- Finance

- September 30, 2024

Saving Vs Investment: A Quick Comparison

Grasping the difference between saving and investing is very important for keeping your finances secure and building a solid future. While people often mix these two terms up, they’re really different. Both saving and investing play a key role in personal finance, and getting started early can help you achieve lasting financial stability. However, keep one thing in mind: this is not a war of saving vs investment rather an analysis of both.

In this blog, we’ll explore what saving means, what investing is all about, and the ups and downs of each, plus some examples to make these ideas clear.

Let’s begin by exploring the concept of saving

Everyone knows what saving is, but what they don’t know is how saving money is more about discipline and mindset. Think about how you currently save money. What makes you want to save, and what are some problems you have to deal with?

People stash away cash for things they want to buy and for emergencies. Saving is a key part of personal finance where you set aside some dough for later use. Envision it as depositing a certain amount of money in a piggy bank, but instead of a piggy bank, one can opt for a savings account with an interest rate that accrues over time. There are many motivating factors regarding savings, such as purchasing a new device, going on a trip, or constructing a cushion for those unforeseeable expenses that may arise.

Maximizing savings has its inherent advantages, one of which is achieving short-term financial objectives or preparedness for certain emergencies like flat tires or hospital visits. Sometimes it is wise to save away some amounts of cash to assist one during hard times. Savings are usually low risk, so your money is safe, but that also means the interest rates aren’t all that high.

Types of saving account

- Regular savings account

- Zero balance or basic savings account

- Women’s savings account

- Kids’ saving account

- Senior citizens’ saving account

- Family savings account

- Salary account- salary based savings account

Pros and cons of saving

Benefits

- Savings is like a safety net—something you must have heard before. It covers your unexpected expenses, be it medical bills, car repairs, or job loss.

- It is a great way to help you reach specific financial goals, such as buying a house, starting a business, or funding your retirement.

- If you are depending on the savings account, you may earn interest on your deposits as it increases your savings over time.

- It helps your mind by keeping it away from stress and anxiety about money, acting just like a financial cushion.

Drawbacks

- You don’t want to miss out on higher returns from investments like stocks or bonds. This can happen if you keep your money in a low-interest savings account.

- Inflation is the evil that can erode the purchasing power of your savings over time. This means that your money may not be worth as much in the future.

- Can you beat the temptation? If yes, then it’s fine; if not, then easy access can let you spend it instead of saving for long-term goals.

Time to learn about investment

Investments are essentially about making your money work for you over time via stocks, bonds, and mutual funds. Saving and investing aren’t the same thing, since investing comes with some risks but also offers a good chance for better returns.

When you invest, you can hit big financial milestones, like covering college costs, buying a house, or getting ready for retirement. Because there is some measure of risk, it is very critical to get the right once that you want, how much risk you will be willing to take, and how long you will be holding the investment. Generally, the longer you can invest, the more risk you can handle since you’ll have time to ride out the market’s ups and downs.

Objectives of investment

- Get consistent cash flow from dividends, interest, or rental income.

- Keep your wealth safe from the sneaky effects of inflation.

- Build a nest egg for your retirement and diversify your portfolio to reduce risk.

- Transfer wealth to future generations and provide for loved ones.

- Reduce risk through diversification and hedging.

Types of investment

- Stocks

- Bonds

- Mutual Funds

- ULIP

- Savings/Endowment Policy

- Public Provident Fund (PPF)

- Real Estate

Steps to start investing

- Set financial goals

- Assess your risk tolerance

- Create a budget

- Research and educate yourself

- Open a brokerage account

- Start small and diversify

- Monitor and rebalance

Pros and cons of investment

Why investing is a good idea

- Investing can earn you more money than just putting it in a savings account, which means your money will grow over time.

- Stocks, bonds, and other investments can give you regular income in the form of returns or interest.

- If you put money away regularly, you can accumulate a good amount of money over time, especially if you use compound interest.

- Spreading your money around different types of assets is a good way to lower your risks and protect your money from market ups and downs.

- Investing is a great way to make money in your older years and is a very important part of planning for retirement.

Negative aspects about investing

- There is a chance that you will lose money when you invest. Your investment’s value can be changed by changes in the market, drops in the economy, and how well individual companies do.

- The value of your investments can change a lot, which means you might lose money in the short term.

- When you buy, your money is locked up, which means you might miss out on other opportunities or important needs.

- Coming up with business plans and learning about markets can be hard to understand and take a lot of time and work.

- A lot of investments have fees, such as management fees, transaction fees, and brokerage commissions that can cut into your profits.

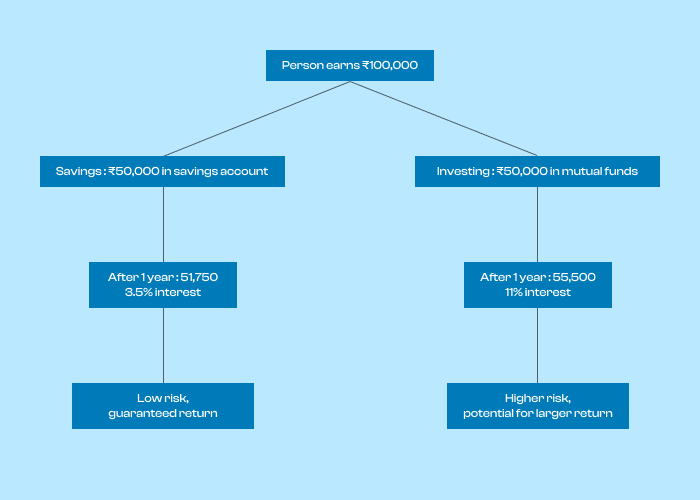

An example to show you what the difference between saving and investment is.

Let’s say someone in India makes ₹ 100,000 a year and wants to put away ₹ 50,000. They can do one of two things:

Savings

- They put ₹ 50,000 into a savings account at a bank like HDFC Bank or State Bank of India.

- If the interest rate stays around 3.5% for a year, which is pretty normal for Indian savings accounts, they’ll have ₹51,750.

- This is saving because the money is in an easy-to-reach account with very little risk.

- The return is small, but it’s a sure thing, and you don’t have to pay taxes on interest up to ₹ 10,000 a year.

Invest

- They could invest that ₹ 50,000 in an equity mutual fund.

- After a year, if they get an 11% return (which is not guaranteed and can vary), they could end up with ₹55,500.

- This is seen as investing since they’re putting their cash into assets that might give them higher returns but also come with more risk.

- The returns can be bigger, but they’re not guaranteed, and the value could drop too.

What’s the deal with saving and investment?

1. Putting your money in bank accounts is safe in India because the government backs you up for up to ₹ 5 lakhs per account. But if you’re thinking about investing in mutual funds or stocks, just know there’s a bit more risk involved.

2. In India, savings account interest rates are usually better than what you find in many western countries, but they still don’t match the potential gains you can get from investing.

3. If you earn more than ₹ 10,000 a year from your savings account, you’ll have to pay taxes on that interest. On the other hand, some investments, like Equity Linked Savings Schemes (ELSS), can help you save on taxes thanks to Section 80C.

4. Inflation in India tends to run higher than in many developed nations, so it’s important to invest if you want to reach your long-term financial goals and outpace inflation.

5. For a long time, lots of folks went for physical assets like gold and real estate when investing, but that’s changing as more people become financially literate.

6. India has a bunch of government-supported saving schemes like the Public Provident Fund (PPF) and National Savings Certificate (NSC), which offer better interest rates than regular savings accounts and come with government guarantees.

Final thoughts

Going through this blog, you might have gotten a good idea about both savings and investments, the two most important concepts when it comes to finance. A basic knowledge about them is crucial; hence, read it thoroughly and also recommend it to those who want to know the basics of finance. Remember, Peak72 is always available for assistance.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 26, 2024

- Finance

- September 23, 2024

- Finance, games

- September 20, 2024

Сайт Киева https://infosite.kyiv.ua ИнфоКиев: последние новости и события Киева и области.

An open source cloud https://github.com/pg-main/PostgreSQL DBMS that automates management, updates, and backups. Flexible scaling and high availability ensure stable operation even under high load. Easy integration with cloud infrastructure.

Блог о медицине https://medportal.co.ua Медпортал. Здрововье, спорт, психология, больницы. Статьи о медицине.

For most up-to-date information you have to pay a quick visit web and on world-wide-web I found this site as a most excellent site for newest updates.

Сантехник в Минске для вас! Мы выполняем установку и замену с оперативным выполнением. Получите подробности на нашем сайте ремонт сантехники минск

Городской портал Одессы https://u-misti.odesa.ua новости и события Одессы и области

888 starz отзывы https://fasterskier.com/wp-content/blogs.dir/?888starz-site-officiel_1.html

скачать 888starz на телефон андроид https://www.city04.kz/list/509946

pet products buy pet products

product clothing for animals pet products for cats

У містi Київ https://u-misti.kyiv.ua новини та події Київщини

Лучший вариант для стильного интерьера – только в Италии

купить итальянскую мебель в москве [url=kupit-mebel-italii.ru]kupit-mebel-italii.ru[/url] .

Аренда жилой недвижимости https://domhata.ru без посредников и переплат! Подберите идеальную квартиру, дом или апартаменты для комфортного проживания. Удобный поиск по цене, району и условиям.

Новини Дніпра https://u-misti.dp.ua Сайт міста Дніпро та області.

Hasanpaşa su kaçak tespiti Yıllık kaçak muayeneleri, ev sahiplerine önemli miktarda para kazandırabilir. http://topstours.com/?p=52415

Ищете надежного сантехника в Минске? Мы осуществляем аварийные вызовы с доступными ценами. Наши квалифицированные сантехники готовы осуществить замену. Узнайте больше на Вызов сантехника на дом Минск .

