сайте купить диплом отзывы

Приобрести документ университета можно в нашей компании. [url=http://diplomservis.com/kupit-diplom-xabarovsk-3]diplomservis.com/kupit-diplom-xabarovsk-3[/url]

симферополь купить диплом

перепланировка помещений [url=svstrazh.forum24.ru/?1-18-0-00000133-000-0-0]перепланировка помещений[/url] .

как зайти на сайт мостбет [url=www.mostbet8.com.kg]www.mostbet8.com.kg[/url] .

1 win официальный сайт скачать [url=https://www.1win22.com.kg]https://www.1win22.com.kg[/url] .

перепланировка согласование [url=www.superogorod.ucoz.org/forum/2-2737-1/]перепланировка согласование[/url] .

mostbet online uz [url=https://mostbet3016.ru]mostbet online uz[/url] .

скачать mostbet uz [url=https://mostbet3015.ru]скачать mostbet uz[/url] .

apple macbook pro 15 2018 https://apple-macbook-15.ru

1win вход [url=www.mostbet18.com.kg]1win вход[/url] .

печать наклеек на пленке спб [url=https://pechat-nakleek-spb11.ru/]печать наклеек на пленке спб[/url] .

1wln [url=https://1win35.com.kg/]1wln[/url] .

1вин официальный сайт [url=http://1win34.com.kg]http://1win34.com.kg[/url] .

1win казино [url=http://1win33.com.kg/]http://1win33.com.kg/[/url] .

1win ваучер [url=https://1win39.com.kg/]https://1win39.com.kg/[/url] .

win 1 [url=http://1win40.com.kg]http://1win40.com.kg[/url] .

ремонт холодильников кузьминки [url=https://remont-holodilnikov11.ru/]ремонт холодильников кузьминки[/url] .

мастер по ремонту холодильников на дому москва [url=https://severussnape.borda.ru/?1-5-0-00000032-000-0-0]мастер по ремонту холодильников на дому москва[/url] .

1 win официальный сайт вход [url=https://1win38.com.kg]https://1win38.com.kg[/url] .

mostbet скачать [url=http://mostbet17.com.kg]mostbet скачать[/url] .

mostbet kg скачать на андроид [url=http://mostbet16.com.kg/]http://mostbet16.com.kg/[/url] .

вход в 1win [url=http://1win18.com.kg]http://1win18.com.kg[/url] .

wikibank.kz [url=https://www.wikibank.kz]https://www.wikibank.kz[/url] .

888starz скачать на айфон бесплатно http://watersport.org.ru/images/pgs/888starz-top-10-slotov-casino.html

888starz bet скачать на айфон http://watersport.org.ru/images/pgs/888starz-top-10-slotov-casino.html

888 starz http://watersport.org.ru/images/pgs/888starz-top-10-slotov-casino.html

888starz http://watersport.org.ru/images/pgs/888starz-top-10-slotov-casino.html

best darknet markets darknet markets links

888starz скачать на айфон http://hckolagmk.ru/images/pgs/888starz-strategia-martingeila.html

1win регистрация кыргызстан [url=http://1win17.com.kg]http://1win17.com.kg[/url] .

промокоды на ставки на спорт [url=http://1win16.com.kg/]http://1win16.com.kg/[/url] .

business 1win [url=https://1win15.com.kg/]1win15.com.kg[/url] .

мостбет официальный вход [url=http://mostbet104.com.kg/]http://mostbet104.com.kg/[/url] .

скачать 1win официальный сайт [url=https://vbfc.uz/]https://vbfc.uz/[/url] .

mostbet kyrgyzstan [url=www.mostbet103.com.kg/]www.mostbet103.com.kg/[/url] .

мостбет официальный сайт [url=https://mostbet102.com.kg/]мостбет официальный сайт[/url] .

планета ставок [url=https://mostbet101.com.kg/]https://mostbet101.com.kg/[/url] .

mostbet kg регистрация [url=http://mostbet100.com.kg]http://mostbet100.com.kg[/url] .

1win game [url=https://1win4.com.ng/]https://1win4.com.ng/[/url] .

лучшие игровые автоматы [url=https://t.me/igrovyyeavtomaty]лучшие игровые автоматы[/url] .

888 starz скачать ios https://globuss24.ru/wp-pages/?888starz-online-casino_2.html

1win login ug [url=http://www.1win1.ug]http://www.1win1.ug[/url] .

1win registration [url=www.1win2.ug/]www.1win2.ug/[/url] .

1win bet app [url=https://1win3.ug]https://1win3.ug[/url] .

1 win bet [url=1win4.ug]1win4.ug[/url] .

