- Finance

- March 1, 2024

Renting Vs Buying a home: Your Path to smart housing decision.

Welcome to our dive into the great debate: Should you rent or buy your home? This isn’t just a financial dilemma; it’s a question that tugs at the heartstrings and stirs up a whirlpool of emotions and calculations. With insights from a recent study by , we’re here to break down this complex decision into bite-sized, digestible pieces. So, buckle up as we embark on a journey through numbers, insights, and perhaps, a little bit of humor, to make this exploration as informative and engaging as possible.

The Cost Conundrum

- Imagine you’re in a game show where you’re given two doors to choose from: one leads to a world where you rent, and the other, to a world where you own your home. Sounds simple, right? But here’s the catch: each door opens to a maze of financial implications, emotions, and long-term outcomes. Let’s decode what’s behind each door with some startling figures:

- In vibrant cities like Bangalore, Mumbai, and Kolkata, the amount of rent needed to equal the purchase price of a home ranges astonishingly from 330 to 606 months of rent.

- The average rental yield in India hovers around a modest 2.9%, starkly lower than the 5-6% seen in countries like the USA, Canada, or glitzy Dubai.

The Rent vs. Buy Rationale

- Many argue in favor of renting, citing the ability to invest the difference between rent and home loan EMIs into avenues that offer higher returns. Meanwhile, buying has its own set of advantages, including the intangible joy of homeownership and the potential for property appreciation.

The Shift in Real Estate Dynamics

- Thanks to the Real Estate Regulation and Development Act (RERA), the landscape is changing. The days of uncontrolled property price are over. Post-RERA, the annual appreciation rate has gone down to around 3%, making the rent-versus-buy equation more intriguing than ever.

The Shift in Real Estate Dynamics

- Thanks to the Real Estate Regulation and Development Act (RERA), the landscape is changing. The days of uncontrolled property price are over. Post-RERA, the annual appreciation rate has gone down to around 3%, making the rent-versus-buy equation more intriguing than ever.

Math behind this madness

- Let’s break down the math behind the rent vs. buy decision into simpler terms so it’s easier to understand. This decision involves comparing the costs and benefits of renting a home versus buying one over a 30-year period. We’ll use some basic assumptions and examples to explain how this works.

The Starting Point:

- Imagine you’re looking at a home worth Rs 1.25 crore. If you rent this home, the initial monthly rent is Rs 30,000. Over time, this rent will increase every year due to inflation and other factors.

The Key Factors to Consider:

- Rent Escalation: Each year, the rent goes up, let’s say by 6.5%, which is similar to the rate of inflation.

- Property Appreciation: If you buy the home, its value will also increase over time, at a rate we’ll assume is the same as the rent escalation rate for simplicity.

- Home Loan Interest: If you buy, you’ll likely take out a home loan. The interest rate on this loan is a bit higher than the inflation rate, at 8.75% in our example.

- Investments and Returns: Money saved by renting or the difference between EMI and rent can be invested, potentially earning more money over time.

In the Early Years:

- As a tenant, your rent is lower than the EMI you would pay if you bought the home. If you invest the difference wisely, you could earn a decent return on this saved money.

- The idea is, instead of spending more money on EMIs, you’re spending less on rent and putting the difference into investments that grow over time.

Midway Through (Around 15-17 Years):

- Your rent has been increasing every year, and now it’s getting closer to what your EMI would have been. Up until this point, you’ve hopefully been saving and investing the difference, benefiting from compound interest.

In the Long Run (After 30 Years):

- If you were renting, you would have paid a lot in rent over 30 years, but you also would have made significant gains from your investments.

- If you bought the home, you’d have paid EMIs and other costs like maintenance, but you also end up owning a valuable asset that has appreciated over time.

Simplifying the Math:

- Renting: You start with lower costs (rent), which allow you to save and invest. Over time, these investments grow, potentially giving you a large sum of money.

- Buying: You pay higher costs initially (EMI, maintenance), but you also own a property that increases in value. Plus, after the loan is paid off, you no longer have EMIs, and you can also invest the money you would have spent on rent.

Summary

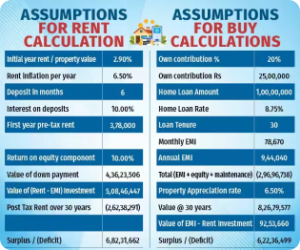

In the above example, the following is the summary:

- While renting, the tenant pays Rs 2.62 crore as rent+incidental charges and Rs 25 lakh invested at 10 percent grows to Rs 4.36 crore by the end of 30 years. Also, the savings (EMI minus rent), when invested, grow to Rs 5.08 crore at the end of 30 years, resulting in a net surplus of Rs 6.82 crore.

- While buying, the total outflow on EMIs and maintenance works out to Rs 2.97 crore over 30 years. The property appreciates from Rs 1.25 crore to Rs 8.26 crore and the savings from surplus funds (EMI–Rent) would grow to Rs 92.5 lakh, resulting in a net surplus of Rs 6.22 crore.

Simplifying the Decision

- To make your decision easier, we introduce a simple ratio: Rent / EMI over the asset’s life. This golden ratio can guide you through the financial fog, highlighting when renting or buying makes more sense under varying conditions of rental yield and annual rent escalation rates.

- Based on our research, we notice that if the Rent / EMI (over the entire 30-year period) is less than 100 percent, then renting the property is better, whereas if it is greater than 100 percent, then buying a property is better.

The Verdict: Rent or Buy?

- The answer isn’t straightforward and depends on multiple factors, including your financial situation, lifestyle preferences, and long-term goals. In some cities, buying is becoming increasingly justified, while in others, renting remains the king of convenience and financial savvy.

Embracing the Future

- As the property market evolves post-RERA, we anticipate a closer alignment between property prices, rental yields, and inflation, making the rent vs. buy decision clearer but no less critical. Remember, whether you rent or buy, planning for the future is paramount.

Wrapping Up

- So, what’s the best choice? The truth is, it varies. What’s most important is understanding your personal and financial circumstances, and making an informed decision that aligns with your long-term goals and happiness. Whether you’re signing a lease or a mortgage, the right choice is the one that makes you feel at home.

Your Next Steps

- Armed with this knowledge, we hope you feel more confident in navigating the housing maze. Remember, whether you’re leaning towards renting or buying, the key is to stay informed, consider your options carefully, and never underestimate the power of a well-planned financial strategy. Happy house hunting (or renting)!

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024