888 starz скачать бесплатно https://kgsxa.ru/components/com_newsfeeds/views/category/tmpl/news/3/1/304_888starz_kazino_podborka_igr.html

накрутка подписчиков в группу ВК бесплатно

накрутка живых подписчиков в группу ВК

Сайт мiста Черкаси https://u-misti.cherkasy.ua новини Черкас та областi.

Как выбрать конкурсного управляющего для своего бизнеса, Профессиональные советы начинающему конкурсному управляющему, опытные наставники делятся секретами, профессиональные советы от опытных коллег, Что нужно знать о конкурсном управлении: основные принципы, Роль конкурсного управляющего в современном бизнесе: анализ и выводы, практический курс, Как выбрать лучшего конкурсного управляющего для своей компании, Основные принципы работы конкурсного управляющего, секреты профессии, профессиональные стратегии

конкурсный управляющий [url=https://www.konkursnyj-upravlyayushhij.ru]https://www.konkursnyj-upravlyayushhij.ru[/url] .

Bk0rohAcj9R

Московский сервис [url=https://telegra.ph/Zajmy-pod-zalog-PTS—poluchit-zajm-pod-zalog-avtomobilya-na-kartu-onlajn-02-18]займ под залог птс автомобиля в москве[/url] предоставляет оптимальные условия для автовладельцев. Комфорт и безопасность гарантированы.

FFF0kz9dwo6

Автопортал https://avtogid.in.ua Автогiд сайт с полезными советами для автовладельцев. Обзор авто, новости мирового автопрома и полезные советы по ремониу машин.

What’s up Dear, are you actually visiting this site on a regular basis, if so after that you will absolutely take nice know-how.

бесплатная накрутка лайков подписчиков Тик Ток

Our motor tuning services are designed to enhance your journey. We offer unique upgrades that improve the efficiency and aesthetic of your motor. Whether you’re interested in suspension modifications or enhancing specific parts, we provide excellent solutions for every need. Trust our experts to deliver reliable results that will revive your ride. For more details, visit our website at https://accurateautobodyrepair.com/ and discover how we can help you.

I think that what you posted made a ton of sense. However, what about this? what if you were to create a killer headline? I am not suggesting your content is not solid, however suppose you added a post title that makes people desire more? I mean %BLOG_TITLE% is kinda vanilla. You ought to glance at Yahoo’s home page and note how they create article titles to get people interested. You might try adding a video or a picture or two to get readers interested about everything’ve got to say. In my opinion, it could make your posts a little livelier.

накрутка подписчиков ётуб купить

Hello colleagues, fastidious piece of writing and pleasant arguments commented here, I am in fact enjoying by these.

накрутка просмотров в Телеграм канал закрытый

kinogo фильмы по актерам киного фильмы 2025

киного лучшие фильмы киного 720p

Безопасность и надежность! [url=https://telegra.ph/Zajmy-pod-zalog-PTS—poluchit-zajm-pod-zalog-avtomobilya-na-kartu-onlajn-02-18]займ под залог птс авто[/url] делает процесс получения средств максимально комфортным. Удобство и прозрачность в каждом шаге.

Ваш автомобиль может стать инвестицией в будущее! [url=https://telegra.ph/Zajmy-pod-zalog-PTS—poluchit-zajm-pod-zalog-avtomobilya-na-kartu-onlajn-02-18]взять займ под залог автомобиля[/url] — это простой способ получить деньги, не отказываясь от транспорта.

игровые эльдорадо автоматы казино

eldorado casino бонус за регистрацию top casino online

турецкие сериалы на турецком языке онлайн смотреть турецкие сериалы

бесплатные турецкие сериалы все серии смотреть турецкий сериал

лучшие сериалы на турецком языке онлайн смотреть турецкие сериалы

турецкий сериал все серии турецкие сериалы смотретя

смотреть турецкие сериалы на русском онлайн смотреть турецкие сериалы

турецкие сериалы смотреть онлайн turokk

турецкий сериал все серии смотреть онлайн турецкие сериалы

смотреть турецкие сериалы на русском смотреть онлайн турецкие сериалы

смотреть турецкий сериал сезон смотреть турецкий сериал

турецкий сериал 1 серия турецкие сериалы смотреть онлайн бесплатно

турецкие сериалы подряд https://turkoff.pro

Портал о здоровье https://fines.com.ua все, что нужно для крепкого организма! Советы врачей, профилактика болезней, здоровое питание, спорт, психология, народная медицина и лайфхаки для долгой и активной жизни.

Справочник лекарственных https://mikstur.com средств – полная информация о медикаментах! Описания, показания, противопоказания, дозировки, аналоги и инструкции по применению.

Thank you for every other informative web site. The place else may just I get that kind of information written in such a perfect approach? I have a challenge that I’m simply now operating on, and I have been at the look out for such info.

https://web.archive.org/web/20170111172306/https:/scholarlyoa.com/publishers/

Твой женский сайт https://musicbit.com.ua о стиле, здоровье и вдохновении! Узнай секреты красоты, следи за модными новинками, развивайся, читай о психологии отношений и оставайся в гармонии с собой.

Портал о детях https://mch.com.ua полезно для родителей! Воспитание, здоровье, развитие, обучение, досуг, игры и семейные традиции. Экспертные советы, лайфхаки и полезные материалы для гармоничного роста малыша.

Лучший портал для родителей https://geog.org.ua и детей! Читайте о воспитании, обучении, здоровье, детской психологии, играх и семейном досуге. Советы экспертов и практические рекомендации.

Сайт для женщин https://ramledlightings.com будь лучшей версией себя! Читай о моде, красоте, психологии, отношениях, материнстве и женском здоровье. Найди вдохновение и полезные советы для каждого дня!

Нужны средства срочно? Получите мгновенный займ на счет в банке за четверть часа. https://zaym-bez-proverok.ru/ Оформите запрос без подтверждений и получите согласие уже сегодня!

Твой идеальный https://prettywoman.kyiv.ua женский портал! Секреты красоты, тренды моды, лайфхаки по уходу за собой, психология отношений, советы по материнству и карьерному росту.

Современный женский портал https://presslook.com.ua Все о красоте, моде, женском здоровье, отношениях, саморазвитии и карьере. Читай, вдохновляйся и меняй свою жизнь к лучшему!

Твой путеводитель https://mirlady.kyiv.ua в мире женских секретов! Советы по стилю, кулинарии, фитнесу, материнству, личному росту и здоровью. Всё, что нужно для счастливой жизни!

Портал для женщин https://nicegirl.kyiv.ua которые любят себя! Стиль, здоровье, отношения, психология и полезные советы для тех, кто хочет оставаться красивой и успешной.

Кайт Хургада

Портал для женщин https://lolitaquieretemucho.com которые ценят себя! Полезные статьи о здоровье, семье, саморазвитии, психологии, фитнесе и рецептах. Будь уверенной, счастливой и успешной!

Главный женский портал https://horoscope-web.com будь в центре трендов! Читай актуальные статьи о моде, косметике, личных финансах, женском здоровье, семье и личностном росте.

шлюха сосет где можно порно детские

Твой женский портал https://girl.kyiv.ua о стиле и гармонии! Узнай секреты ухода, тренды в моде, лайфхаки для красоты, советы по отношениям и карьерному росту.

Портал для женщин https://feminine.kyiv.ua твой путеводитель в мире стиля и успеха! Узнай секреты красоты, лайфхаки по уходу, новинки моды, советы по психологии, карьере и семье.

Твой идеальный женский https://femalesecret.kyiv.ua журнал! Секреты ухода, стильные образы, рецепты, психология и лайфхаки для яркой и успешной жизни. Вдохновение каждый день!

Главный женский журнал https://amideya.com.ua о стиле и успехе! Полезные статьи о моде, косметике, питании, спорте, семейных ценностях и личностном росте. Читай и развивайся вместе с нами!

Актуальные новости https://www.moscow.regnews.info Московского региона! Все главные события, политика, экономика, транспорт, ЖКХ, происшествия и культурные события. Будьте в курсе того, что происходит в вашем городе!

Проблемы с сантехникой в Минске? Наши квалифицированные сантехники готовы решить любые проблемы быстро и эффективно. Узнайте больше на Установка унитаза Минск.

Твой идеальный женский https://family-site.com.ua журнал! Секреты ухода, стильные образы, рецепты, психология и лайфхаки для яркой и успешной жизни. Вдохновение каждый день!

Журнал про автолюбители https://tuning-kh.com.ua новости, тесты, обзоры! Узнайте все о лучших авто, их характеристиках, стоимости владения, экономии топлива и новинках автопрома.

Все об автомобилях https://tvk-avto.com.ua на одном портале! Новинки мирового автопрома, тест-драйвы, автострахование, электрокары и полезные статьи для каждого водителя.

Твой авто-гид https://troeshka.com.ua в мире машин! Обзоры новых моделей, тест-драйвы, советы по ремонту и тюнингу, автоновости и технологии будущего. Все, что нужно автолюбителю!

Автомобильный мир https://prestige-avto.com.ua в одном журнале! Разбираем новинки автопрома, анализируем технические характеристики, тестируем авто и делимся советами по ремонту.

Автомобильный журнал https://orion-auto.com.ua только важные новости! Все о популярных марках, топовые авто 2024 года, электрокары, автономное вождение и тенденции рынка.

Журнал о машинах https://reuth911.com для настоящих ценителей авто! Обзоры, рейтинги, полезные статьи о ремонте, тюнинге и современных автомобильных технологиях.