1win sport [url=https://1win2.am]https://1win2.am[/url] .

скачать 888 starz https://fasterskier.com/wp-content/blogs.dir/?888starz-site-officiel_1.html

скачать 888starz на андроид бесплатно https://www.city04.kz/list/509946

1вин казино официальный [url=www.1win8.com.kg/]www.1win8.com.kg/[/url] .

плинко онлайн [url=https://1win7.com.kg]https://1win7.com.kg[/url] .

авиатор на 1win [url=www.1win2.com.kg]www.1win2.com.kg[/url] .

1win сайт online [url=http://1win1.am]http://1win1.am[/url] .

4khymHqtNmu

888starz бонусы https://kgsxa.ru/components/com_newsfeeds/views/category/tmpl/news/3/1/304_888starz_kazino_podborka_igr.html

oue3clx5AaJ

как выводить деньги с 1win [url=http://1win1.com.kg/]http://1win1.com.kg/[/url] .

1win site [url=https://1win2.md/]https://1win2.md/[/url] .

1 win сайт [url=1win3.md]1win3.md[/url] .

накрутка живых зрителей на Твиче [url=www.twitchvc.ru/]www.twitchvc.ru/[/url] .

накрутка подписчиков в ТГ 100 [url=www.tgpodvc.ru]накрутка подписчиков в ТГ 100[/url] .

лаборатория соут [url=http://www.sout213.ru]лаборатория соут[/url] .

аттестация обучение охрана труда [url=https://www.ohrana-truda-distancionno.ru]аттестация обучение охрана труда[/url] .

mostbet kg [url=www.mostbet4.com.kg]mostbet kg[/url] .

ваучер мостбет [url=mostbet3.com.kg]mostbet3.com.kg[/url] .

рулонные шторы электрические [url=www.rulonnye-shtory-s-elektroprivodom177.ru]рулонные шторы электрические[/url] .

888starz https://rossensor.ru/forum/?PAGE_NAME=profile_view&UID=43306

услуги по специальной оценке условий труда [url=www.sout095.ru]услуги по специальной оценке условий труда[/url] .

Как заменить турбину на машине и не переплатить втрое больше. Типичная схема развода на замену турбины. Будьте осторожны. Подробности тут [url=www.drive2.ru/l/692995242026081345//]Как заменить турбину на машине и не переплатить втрое больше. Типичная схема развода на замену турбины. Будьте осторожны. Подробности тут[/url] .

Чистоговорки для детей [url=https://www.raskraska1.ru]Чистоговорки для детей[/url] .

red sp5der hoodie [url=https://spiderhoodie-us.com/spider-hoodies]https://spiderhoodie-us.com/spider-hoodies[/url] .

скачать мостбет казино на андроид [url=mostbet2.com.kg]mostbet2.com.kg[/url] .

Любители спортивных ставок теперь могут делать прогнозы на важнейшие события, пользуясь удобным и надежным мобильным клиентом. Теперь ставки доступны в один клик, а возможность просмотра матчей в лайв-режиме делает игру еще более захватывающей. Платформа предлагает высокие коэффициенты, мгновенные выплаты и персонализированные предложения для каждого пользователя. Для полного доступа ко всем функциям достаточно 888starz скачать на андроид телефон бесплатно. Приложение гарантирует надежность, высокую скорость работы и поддержку множества платежных методов. Кроме того, доступны дополнительные бонусы для мобильных пользователей – фрибеты, кэшбэк и персональные акции. Скачивайте клиент и начинайте зарабатывать на ставках уже сегодня!

мосьет [url=https://mostbet111.ru/]мосьет[/url] .

мостбет ставки [url=https://www.mostbet113.ru]мостбет ставки[/url] .

мостбет ставки [url=https://mostbet112.ru]мостбет ставки[/url] .

most bet скачать [url=http://www.mostbet1.com.kg]http://www.mostbet1.com.kg[/url] .

1win онлайн [url=1win3.com.kg]1win3.com.kg[/url] .

somfy shop [url=www.prokarniz25.ru/]www.prokarniz25.ru/[/url] .

рулонные шторы с электроприводом [url=https://www.prokarniz24.ru]рулонные шторы с электроприводом[/url] .

автоматические рулонные шторы с электроприводом на окна [url=www.prokarniz13.ru]автоматические рулонные шторы с электроприводом на окна[/url] .

электрические шторы на пульте [url=https://www.prokarniz15.ru]электрические шторы на пульте[/url] .

электрокарниз для зашторивания окон купить [url=https://prokarniz38.ru]https://prokarniz38.ru[/url] .