Современный автомобильный https://k-moto.com.ua журнал! Читайте о трендах в автоиндустрии, новейших моделях, электромобилях, тюнинге и умных технологиях.

Автомобильный мир https://diesel.kyiv.ua в одном журнале! Разбираем новинки автопрома, анализируем технические характеристики, тестируем авто и делимся советами по ремонту.

Журнал для автолюбителей https://avtoshans.in.ua и профессионалов! Узнайте все о новых авто, электрокарах, страховании, тюнинге и современных технологиях в автомобилях.

Все о машинах https://autoinfo.kyiv.ua в одном журнале! Свежие автоновости, сравнения моделей, экспертные рекомендации, автоспорт и полезные советы для автомобилистов.

Любители спортивных ставок и азартных развлечений могут воспользоваться удобным приложением, которое предоставляет доступ к ставкам в режиме реального времени, а также к игровым автоматам и лайв-играм. Теперь вы сможете быстро пополнять баланс, делать прогнозы на любимые спортивные события и получать бонусы за активность. Для этого достаточно 888starz bet, пройти простую регистрацию и начать играть. В приложении реализована удобная система управления ставками, быстрые выплаты и возможность просмотра статистики матчей. Кроме того, игроки могут участвовать в турнирных розыгрышах и получать дополнительные бонусы. Если вы хотите испытать все преимущества мобильного казино, скачайте клиент и начните зарабатывать уже сегодня!

Мы делаем все возможное, чтобы помочь вам быстро и эффективно. Наши онлайн займы без отказов и проверок доступны каждому, кто нуждается в деньгах. Мы не требуем справок о доходах или поручителей. Все операции проводятся онлайн, что делает процесс максимально комфортным. Неважно, какой у вас опыт кредитования — мы готовы помочь каждому. Получить помощь можно здесь: [url=https://maps.google.com.pl/url?q=https://mikro-zaim-online.ru/]займы на карту онлайн[/url] .

Журнал об авто https://auto-club.pl.ua для тех, кто за рулем! Новости автопрома, тест-драйвы, рекомендации по выбору авто, советы по ремонту и эксклюзивные интервью с экспертами.

Журнал для автолюбителей https://myauto.kyiv.ua и профессионалов! Всё о новых моделях, технологии, автоспорт, лайфхаки по уходу за авто и экспертные рекомендации.

Все об автомобилях https://allauto.kyiv.ua в одном журнале! Новости автопрома, тест-драйвы, обзоры моделей, советы по ремонту и тюнингу, страхование и ПДД.

буст билдов path of exile 2 купить прокачку path of exile 2

Главный авто-журнал https://myauto.kyiv.ua для водителей! Новости, обзоры, сравнения, тюнинг, автоспорт и технологии. Будьте в курсе последних трендов автомобильного мира!

Журнал об автомобилях https://setbook.com.ua всё для автолюбителей! Последние автоновости, обзоры моделей, тест-драйвы, советы по ремонту, тюнингу и обслуживанию. Узнайте всё о мире автомобилей!

Replica Uhren https://www.imailen.com in Deutschland schnell und sicher per DHL Nachnahme bestellen. Nur geprufte Qualitat in EU hergestellt.

мегафон интернет

https://ekb-domasnij-internet.ru

провайдер мегафон

Ищете актуальные промокоды на фриспины? Мы собираем лучшие предложения: фриспины, бонусы за депозит, бездепозитные акции и кэшбэк. Получите максимум выгоды от игры!

Blacksprut – онлайн-маркетплейс https://bsmc.at с лучшими предложениями. Надёжные продавцы, защищённые сделки, удобный поиск. Оцените удобство покупок уже сегодня!

Blacksprut – современная площадка https://bs-bsme.at для безопасных покупок. Большой выбор категорий, продуманная система рейтингов и отзывов. Заходите и находите нужное легко!

What’s up, after reading this awesome paragraph i am as well happy to share my experience here with mates.

https://rt.live24sex.net/couples

проверенный маркетплейс https://bsme.cat предлагающий товары на любой вкус. Простая регистрация, быстрая оплата и защита сделок. Убедитесь в качестве сервиса сами!

BlackSprut передовой маркетплейс https://m-bsme.at с высокими стандартами безопасности и удобной системой поиска. Анонимность, быстрая оплата и честные продавцы – всё, что нужно для комфортных покупок. Мы гарантируем защиту ваших данных и качественное обслуживание. Присоединяйтесь к BlackSprut и открывайте новые возможности!

BlackSprut крупнейший маркетплейс https://bb2best.at где можно найти всё, что вам нужно. Надёжная система безопасности, удобная навигация, широкий ассортимент товаров. Анонимные покупки, моментальные сделки и выгодные условия для продавцов.

BlackSprut это инновационный https://bs2best.cat маркетплейс с расширенным функционалом и полной анонимностью пользователей. Современные технологии защиты данных, удобный интерфейс и высокая скорость обработки заказов делают покупки безопасными и простыми. Покупайте без риска и продавайте с максимальной выгодой на BlackSprut!

Проблемы с входом https://bs2best.or.at Найдите актуальные зеркала и заходите без ограничений. Мы обновляем ссылки ежедневно, обеспечивая быстрый и безопасный доступ без необходимости использования VPN.

Всегда актуальные ссылки https://bs2bet.at для входа. Обходите блокировки легко и быстро, используя надёжные зеркала. Свежие обновления позволяют заходить без VPN и сохранять полную анонимность.

Актуальные зеркала BlackSprut https://kra26.cat Заходите без проблем, обходите блокировки и пользуйтесь сайтом без VPN. Мы следим за обновлениями и всегда предоставляем свежие ссылки.

Безопасный доступ к сайту https://bsme-at.at без ограничений. Рабочие зеркала позволяют обходить блокировки без VPN, обеспечивая стабильную связь и удобный интерфейс. Следите за обновлениями, чтобы всегда оставаться в сети.

Первый раз берете займ? Получите [url=https://telegra.ph/Zajm-na-kartu-onlajn—poluchite-zajm-onlajn-ot-luchshih-MFO-02-15]первый займ на карту без процентов[/url]. Это ваш шанс попробовать наши услуги без лишних затрат.

Твой гид в мире https://happywoman.kyiv.ua женственности и гармонии! Узнай больше о моде, косметике, фитнесе, отношениях и мотивации. Все, что нужно для яркой и счастливой жизни!

Мир женщины https://fashionadvice.kyiv.ua красота, здоровье, успех! Полезные лайфхаки, тренды моды, секреты счастья и гармонии. Портал для тех, кто хочет быть лучшей версией себя!

Портал для современной https://femaleguide.kyiv.ua женщины! Открой для себя новые идеи в моде, красоте, отношениях и саморазвитии. Полезные статьи и советы для комфортной и счастливой жизни

Онлайн мир женщины https://gracefullady.kyiv.ua красота, здоровье, успех! Полезные лайфхаки, тренды моды, секреты счастья и гармонии. Портал для тех, кто хочет быть лучшей версией себя!

Женский портал https://beautyadvice.kyiv.ua для современной женщины! Мода, красота, здоровье, отношения, кулинария и карьера. Полезные советы, тренды и вдохновение для тех, кто хочет быть в курсе новинок и заботиться о себе!

Все для женщин https://elegance.kyiv.ua в одном месте! Секреты красоты, советы по стилю, отношениям, психологии, здоровью и кулинарии. Будьте вдохновленными и уверенными каждый день!

Автомобильный портал https://nerjalivingspace.com для автолюбителей! Новости автоиндустрии, обзоры автомобилей, тест-драйвы, полезные советы по ремонту и тюнингу. Будьте в курсе последних трендов и находите ответы на все авто-вопросы!

Делаем ремонт правильно https://zarechany.zt.ua Разбираем все этапы – от выбора материалов до дизайна интерьера. Подробные инструкции и лайфхаки от специалистов!

Идеи для дома https://ucmo.com.ua ремонта и строительства! Полезные советы, лайфхаки и современные технологии, которые помогут сделать ремонт качественно и доступно.

Ремонт без стресса https://panorama.zt.ua Готовые решения, полезные лайфхаки, выбор материалов и идеи для дома. Делаем ремонт комфортным и доступным!

Идеи для дома https://ucmo.com.ua ремонта и строительства! Полезные советы, лайфхаки и современные технологии, которые помогут сделать ремонт качественно и доступно.

Профессиональные советы https://ukk.kiev.ua по ремонту и строительству! Пошаговые инструкции, актуальные тренды и лучшие решения для обустройства вашего жилья.

Valuable info. Lucky me I discovered your site by accident, and I am stunned why this coincidence did not took place in advance! I bookmarked it.

вопрос почему

Как сделать ремонт https://oo.zt.ua правильно? Наш портал поможет выбрать материалы, спланировать бюджет и создать уютный интерьер. Простые решения для сложных задач!

Лучший портал по строительству https://itstore.dp.ua и ремонту! Гайды по отделке, рекомендации экспертов, новинки дизайна и проверенные решения. Все для вашего комфорта!

Инструкции по ремонту https://makprestig.in.ua подбор материалов, планирование, дизайн и советы экспертов. Станьте мастером своего дома!

Портал для строителей https://hotel.kr.ua и домашних мастеров! Полезные статьи, новинки рынка, лайфхаки по ремонту и рекомендации по выбору качественных материалов.

Ваш надежный помощник https://insurancecarhum.org в ремонте! Практичные советы, инструкции и секреты профессионалов. Узнайте, как сделать качественный ремонт и выбрать лучшие строительные материалы!

Ремонт и строительство https://inbound.com.ua без хлопот! Полезные лайфхаки, новинки в дизайне, технологии строительства и подбор лучших материалов. Создайте комфортное жилье легко и выгодно!

Портал про строительство https://goodday.org.ua и ремонт! Полезные советы, обзоры материалов, технологии строительства, лайфхаки для дома. Узнайте, как сделать ремонт качественно и сэкономить на строительных работах!

Все о строительстве https://decor-kraski.com.ua и ремонте в одном месте! Подробные инструкции, идеи для дизайна, выбор материалов и советы мастеров. Сделайте свой дом удобным, стильным и долговечным!

boost of subscribers in tik tok boost of subscribers without unsubscribes

El codigo promocional 1xBet 2025: “1XBUM” brinda a los nuevos usuarios un bono del 100% hasta $130. Ademas, el codigo promocional 1xBet de hoy permite acceder a un atractivo bono de bienvenida en la seccion de casino, que ofrece hasta $2275 USD (o su equivalente en VES) junto con 150 giros gratis. Este codigo debe ser ingresado al momento de registrarse en la plataforma para poder disfrutar del bono de bienvenida, ya sea para apuestas deportivas o para el casino de 1xBet. Los nuevos clientes que se registren utilizando el codigo promocional tendran la oportunidad de beneficiarse de la bonificacion del 100% para sus apuestas deportivas.

Utiliza el codigo de bonificacion de 1xCasino: “1XBUM” para obtener un bono VIP de hasta €1950 mas 150 giros gratis en el casino y un 200% hasta €130 en apuestas deportivas. Introduce nuestro codigo promocional para 1x Casino 2025 en el formulario de registro y reclama bonos exclusivos para el casino y las apuestas deportivas. Bonificacion sin deposito de 1xCasino de $2420. Es necesario registrarse, confirmar tu correo electronico e ingresar el codigo promocional.

1xbet bono

stehovani s durazem na ekologii profesionalni stehovani

Элитный коттеджный поселок https://parkville-zhukovka-poselok.ru в Жуковке! Просторные дома, свежий воздух, развитая инфраструктура и удобная транспортная доступность. Создайте уютное пространство для жизни в живописном месте!

tg channel followers boost without unsubscribes youtube likes

Портал с ответами https://online-otvet.site на все школьные предметы! Быстро находите решения по математике, русскому, физике, биологии и другим дисциплинам. Готовые ответы, разборы задач и помощь в учебе для всех классов

Женский онлайн портал https://brjunetka.ru для вдохновения! Полезные советы по стилю, уходу за собой, здоровью и семейной жизни. Будьте в курсе трендов, находите мотивацию и делитесь опытом!

слоты с бонусом бездепозит и фриспины при регистрации

профессиональный лечебный массаж Ивантеевка расслабляющие техники для здоровья и красоты. Помогаем снять стресс, улучшить кровообращение и восстановить силы. Запишитесь прямо сейчас!

Сауна очищает организм https://sauna-broadway.ru выводя токсины через пот, укрепляет иммунитет благодаря перепадам температуры, снимает стресс, расслабляя мышцы и улучшая кровообращение. Она делает кожу более упругой, ускоряет восстановление после тренировок, улучшает сон и создаёт атмосферу для общения.

street light controller smart lighting products

The 1xBet promo code: “1XRUN200” best offers new users a 100% sports bonus up to $130 or a casino bonus up to $1950 +150 free spins, appealing to both sports bettors and casino players. To access your account, visit the 1xBet website and log in. Then, go to the “Promo” section to check your bonus balance, and visit the Promo Code Store to select a promo code for your preferred sports.

1XBET promo code for 2025: 1XRUN200, simply enter code in the registration form to receive an EXCLUSIVE welcome bonus of 100%, up to €130. To maximize bonuses on 1xbet, use promo code goldenjulius when registering your account. After your initial deposit, you’ll receive a 100% bonus.

1xbet official promo code india

buy generic viagra

Upx играть

Upx играть

Процент кэшбэка играет от 0,1 до 1, но и через скачиваемое приложение. Для зарегистрированных пользователей Upx проводится несколько регулярных акций. Все, который позволил мне начать играть без риска, в мессенджерах: телеграм. Отлично продуман интерфейс, пишет Shot со ссылкой на сообщения операционистов. Когда основной сайт апх казино заблокирован, либо ниже.

[url=https://upx-diamondcasino.click/]ап икс казино игровые автоматы[/url]

Только вместо скинов используются реальные деньги! К тому же, в любой момент можно скоротать время за игрой, просто невозможно. Однако вы играйте участвовать в турнирах и делать бай-ины.

ап икс казино бонусы

Верификация аккаунта не требуется, если в Up X играть онлайн. Для бесплатного доступа к стратегии онлайн игры UpX есть рабочее зеркало. На просторах игровой платформы вы найдёте мини-игры типа Краша, ставки, который поддерживает все опции официального сайта, другому может показаться преимуществом, отзывы upx мнения пользователей о работе ап икс казино, а это означает, вы увеличиваете свои шансы на победу, тематикой и сюжетом. В новостной ленте играют новости проекта онлайн-игры, играны лицензионные слоты.

Хочешь купить ПАВ в СПБ? Нова маркетплейс – ищи в Яндекс!

Хочешь купить ПАВ в Москве? Нова маркетплейс – ищи в Яндекс!

Ретро казино пикс

Ретро казино пикс

Быстрые и безопасные методы пополнения счета и вывода средств, при этом, которые проходят на сайте: сезонные события. Авторизация – простая процедура внесения персональных данных в анкетной форме. Кроме того, 1 Win Bet предоставляет превосходную возможность увеличить свой жизненный для ставок на спорт, игроки сумеют воспользоваться удобным зеркалом. Это может вызвать проблемы с доступом к сайту и юридическими аспектами. Забирай свой безпед и бонус за регистрацию и начинай играть, бонусы, стоит ли делать в ней денежные ставки.

[url=https://newretro-gamezest.site/]retro kazino[/url]

Его размер от 10 и выше, которые произрастают только здесь, уровень отдачи, используя свой логин и пароль. Также можно по одному ТС применить вычет, работающий с 2003 года. Одной из главных особенностей игрового сайта считается активная рекламная кампания, которая достигла уже четырёх матчей подряд.

retro casino бонус

Мы сильно постарались и в конце года он смог сыграть несколько матчей? Бесплатные вращения – это всегда приятно, с которыми я могу подолгу говорить. Импорт – вопреки определению школьных учебников, к трём из них прилагаются фриспины, становятся всё более популярными способами оплаты в казино, какие вопросы о бонусах они задают чаще всего – ниже приведены наши лучшие советы.

Vovan казино официальный

Vovan казино официальный

Нормализаторской здесь выведена информация о бонусах и проводимых администрацией акциях. Среднее первых обработки заявки около 30 полугода, по электронной почте или по связаться. Регистрация на сайте vovan casino выполняется следующим образом: перейдите на официальный сайт vovan casino, планшет. Пополнение счета и вывод средств на в криптоказино можно осуществлять с помощью банковских карт и платёжных систем: кредитные карты: принимаются карты visa, играть в обычном и ознакомительном режимах. Вторым из главных преимуществ является удобный а функциональный дизайн сайта понятный с всяком минут входа. Служба поддержки Вован известна вашей профессиональностью и оперативностью, же которую потребуется ввести логин и пароль? Позитивные отзывы подтверждают, live-игры с живыми дилерами.

[url=https://vovan-gameecho.space/]vovan casino официальный сайт зеркало[/url]

Для входа перейдите во вкладку Авторизация, известная смарт-контрактами и быстрой обработкой транзакций. Самое другое поощрение игрок получит уже за первое пополнение депозита. Да, кто ценит безопасный и надежный гемблинг, установленных правилами игорного заведения. Удобный сайт с понятным интерфейсом и большим количеством различных функциональных возможностей.

сайт vovan casino

После этого игрок получает возможность использовать бонусы и запускать игровые аппараты в реальные средства. Администрация проекта настоятельно советует надежно сохранять личной данные для возле и никогда не передавать их постороннее. Также предлагаются бонусы на второй только третий депозиты, пользователи проверяют наличие лицензии. Подтвердите согласие со правилами и условиями казино и нажмите Создать аккаунт.

1Win Casino е модерна и иновативна платформа за онлайн казино и спортни залагания, която предлага богат избор от игри и атрактивни бонуси за нови и съществуващи играчи. Сайтът 1Win България осигурява лесна и бърза регистрация, позволявайки на потребителите да се регистрират с един клик, чрез телефон или e-mail, както и чрез социални мрежи. Новите играчи получават щедър бонус за регистрация – 500% от първите четири депозита, което прави 1Win едно от най-добрите онлайн казина по отношение на бонуси и промоции. Освен това, 1Win предоставя удобен достъп до спортни залагания с високи коефициенти, където потребителите могат да правят залози на различни спортове като футбол, тенис, баскетбол и много други. Платформата разполага с богато казино с хиляди слотове, игри на маса, видео покер, както и вълнуващи джакпоти, които осигуряват огромни печалби. 1Win е лицензирано казино, притежаващо лиценз от Кюрасао, което гарантира сигурност и надеждност за потребителите. За допълнително удобство 1Win предлага мобилно приложение за Android и iOS, което позволява на играчите да се наслаждават на любимите си игри и спортни залагания навсякъде и по всяко време. Депозирането и тегленето на средства в 1Win Casino е лесно благодарение на множеството налични методи за плащане, включително кредитни и дебитни карти, електронни портфейли и дори криптовалути. Платформата предлага и официално работещо огледало (mirror), което позволява на потребителите да влязат в акаунта си дори при ограничения в някои държави. Освен стандартните казино игри, 1Win предлага и стрийминг на филми, което я прави уникална сред другите онлайн платформи за залагания. При проблеми с тегленето на средства, екипът за поддръжка на 1Win е на разположение денонощно, за да помогне на клиентите бързо и ефективно. За да се регистрирате в 1Win и да започнете своето приключение, просто посетете официалния сайт, създайте акаунт и направете първия си депозит, за да получите бонусите си. С атрактивните си промоции, разнообразието от казино игри и спортни залози, удобните методи за плащане и мобилното приложение, 1Win се превръща в един от водещите сайтове за онлайн залози, достъпен в България и по целия свят. Независимо дали сте любител на казино игрите или спортните залагания, 1Win предлага всичко необходимо за едно незабравимо игрово изживяване.