электронный карниз для штор [url=prokarniz34.ru]электронный карниз для штор[/url] .

карниз с электроприводом [url=http://prokarniz20.ru/]карниз с электроприводом[/url] .

электрокарнизы для штор купить [url=prokarniz20.ru]электрокарнизы для штор купить[/url] .

электроприводы для штор [url=http://prokarniz19.ru]http://prokarniz19.ru[/url] .

электрокарнизы в москве [url=http://www.prokarniz17.ru]электрокарнизы в москве[/url] .

электрокарнизы [url=http://prokarniz11.ru]электрокарнизы[/url] .

student xxx sex video [url=www.teacherporntube.com/]www.teacherporntube.com/[/url] .

купить виагру для мужчин [url=http://viagramsk.biz/]купить виагру для мужчин[/url] .

ku9 app download [url=http://ku9-app.org]http://ku9-app.org[/url] .

tk999 download [url=www.tk999.dev]tk999 download[/url] .

tk999 bangladesh [url=http://tk999-app.info]http://tk999-app.info[/url] .

электрокарниз купить в москве [url=https://www.elektrokarnizy77.ru]электрокарниз купить в москве[/url] .

1win online login [url=https://bbcc.com.kg]https://bbcc.com.kg[/url] .

elion casino [url=https://www.elonbangladeshbet.com]elion casino[/url] .

elon bet [url=https://eloncasinofun.com]elon bet[/url] .

elonbet casino [url=https://elonbetting.com]https://elonbetting.com[/url] .

elonbet bangladesh [url=http://elonspin.com]http://elonspin.com[/url] .

888starz бонусы https://888-starz.blogspot.com/

порно гинеколог [url=ginekolog-rukoeb1.ru]порно гинеколог[/url] .

порно с милфой [url=http://milfland-pro1.ru]порно с милфой[/url] .

мультики порно [url=multiki-rukoeb1.ru]мультики порно[/url] .

1win официальный сайт войти [url=https://www.mabc.com.kg]1win официальный сайт войти[/url] .

вход мостбет [url=http://gtrtt.com.kg/]http://gtrtt.com.kg/[/url] .

telecharger 888starz sur Android gratuitement https://888stars.wordpress.com/

порно немцы [url=www.trax-nemeckoe1.ru/]www.trax-nemeckoe1.ru/[/url] .

elonbet bangladesh [url=http://www.elongaming.com]http://www.elongaming.com[/url] .

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Avec 888starz Casino version mobile, profitez d’une interface rapide et intuitive qui vous permet de jouer n’importe ou. Que vous soyez fan de poker, de blackjack ou de machines a sous, ce casino mobile vous garantit une experience fluide et des paiements rapides !

Чтобы играть без ограничений, заходите на 888starz официальный. Этот сайт предлагает надёжную защиту данных, быстрые выплаты выигрышей и множество выгодных акций.

888starz скачать https://g-r-s.fr/pag/888starz-casino-bookmaker_1.html

888starz официальный сайт https://akteon.fr/misc/pgs/casino-888starz-cotedivoire.html

888starz скачать https://nestone.uz/assets/pages/?888starz-download-app.html

888starz официальный сайт https://nestone.uz/assets/pages/?888starz-download-app.html

888starz https://nestone.uz/assets/pages/?888starz-download-app.html

888starz скачать https://manifesto-21.com/pages/888starz-bet-bookmaker.html

888starz https://manifesto-21.com/pages/888starz-bet-bookmaker.html

888starz https://veche.ru/parser/inc/888starz-obzor-casino.html

888starz скачать https://veche.ru/parser/inc/888starz-obzor-casino.html

888starz официальный сайт https://veche.ru/parser/inc/888starz-obzor-casino.html

888starz http://igpran.ru/sobytiya/artcls/?skachat_638.html

888starz https://www.lemontbrezno.sk/2024/09/23/skachat-i-igrat-na-dengi-onlajn-bonus-88/

Pour les amateurs de paris sportifs, bk 888 starz offre une plateforme dediee aux paris sur vos sports preferes. Avec des cotes competitives, une interface utilisateur fluide et des options de paris en direct, cette plateforme est parfaite pour tous ceux qui cherchent a ameliorer leur experience de pari en ligne.

You made some good points there. I looked on the internet for the topic and found most persons will agree with your site.

https://888starz-egypt.online/ ЩЉЩ€ЩЃШ± Щ„Щѓ ШЄШ¬Ш±ШЁШ© Щ…Ш±Ш§Щ‡Щ†Ш§ШЄ Ш±ЩЉШ§Ш¶ЩЉШ© Щ…Щ…ЩЉШІШ© Щ…Ш№ Щ…ЩѓШ§ЩЃШўШЄ Щ€Ш№Ш±Щ€Ш¶ ШШµШ±ЩЉШ©. Щ„Ш§ ШЄЩЃЩ€ШЄ Ш§Щ„ЩЃШ±ШµШ©.