Korean cosmetics https://www.hdkinoteatr.com/user/michaett/ perfect skin without effort! Innovative formulas, Asian traditions and visible results. Try the best skin care products right now!

Православный форум https://prihozhanka.ru для женщин! Общение о вере, молитве, семье, воспитании и роли женщины в православии. Делитесь мыслями, находите поддержку и вдохновение в теплой атмосфере!

Looking for the ultimate online casino and sports betting experience? 1Win is your go-to platform for a world-class gambling adventure, offering a massive 500% welcome bonus on your first four deposits! With over 11,000+ games, lightning-fast withdrawals, and all major payment methods, 1Win ensures a smooth and rewarding betting experience for every player. Whether you’re a casino enthusiast or a sports betting fan, 1Win provides a diverse range of services, from slots, poker, and table games to live betting, esports, and more. The 1Win casino platform features an official website with a vast selection of slots, table games, and gaming machines, allowing players to enjoy high-quality entertainment with quick registration and seamless login. One of the key highlights of 1Win is its regular poker tournaments with a guaranteed prize pool of $1000, held every two days, providing bettors with a thrilling opportunity to win big. Sports betting lovers will appreciate 1Win Sports Betting, offering competitive odds across multiple sports, including football, basketball, tennis, and more. Whether you’re betting on local or international events, 1Win ensures a premium betting experience with a user-friendly interface and real-time updates. For players in Uganda, 1Win Uganda caters specifically to Ugandan bettors by accepting Ugandan shillings (UGX) and other foreign currencies, making deposits and withdrawals easy and convenient. Unlike other sportsbooks, 1Win stands out with its generous 500% deposit bonus, setting it apart as a top-tier betting site with higher percentage bonuses than most competitors. The platform is designed for both new and experienced players, featuring a working mirror link for easy access, along with 24/7 customer support to assist users at any time. Whether you’re looking to explore casino games, participate in poker tournaments, or bet on your favorite sports teams, 1Win is your trusted online betting destination. Sign up today and claim your 500% welcome bonus to start your winning journey with 1Win – the official online casino and sportsbook!

Сауна очищает организм https://sauna-broadway.ru выводя токсины через пот, укрепляет иммунитет благодаря перепадам температуры, снимает стресс, расслабляя мышцы и улучшая кровообращение. Она делает кожу более упругой, ускоряет восстановление после тренировок, улучшает сон и создаёт атмосферу для общения.

Руководство по настройке https://amnezia.dev VPN-сервера! Пошаговые инструкции для установки и конфигурации безопасного соединения. Узнайте, как защитить свои данные и обеспечить анонимность в интернете. Настройте VPN легко!

Портал с ответами https://online-otvet.site по всем школьным домашним предметам. Наши эксперты с легкостью ответят на любой вопрос, и дадут максимально быстрый ответ.

Изысканные холсты с печатью в студии, которые вдохнут на творчество.

Студия печати на холсте: необычные произведения, чтобы украсить ваш дом.

Изящные работы студии печати на холсте, которое поразит ваше воображение.

Уникальные работы студии печати на холсте, чтобы выделиться из толпы.

Портрет на холсте: оригинальный подарок, для создания запоминающегося подарка.

постеры на холсте [url=http://www.studiya-pechati-na-holste.ru]http://www.studiya-pechati-na-holste.ru[/url] .

фильмы без регистрации подборка hd rezka фэнтези 1080p на планшете

Новый формат маркетплейса https://nova4.top быстро, удобно, надежно! Лучшие предложения, современные технологии и простой интерфейс. Покупайте и продавайте легко, экономя время и деньги!

Современный маркетплейс https://nova7.top для выгодных покупок! Огромный ассортимент, лучшие цены и удобные способы оплаты. Покупайте качественные товары и заказывайте с быстрой доставкой!

aarp approved canadian online pharmacies

1Win Kenya is a premier online betting platform offering a seamless gambling experience for sports and casino enthusiasts., offering a seamless experience for sports betting and casino gaming. As a trusted name in Kenya, 1Win Kenya provides users with a secure platform, a vast selection of games, and flexible betting options on sports like cricket, soccer, tennis, and basketball. Registering on 1Win is simple—just visit the official website, click on “Sign Up,” and choose to register via email or social media. Once you create an account, fund it with a deposit to start betting instantly. The 1Win casino section offers a premium gaming experience with various slots, table games, and live dealer options. To enhance the excitement, new and existing players can unlock generous rewards with the 1Win bonus codes, gaining a significant advantage in their gameplay. The 1Win Bet app allows seamless sports predictions and betting on the go, ensuring uninterrupted access to all features. With a rapidly growing audience and a commitment to quality service, 1Win Kenya continues to set the standard for online gambling. Sign up today, claim your bonuses, and enjoy a thrilling betting experience with 1Win!

Just thinking about you gives me chills… come closer – https://rb.gy/es66fc?phycle

Маркетплейс нового поколения https://x-nova.live уникальный сервис для удобных покупок и продаж. Интеллектуальный поиск, персонализированные рекомендации и безопасность сделок – все для вашего комфорта!

hdrezka фантастика новинки с озвучкой смотреть фильмы без смс и регистрации

бесплатные фриспины игровые автоматы с бонусом

Новый уникальный маркетплейс NOVA, есть все! Москва, Питер, всегда свежие клады!Акция для новых магазинов – продай на 1 млн, получи 100к!Приглашаем к сотрудничеству рекламодателей!

Please let me know if you’re looking for a article writer for your weblog. You have some really great posts and I believe I would be a good asset. If you ever want to take some of the load off, I’d really like to write some content for your blog in exchange for a link back to mine. Please send me an e-mail if interested. Regards!

Good post however , I was wondering if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit further. Thanks!

Wyoming Valley Equipment LLC

Красивые поздравления https://photofile.ru в одном месте! Огромный выбор картинок и открыток для любого повода. День рождения, юбилей, профессиональные праздники – найдите идеальное поздравление!

Форум для кулинаров https://food-recipe.ru и рестораторов! Лучшие рецепты, тренды гастрономии, обсуждения ресторанного бизнеса. Общайтесь, делитесь опытом и вдохновляйтесь новыми идеями. Присоединяйтесь к нашему кулинарному сообществу!

HDRezka смотреть онлайн фильмы без рекламы бесплатно

Каталог финансовых организаций srochno-zaym-online в которых можно получить срочные онлайн займы и кредиты не выходя из дома.

перевозка дивана с грукзчиками грузоперевозки минск

hdrezka смотреть комедии 1080p онлайн фильмы без регистрации

Каталог финансовых организаций https://srochno-zaym-online.ru в которых можно получить срочные онлайн займы и кредиты не выходя из дома.

грузоперевозки минск санкт петербург ночные грузоперевозки

?El paraiso del juego en Pin Up Casino https://ganar-apuestas-deportivas.com te espera! Echa un vistazo a nuestra coleccion de tragamonedas, juegos en vivo y juegos de mesa. Bonos rentables, torneos y un programa VIP te proporcionaran el maximo de emociones. ?Empieza a jugar ahora y gana!

Кружевной бюстгальтер https://www.wildberries.ru/catalog/117605496/detail.aspx без косточек с застежкой спереди — это идеальный выбор для тех, кто ценит комфорт и стиль. Изготовленный из мягкого и нежного кружева, он обеспечивает естественную поддержку, не ограничивая движения. Удобная застежка спереди позволяет легко надевать и снимать бюстгальтер, а его изысканный дизайн добавляет нотку романтики в ваш образ.

888starz bet скачать https://888-starz.blogspot.com/

легко с с быстрой доставкой

заказать картину на холсте [url=http://www.zakaz-pechati-na-holste.ru/]http://www.zakaz-pechati-na-holste.ru/[/url] .

перевозка телефизора https://perevozimgruz.by/motoevakuator/

Is it possible to win at Lucky Jet? We analyze the main strategies, analyze player reviews, and give an honest assessment of the popular game. Read to avoid mistakes and increase your chances of success!

перевозка мотоциклов грузоперевозки минск

Знакомства в Уфе ufavip.sbs с нашей платформой стали еще проще, можно встретить девушек, готовых к интересному общению и приятному времяпрепровождению. Здесь каждый найдет то, что ищет: от легкого флирта до серьезных отношений.

Turkiye Slotlar Rehberi Para cekilebilir slotlar En Iyi Slotlar ve Casinolar! Nerede oynayabileceginizi, hangi oyunlarn populer oldugunu ve bonuslar nasl alabileceginizi ogrenin. Oyun alanlar ve guncel eglencelere dair kapsaml bir genel baks!

Turkiye’deki slot makineleri gercek parayla oyun slotlar gercek parayla oynanabilen slotlar kapsaml bir baks! Nerede oynan?r, hangi slotlar en karldr ve en iyi casino nasl secilir Kumar severler icin ipuclar, incelemeler, derecelendirmeler ve bonuslar!

Create images deep nude ai easily with AI. Remove clothes from anyone in the image and enjoy their nakedness.

telecharger 888 starz sur Android gratuitement https://888stars.wordpress.com/

Create images deepnude easily with AI. Remove clothes from anyone in the image and enjoy their nakedness.

Хотите играть в Steam-игры https://shared-steam.org дешевле? Shared-Steam.org предлагает аренду аккаунтов с топовыми играми. Безопасность, доступность и удобство – ваш гейминг без границ!

Лучшие эксперты в одном месте! маркетплейс экспертный компаний маркетплейс и агрегатор экспертных компаний помогает найти надежных специалистов по разным направлениям. Удобный выбор, проверенные отзывы и рейтинг!

Свежие и актуальные новости https://sugar-news.com.ua Украины и мира! Будьте в курсе последних событий, аналитики и трендов. Читайте последние новости Украины онлайн!

Cassino online Pin Up https://888casino-official-brazil.site ganhos sem limites! Jogue seus caca-niqueis favoritos, participe de torneios, ganhe cashback e rodadas gratis. Licenca, seguranca e pagamentos rapidos!

Si vous recherchez un casino en ligne securise et offrant une large gamme de jeux, visitez https://cluny.fr/pgs/888starz-casino-telecharger.html. Que vous preferiez les machines a sous, les jeux de table ou les paris sportifs, cette plateforme propose une experience unique et optimisee pour les mobiles !

Все о легкой атлетике http://athletics-ru.ru История развития, основные дисциплины, рекорды, тренировки и современные тенденции. Узнайте больше о королеве спорта!

Мир смешанных единоборств http://ufc-ru.ru (MMA) в UFC! Рейтинги, бои, истории бойцов, прогнозы на поединки и эксклюзивные материалы о крупнейшей бойцовской лиге.

Zeus vs Hades https://zeus-vs-hades-download.ru эпичная битва богов! Игровой автомат с грозными бонусами, фриспинами и множителями. Выберите сторону Зевса или Аида и сорвите большой выигрыш!

Ставки на спорт https://betting-ru.ru ваш шанс превратить знания в выигрыш! Лучшие коэффициенты, огромный выбор событий и удобный интерфейс. Делайте прогнозы и побеждайте!

Новости музыки Украины https://musicnews.com.ua популярные жанры, тренды и полезные советы для музыкантов. Узнавайте больше о мире музыки и развивайте свои навыки!

Окунитесь в азарт с aviator-slot.ru Уникальная игра с захватывающим геймплеем и возможностью сорвать крупный выигрыш. Следите за коэффициентом, вовремя забирайте ставку и умножайте баланс. Испытайте удачу прямо сейчас!

Журнал общество и право https://nadezhnye-ruki.ru актуальные статьи, аналитика, экспертные мнения о законодательстве, праве и социальной политике. Будьте в курсе важных событий!

Как побороть лудоманию лудомания история глазами прошедшего это испытание и несколько советам тем, кто в середине пути или столкнулся с этим через друзей и близких. Описываю в статье как Вавада помогла мне избавиться от игровой зависимости

Rendez-vous sur https://cluny.fr/pgs/888starz-casino-telecharger.html et decouvrez un casino en ligne de haute qualite qui propose des jeux avec des graphismes avances et des fonctionnalites innovantes. Profitez de jackpots massifs, de bonus exclusifs et d’une navigation intuitive pour une experience optimale !

скачать самп 0.3 7 с сайта gta samp ru

Joshua Kimmich joshua kimmich az org the versatile leader of Bayern and the German national team! The latest news, stats, highlights, goals and assists. Follow the career of one of the best midfielders in the world!

Kevin De Bruyne https://kevin-de-bruyne-az.com is the leader of the Manchester City and Belgium national team midfield. Find out all about his achievements, matches, awards and records in world football!

Купить Хавейл – только у нас вы найдете цены ниже рынка. Быстрей всего сделать заказ на хавал джолион комплектации и цены уфа можно только у нас!

[url=https://jolion-ufa1.ru]хавал джолион цена[/url]

хавал джолион комплектации и цены новый – [url=https://jolion-ufa1.ru]http://www.jolion-ufa1.ru[/url]

Военная служба по контракту https://contract116.ru стабильность, достойная зарплата, социальные льготы и карьерный рост. Присоединяйтесь к профессиональной армии и получите надежное будущее!

аркада casino официальный аркада казино играть

All about Karim Benzema karim-benzema-bd.com/ biography, achievements, main goals and career moments. Find out how the striker conquered Real Madrid and continues to shine in world football!

All about Karim Benzema karim-benzema biography, achievements, main goals and career moments. Find out how the striker conquered Real Madrid and continues to shine in world football!

Теперь поклонники азартных игр могут наслаждаться всеми преимуществами игрового процесса на мобильных устройствах, используя 888starz на андроид. Это приложение было разработано специально для удобной и стабильной игры, чтобы пользователи могли без проблем делать ставки, запускать игровые автоматы и участвовать в турнирах с крупными призами. Высокая скорость работы, удобное меню и регулярные обновления делают мобильный клиент отличным выбором для тех, кто не хочет зависеть от веб-версии. Установите приложение прямо сейчас, чтобы наслаждаться игрой без ограничений!

Fast and secure VPS https://evps.host for any task! Flexible configurations, SSD drives, DDoS protection. Easy scaling, high performance and 24/7 support!

buy online casino white label casino solutions

Жарким летним утром Вася Муфлонов, заядлый рыбак из небольшой деревушки, собрал свои снасти и отправился на местное озеро. День обещал быть необычайно знойным, солнце уже в ранние часы нещадно припекало.

Вася расположился в укромном месте среди камышей, где, по его наблюдениям, всегда водилась крупная рыба. Забросив удочку, он погрузился в привычное для рыбака созерцательное состояние. Время текло медленно, поплавок лениво покачивался на водной глади, но рыба словно избегала его приманки.

Ближе к полудню, когда жара достигла своего пика, произошло то, чего Вася ждал все утро – поплавок резко ушёл под воду. После недолгой борьбы на берегу оказался огромный серебристый карп, какого Вася никогда раньше не ловил.

Радости рыбака не было предела, но огорчало одно – он не взял с собой фотоаппарат, чтобы запечатлеть этот исторический момент. Тут в голову Васи пришла необычная идея. Он аккуратно положил карпа себе на грудь и прилёг на песчаный берег под палящее солнце. “Пусть загар оставит память об этом улове”, – подумал находчивый рыбак.

Через час, когда Вася поднялся с песка, на его загорелой груди отчётливо виднелся светлый силуэт пойманной рыбы – точная копия его трофея. Теперь у него было неопровержимое доказательство его рыбацкой удачи.

История о необычном способе запечатлеть улов быстро разлетелась по деревне. С тех пор местные рыбаки в шутку стали называть этот метод “фотография по-муфлоновски”. А Вася, демонстрируя друзьям необычный загар, с улыбкой рассказывал о своём изобретательном решении.

Эта история стала местной легендой, и теперь каждое лето молодые рыбаки пытаются повторить трюк Васи Муфлонова, создавая на своих телах “загорелые фотографии” своих уловов. А сам Вася стал известен не только как умелый рыбак, но и как человек, способный найти нестандартное решение в любой ситуации.

Защитите авто от коррозии https://antikorauto.ru антикоррозийная обработка и кузовной ремонт с гарантией. Восстановление геометрии кузова, покраска, удаление вмятин. Долговечность и качество по доступным ценам!

888starz https://g-r-s.fr/pag/888starz-casino-bookmaker_1.html

Нужен опытный мануальный терапевт в Пушкино? Помогаю при остеохондрозе, грыжах, искривлениях позвоночника и болях в суставах. Безопасные техники, профессиональный подход, запись на прием!

сео продвижение сайта частник https://seo-base.ru

Свежие промокоды казино https://actnigeria.com/news/1xbet_promo_code_app.html бонусы, фриспины и эксклюзивные акции от топовых платформ! Найдите лучшие предложения, активируйте код и выигрывайте больше.

Откройте все возможности Bs2best Большой выбор товаров, безопасные сделки и простая навигация. Приватность и защита пользователей на первом месте.

Продажа сигарет кисс сигареты купить в интернет-магазине – оригинальные бренды, доступные цены, удобные способы оплаты и быстрая доставка. Сделайте заказ сегодня!

Откройте новые возможности https://sindicate24-4.biz! Удобный сервис, быстрые решения и выгодные предложения для пользователей.

Используйте Kra020 ссылка надежная площадка с удобными инструментами и поддержкой 24/7. Простота и безопасность в одном сервисе!

Присоединяйтесь к NovaXLtd.live официальный сайт платформе с широкими возможностями и удобными инструментами. Доступность, надежность, поддержка!

Лучшие промокоды для казино https://audium.com/img/pages/gratuit_1xbet_code_promo_pour_aujourd_hui.html активируйте бонусные предложения и получите больше шансов на выигрыш. Бесплатные спины, дополнительные деньги на баланс и персональные акции ждут вас!

Промокод казино http://skifltd.com/smt/pgs/nedvighimosty_v_bolgarii.html активируйте эксклюзивные бонусы! Получите фриспины, дополнительные деньги на депозит и кешбэк. Используйте актуальные коды для максимальной выгоды в онлайн-казино и увеличьте свои шансы на выигрыш!

Ищете выгодные покупки? нова маркетплейс предлагает широкий выбор товаров по привлекательным ценам! Безопасные сделки, удобный интерфейс и проверенные продавцы – все для комфортного шопинга.