ШҐШ°Ш§ ЩѓЩ†ШЄ ШЄШ±ШєШЁ ЩЃЩЉ Ш§Щ„ЩЃЩ€ШІ Ш§Щ„ЩѓШЁЩЉШ±ШЊ ЩЃШҐЩ† https://888starz-egypt.online/ Щ‡Щ€ Ш§Щ„Щ…Щ†ШµШ© Ш§Щ„Щ…Ш«Ш§Щ„ЩЉШ© Щ„Щѓ. Ш§ШЁШЇШЈ Ш§Щ„ШўЩ†.

https://888starz-egypt.online/ ЩЉЩ‚ШЇЩ… Щ„Щѓ ШЈЩЃШ¶Щ„ Ш§Щ„Ш№Ш±Щ€Ш¶ Ш§Щ„Ш±ЩЉШ§Ш¶ЩЉШ© Щ€Ш§Щ„ЩѓШ§ШІЩЉЩ†Щ€. Ш§ШЁШЇШЈ Ш§Щ„ШўЩ† Щ€Ш§ЩѓШЄШґЩЃ Ш§Щ„Щ…ШІЩЉШЇ.

Щ‚Щ… ШЁШ§Щ„ШЇШ®Щ€Щ„ ШҐЩ„Щ‰ https://888starz-egypt.online/ Щ„Щ„Ш§ШіШЄЩЃШ§ШЇШ© Щ…Щ† Ш¬Щ…ЩЉШ№ Ш§Щ„Ш№Ш±Щ€Ш¶ Ш§Щ„ШШµШ±ЩЉШ© Щ€Ш§Щ„Ш®ШЇЩ…Ш§ШЄ Ш§Щ„Щ…Щ…ЩЉШІШ© Ш§Щ„ШЄЩЉ ЩЉЩ‚ШЇЩ…Щ‡Ш§ Ш§Щ„Щ…Щ€Щ‚Ш№.

Kazino o‘yinlari va sportga stavkalar qilishni istaysizmi? Unda 888starz stavka ilovasini yuklab oling. Ushbu dastur qulay interfeys, yuqori tezlik va xavfsizlikni ta’minlaydi. Ilova foydalanuvchilarga barcha funksiyalardan cheksiz foydalanish imkoniyatini beradi. Yuklab olib, yutuqlarga erishing.

Откройте для себя мир азартных игр и ставок, установив 888starz ios. Это приложение специально адаптировано для iOS-устройств, предлагая удобный доступ к платформе. Вы сможете делать ставки на спорт, участвовать в акциях и наслаждаться казино-играми прямо с вашего телефона. Установка проста и занимает всего несколько минут, после чего вы получите полный доступ ко всем функциям, включая эксклюзивные бонусы. Безопасность и скорость работы приложения делают его идеальным выбором для любого пользователя. Установите 888starz для iOS сегодня и начните пользоваться всеми преимуществами платформы.

Yuqori darajadagi xavfsizlikni ta’minlovchi 888starz rasmiy ilovasini yuklab oling. Ushbu dastur orqali siz barcha sport turlari va kazino o‘yinlariga ulanish imkoniyatini qo‘lga kiritasiz. Ilovada yuqori koeffitsiyentlar va eksklyuziv bonuslar mavjud. Hoziroq yuklab olib, barcha funksiyalardan foydalanishni boshlang.

888starz ilovasini yuklab oling va barcha sport tadbirlari, kazino o‘yinlari hamda jonli stavkalardan foydalanish imkoniyatini qo‘lga kiriting. Ushbu dastur qulay interfeys, yuqori tezlik va xavfsizlikni ta’minlaydi. 888starz yuklab olish orqali barcha blokirovkalarni chetlab o‘ting va o‘yin dunyosidan zavqlaning.

IOS ?шін 888starz ?осымшасын орнатып, ?здік ставкаларды жаса?ыз.

Great post on money management tips. It’s impressive how you break down budgeting in such a practical way. Quick question: do you have any suggestions on how to stay motivated during long-term savings plans? Sometimes sticking to a budget feels tough. Thanks!

Eszter

At this time it sounds like Drupal is the best blogging platform available right now. (from what I’ve read) Is that what you are using on your blog?

I really like your writing style, superb information, thankyou for putting up : D.