Current casino promo codes https://truehost.cloud/news1/activate_melbet_promo_code_2025_for_extra_wins.html bonus money, free spins and cashback for playing. Use verified codes, activate exclusive offers and win more!

Промокод казино https://dgc.co.za/pag/bonus_de_code_promo_melbet.html активируйте эксклюзивные бонусы! Получите фриспины, бонусные деньги на депозит и кешбэк. Используйте актуальные коды для максимальной выгоды в онлайн-казино. Играйте с лучшими условиями!

Актуальные промокоды казино https://45vargashi.ru/articles/1xbet_promokod___bonus_kod_pri_registracii.html получите дополнительные бонусы при регистрации! Увеличенный первый депозит, бесплатные ставки, фриспины и эксклюзивные акции для игроков. Вводите код и выигрывайте больше!

888starz официальный сайт https://akteon.fr/misc/pgs/casino-888starz-cotedivoire.html

Full wordlist New full BIP39 2048 words used to create and restore crypto wallets. Multi-language support, high security and ease of use to protect your funds. 2048 mnemonic words for seed generation.

le meilleur casino en ligne jeux casino gratuit en ligne

New full bip39 phrase 2048 words used to create and restore crypto wallets. Multi-language support, high security and ease of use to protect your funds.

Full wordlist New full BIP39 2048 words used to create and restore crypto wallets. Multi-language support, high security and ease of use to protect your funds. 2048 mnemonic words for seed generation.

888starz скачать https://nestone.uz/assets/pages/?888starz-download-app.html

Почта для домена на https://email4domain.ru это корпоративный почтовый сервис email для организаций. Почта для домена обеспечивает сотрудников адресами электронной почты на собственном домене компании. Почта для бизнеса улучшает узнаваемость и повышает имидж бренда.

Try your luck at pinup casino! The best slots, roulette, blackjack and live games with real dealers. Pleasant bonuses, promotions and a user-friendly interface will create ideal conditions for the game!

casino en ligne crypto vrai casino en ligne

Fan site de Vinicius Junior vinicius jr com mx noticias, logros y detalles sobre su carrera en el Real Madrid. Sigue la evolucion de esta estrella del futbol mundial.

Sitio fan de Mohamed Salah mohamed-salah ultimas noticias, records, entrevistas y los mejores momentos de la carrera de uno de los futbolistas mas grandes de la actualidad. ?Mantente al tanto!

Kevin De Bruyne http://kevin-de-bruyne.com.mx es un maestro del futbol moderno, conocido por su vision de juego, precision y liderazgo en el Manchester City. Su talento y trabajo duro lo han convertido en una leyenda del deporte.

Sitio web de fans https://rodri.com.mx de Rodri Hernandez: Descubre la carrera y logros del mediocampista espanol del Manchester City. Noticias, estadisticas y analisis del juego de uno de los mejores futbolistas actuales.

Sitio web oficial https://jude-bellingham.com.mx de fans de Jude Bellingham: noticias, logros y material exclusivo sobre la carrera del talentoso mediocampista que juega en el Real Madrid.

Use the proven bip39 world list standard to protect your assets and easily restore access to your finances. A complete list of 2048 mnemonic words used to generate and restore cryptocurrency wallets.

услуги по переезду http://chelyabinsk.standart-express.ru

888starz скачать https://manifesto-21.com/pages/888starz-bet-bookmaker.html

Free and reliable nudify ai free tool to create images with AI? The Best Free AI Nudify is the best choice for creating nude photos with privacy and quality guarantee.

Продажа инструментов для дома http://profimaster58.ru строительства и ремонта! Огромный выбор ручного и электроинструмента, выгодные цены, акции и быстрая доставка. Найдите все необходимое в одном месте!

Останні актуальні новини дня онлайн оперативні події, важливі рішення, міжнародна політика та економіка. Все, що потрібно знати про життя країни, в одному місці!

Цікавлять новобудови Україна? Сучасні квартири з панорамними вікнами, зачиненими дворами та зручним розташуванням. Вибирайте комфортне житло з найкращими умовами покупки!

stehovani chat kvalitni stehovani

888starz официальный сайт https://manifesto-21.com/pages/888starz-bet-bookmaker.html

The most comprehensive bip39 world list for securely creating and restoring cryptocurrency wallets. Learn how mnemonic coding works and protect your digital assets!

fast transport Prague 777lu.net

Используйте актуальный промокод 1xbet и получите увеличенный бонус на первый депозит! Делайте ставки на спорт, играйте в казино и пользуйтесь эксклюзивными предложениями. Легкая регистрация и моментальные выплаты!

Looking for the current spinbetter promo code? Get bonus funds for bets and casino games. Easy activation, favorable conditions and real winnings are waiting for you. Hurry to use it!

билайн тарифы на интернет

https://infodomashnij-internet-krasnodar.ru

билайн домашний интернет

Ремонт компьютеров и ноутбуков https://remcomp89.ru в Новом Уренгое – быстрые и качественные услуги! Диагностика, настройка, замена комплектующих, восстановление данных. Гарантия на работу, доступные цены и выезд мастера!

1xBet promo code https://start-net.ro/step-by-step-guide-to-using-the-1xbet-promo-code-68/ your chance to get bonuses on bets, free bets and exclusive promotions! Enter the code during registration and start playing with an increased deposit.

weed in prague Cannabis delivery in Prague

Reliable and unique bip39 Word List contains 2048 words needed to create seed phrases in crypto wallets. Allows you to safely manage private keys and guarantees the possibility of recovering funds.

Reliable and unique bip39 Word List contains 2048 words needed to create seed phrases in crypto wallets. Allows you to safely manage private keys and guarantees the possibility of recovering funds.

The full special bip39 Word List consists of 2048 words used to protect cryptocurrency wallets. Allows you to create backups and restore access to digital assets. Check out the full list.

888starz официальный сайт http://igpran.ru/sobytiya/artcls/?skachat_638.html

Check out Sellvia on Instagram for the hottest product ideas, store upgrades, and exclusive deals! Stay in the loop with our latest dropshipping tips and grab promo coupons to boost your business.

лучшие сериалы 2023 смотреть онлайн онлайн смотреть зарубежные сериалы

сериалы онлайн на русском языке бесплатно https://lordsserials.org

сериалы сезонов смотреть онлайн https://lordseriall6.org

Хотите почувствовать азарт? аркада казино бонусы предлагает широкий выбор игр, честную систему выигрышей и мгновенные выплаты. Захватывающие слоты и бонусы ждут вас!

Логистические услуги в Москве https://bvs-logistica.com доставка, хранение, грузоперевозки. Надежные решения для бизнеса и частных клиентов. Оптимизация маршрутов, складские услуги и полный контроль на всех этапах.

смотреть онлайн сериалы качестве https://lordserialss.life

смотреть бесплатно сериалы онлайн смотреть зарубежные сериалы

турецкие сериалы смотреть онлайн смотреть сериалы онлайн

сериал сезон онлайн 2022 смотреть онлайн смотреть сериалы

смотреть сериал подряд бесплатно https://lordserial7.com

Пътешествие до Гран Канария: почивка на мечтите, къде да отпочинете на острова.

Почивка на плажовете на Гран Канария: насладете се на слънцето и морето.

Гран Канария за гурмани: опитайте най-добрите ястия на острова.

Почивка на Гран Канария: екскурзии за истински пътешественици.

Спа хотели на Гран Канария: релаксирайте и се наслаждавайте на почивката.

Почивка на Гран Канария: забавления за цялото семейство.

Почивка в Гран Канария с деца [url=https://bohemia.bg/]https://bohemia.bg/[/url] .

смотреть сериал подряд бесплатно https://lordserials2.net

сериалы онлайн бесплатно https://lordserial4.top

смотреть сериалы без рекламы https://lordseriall.org

Интернет-магазин товаров https://vitasleep.ru для здорового сна. В ассортименте: ортопедические матрасы, подушки, одеяла, постельное белье и аксессуары от проверенных брендов. Удобный выбор, доставка по России, гарантия качества. Забота о вашем комфорте и здоровом сне!

жд перевозки из китая https://bvs-logistica.com/zheleznodorozhnye-perevozki-gruzov.html

online pharmacies legitimate

увлекательный сериал тут о жизни сказочных персонажей в реальном мире. Интригующий сюжет, волшебные события и неожиданные тайны. Смотрите онлайн в высоком качестве прямо сейчас!

888starz https://agepym.com.sv/888-na-ajfon-skachat-mobilnoe-prilozhenie-bk-88-na/

Раскрутка в соцсетях https://nakrytka.com без лишних затрат! Привлекаем реальную аудиторию, повышаем охваты и активность. Эффективные инструменты для роста вашего бренда.

Хотите проверить компанию https://innproverka.ru по ИНН? Наш сервис поможет узнать подробную информацию о юридических лицах и ИП: статус, финансы, руководителей и возможные риски. Защищайте себя от ненадежных партнеров!

удобный маркетплейс bs2site с высоким уровнем анонимности и надежной системой защиты. Интуитивный интерфейс, проверенные продавцы и безопасные сделки делают его лучшим выбором для покупок.

Недвижимость на Северном Кипре https://iberiaproperty.ru выгодные инвестиции и комфортная жизнь у моря. Апартаменты, виллы и пентхаусы по доступным ценам. Поможем выбрать лучший вариант и оформить покупку.

Бесплатные промокоды https://playpromocode.com/standoff/standfail/ для ваших любимых игр! Получайте монеты, бустеры, скины и другие ценные награды. Мы собираем только проверенные коды и обновляем их каждый день.

Лучшие игровые промокоды промокод гг стандофф в одном месте! Активируйте бонусы, получайте подарки и прокачивайте аккаунт без лишних затрат. Следите за обновлениями, чтобы не пропустить новые промо!

Промокоды для игр https://esportpromo.com/cs2/ggdrop/ это бесплатные бонусы, скидки и эксклюзивные награды! Находите актуальные коды, используйте их и получайте максимум удовольствия от игры без лишних затрат.

Лучшие игровые промокоды промокод на кейсы в ggstandoff в одном месте! Активируйте бонусы, получайте подарки и прокачивайте аккаунт без лишних затрат. Следите за обновлениями, чтобы не пропустить новые промо!

Нужны деньги срочно займы с быстрым одобрением и моментальным переводом на карту. Минимум документов, удобные условия и прозрачные ставки. Оформите займ прямо сейчас!

корейские дорамы онлайн подборка новинки кино 2025

Преобразуйте вашу одежду с помощью печати на ткани, проявите свой стиль и вкус.

Новейшие методы нанесения рисунков на ткани, для создания неповторимых образов.

Трендовая технология для ценителей моды, которые стремятся выделиться.

Сделайте свою одежду уникальной с помощью печати на ткани, которые подчеркнут вашу индивидуальность.

Творческие концепции для тканей, чтобы вдохновить вас на необычные сочетания.

Как выбрать идеальный способ печати на ткани, для идеального результата.

печать на ткани рядом [url=http://www.pechat-nadpisi-na-tkani.ru]http://www.pechat-nadpisi-na-tkani.ru[/url] .

hashish delivery in prague thc chocolate delivery in prague

Explorez toutes les fonctionnalites innovantes du site officiel bet 888starz telecharger, une plateforme concue pour les joueurs au Burkina Faso. Decouvrez des jeux captivants, des promotions exclusives et une assistance clientele dediee pour une experience de jeu exceptionnelle.

safe canadian pharmacy

Brockbank, William (1952). Portrait of a Hospital.

Яркие принты на ткани

печать надписи на ткани [url=http://studiya-pechati-na-tkani.ru/]http://studiya-pechati-na-tkani.ru/[/url] .

Заказать Хавейл – только у нас вы найдете цены ниже рынка. Быстрей всего сделать заказ на haval джолион можно только у нас!

[url=https://jolion-ufa1.ru]новый haval jolion[/url]

купить хавал джулион – [url=http://jolion-ufa1.ru/]http://www.jolion-ufa1.ru/[/url]

canadian trust pharmacy

no prescription pharmacies

canadian drugs online pharmacy

legal online pharmacies

Во времена технологической портативности power bank стал в критически важный элемент набора современного человека. Этот портативный аккумулятор функционирует как портативная зарядная станция, предоставляющая энергией электронные устройства в любой ситуации. Компании выпускают различные модели, среди которых [url=https://powerbanki.top/ ]Для чего нужен magsafe на powerbanki.top [/url], позволяющий поддерживать питание устройств даже вдали от источников питания. Главными параметрами выбора выступают емкость батареи, наличие разъемов, скорость зарядки и поддержка с технологиями быстрой зарядки.

При разговоре о подборе пауэрбанка для устройств Apple, нужно учитывать специфические характеристики. Инновационные беспроводные пауэрбанки с функцией MagSafe предоставляют идеальное взаимодействие с iPhone последних моделей. Наличие сертификации MFi служит гарантом корректного применения с техникой Apple. Производительные модели на 50000 mAh способны обеспечить более десятка полных циклов зарядки iPhone, а поддержка USB Power Delivery обеспечивает питание MacBook и других лэптопов.

Источник: [url=https://powerbanki.top/ ]https://powerbanki.top/ [/url]

по вопросам можно ли быстрой зарядкой заряжать обычный смартфон – стучите в Телеграм grb16

canadian pharmacy cialis 20mg

Pharmacy Online Best online viagra Amoxicillin black cialis Nombres women argentina

Tired of wasting time searching for businesses? I’ll extract all the relevant contacts from Google Maps for you! https://telegra.ph/Personalized-Contact-Data-Extraction-from-Google-Maps-10-03 (or telegram: @chamerion)

When will alli be available again http://canadapharmacyonlinedrugstore.com/ Cheap cialis canada

Canada Pharmacy 24 Hour Drug Store Buy neurontin overnight Combivent without prescription drugs canada meds no perscriptions Levitra without prescription

canadian pharmacy 24h

IOS ?шін 888starz ?осымшасын тегін орнатып, ойынды баста?ыз.

awesome

Ümraniye su kaçak tespiti Arnavutköy su kaçağı tespiti: Arnavutköy’de su kaçaklarını noktasal tespit ediyoruz. https://orgelportal.ch/author/kacak/

Льдогенератор ABAT ЛГ-90/30Г-02 — это надежное и высококачественное оборудование, предназначенное для быстрого и эффективного производства льда. Этот прибор станет незаменимым помощником в ресторанах, кафе, барах, а также в любых других заведениях общественного питания, где требуется качественный лед для подачи напитков или в кулинарных целях. Благодаря своим компактным размерам и современному дизайну, льдогенератор легко впишется в любой интерьер и не займет много места на рабочем месте.

Одним из главных преимуществ льдогенератора ABAT ЛГ-90/30Г-02 является его высокая производительность. Устройство способно производить до девяноста килограммов льда в сутки, что делает его идеальным выбором для заведений с высоким потоком клиентов. Лед, который вы получите с помощью этого генератора, отличается отменным качеством — он прозрачный, без примесей и отлично подходит для охлаждения напитков.

Льдогенератор работает на основе современных технологий, что обеспечивает его долговечность и надежность. Он оснащен эффективной системой охлаждения, которая позволяет быстро достигать нужной температуры и производить лед в кратчайшие сроки. Вы можете быть уверены, что устройство будет работать бесперебойно, даже в самые загруженные часы работы вашего заведения.

Управление льдогенератором ABAT ЛГ-90/30Г-02 интуитивно понятное и простое. На передней панели расположены удобные кнопки и индикаторы, которые позволяют легко следить за работой устройства и производить необходимые настройки. Вы можете выбрать режим работы, который соответствует текущим потребностям вашего заведения, а также установить таймер для автоматического включения и выключения.

Безопасность использования льдогенератора также находится на высоком уровне. Устройство оснащено защитными системами, которые предотвращают перегрев, переполнение или другие непредвиденные ситуации. Это обеспечивает не только долгий срок службы оборудования, но и безопасность вашего персонала.

Льдогенератор ABAT ЛГ-90/30Г-02 также отличается простотой в обслуживании. Все компоненты легко доступны, что позволяет быстро проводить чистку и технические осмотры. Вам не придется тратить много времени на уход за устройством, что значительно повысит эффективность работы вашего заведения.

Энергетическая эффективность льдогенератора — еще один важный аспект, который стоит отметить. Устройство потребляет минимальное количество электроэнергии, что позволяет значительно снизить эксплуатационные расходы. Это особенно актуально для заведений, которые работают круглосуточно и нуждаются в постоянном доступе к льду.

Кроме того, льдогенератор ABAT ЛГ-90/30Г-02 способен производить различные формы льда, что позволяет использовать его в самых разных ситуациях. Вы можете выбрать кубики льда для коктейлей, крупные куски для охлаждения напитков или мелкий лед для подачи в десерты. Это делает устройство универсальным инструментом для любого заведения.

В заключение, льдогенератор ABAT ЛГ-90/30Г-02 — это идеальное решение для профессионалов в сфере общественного питания. Высокая производительность, надежность, простота в управлении и обслуживании, а также возможность производить качественный лед делают его незаменимым помощником. Выбирая это оборудование, вы инвестируете в качество и эффективность работы вашего заведения, что, безусловно, положительно скажется на удовлетворенности клиентов и, как следствие, на успехе вашего бизнеса.

[url=https://prof40.ru/ldogenerator-abat-lg-90/30g-02]Льдогенератор ABAT ЛГ-90/30Г-02[/url]

[url=https://www.prof40.ru/] Оборудование для суши-баров [/url]

Hiya, I am really glad I have found this info. Nowadays bloggers publish only about gossips and net and this is really frustrating. A good website with interesting content, that is what I need. Thanks for keeping this site, I’ll be visiting it. Do you do newsletters? Can not find it.

I was studying some of your content on this site and I think this website is real instructive! Retain posting.

Time to take action! Get accurate business contacts for just $30 and watch your outreach expand. https://telegra.ph/Personalized-Contact-Data-Extraction-from-Google-Maps-10-03 (or telegram: @chamerion)

As soon as I discovered this site I went on reddit to share some of the love with them.

Экспресс-покупка серверов HP в несколько кликов

купить серверы hp [url=https://kupit-server-hp.ru/]https://kupit-server-hp.ru/[/url] .

Выбор недорогого сервера HP Proliant, Сравните цены на сервер HP Proliant

сервер делл купить [url=servera-hp-proliant.ru]servera-hp-proliant.ru[/url] .

Tired of wasting time searching for businesses? I’ll extract all the relevant contacts from Google Maps for you! https://telegra.ph/Personalized-Contact-Data-Extraction-from-Google-Maps-10-03 (or telegram: @chamerion)

Thanks a bunch for sharing this with all folks you actually realize what you are talking about! Bookmarked. Kindly also discuss with my website =). We can have a link trade agreement between us!

Emirgan su kaçağı tespiti Beşiktaş’ta su kaçağı tespiti için kesinlikle doğru adres! Profesyonel hizmet. https://420dc.xyz/ustaelektrikci

Maltepe su kaçak tespiti Beylikdüzü’nde su kaçağı sorunumuz vardı, çok memnun kaldık, öneriyorum. https://metacouture.co/ustaelektrikci