- Finance

- July 8, 2024

Money Saving Hacks for Every Age Group

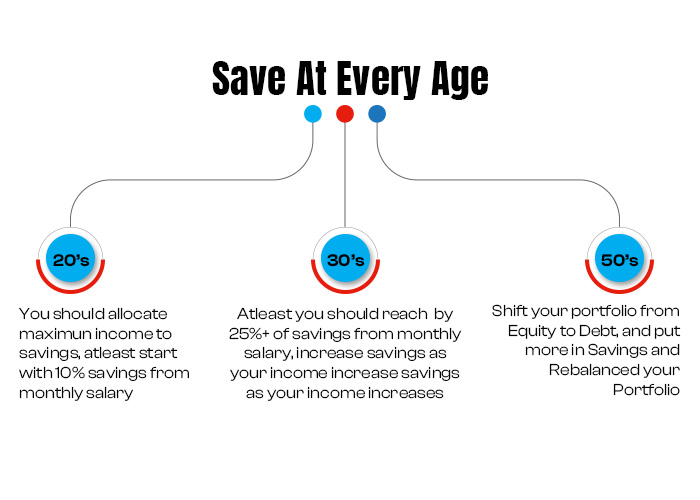

Your grandfather must have told you about saving when you were a kid. As you grow older, you often tend to forget these lessons. Regardless of age, everyone should remember the importance of saving. People in India often keep their children away from financial matters, but this should not be the case, as they cannot learn the value of money until they handle it themselves. Developing money saving hacks early can help you be financially stable for a lifetime. Then comes adulthood, an age where people understand money more than any other age group. So, the responsibility of saving here is more crucial than ever. And finally, in old age, savings take a back seat as income ceases, but not the demands and needs. Overall, it’s clear that every age group needs strategies to save money, and this blog aims to help you achieve this goal. Read it through and learn how it feels to be financially secure.

Saving Hacks for Children (and Young Adults)

It is essential to educate children and young people about saving if you want to minimize the risk of forming unfavourable attitudes towards financial stability. In this sense, being able to begin early is especially important because they must learn when spending money is appropriate, along with personal finance and budgeting.

For children and young adults, saving should be introduced as a fun and rewarding activity. Parents and educators can use several methods to teach the concept of delayed gratification and the importance of setting financial goals. As they grow older, more complex saving strategies can be introduced to prepare them for financial independence.

- Use piggy banks or clear jars to visualize savings growth

- Implement a reward system for saving milestones

- Open a savings account and explain interest

- Encourage part-time jobs or entrepreneurial activities

- Teach budgeting basics using allowance or earned money

- Introduce the concept of saving for short-term and long-term goals

- Let them use apps to help save money

Example: Sonia, a ten-year-old girl, has plans to buy a new cycle, which is priced at Rs 5000. Her parents assist her in coming up with a savings plan where she can save Rs 250 out of the weekly allowance of Rs 500. They record her progress using a clear jar. In the 20th week, Sarah is finally able to purchase her bicycle after waiting for a long time, which has helped her value the concepts of patience and goal setting.

Saving Strategies for Adults (Middle Age)

Young adults and middle-aged individuals are usually weighed down by various financial pressures, including child-rearing, home loans, and retirement expenses. Saving becomes important, especially during this period, to be able to come up with long-term plans.

Saving for middle-aged adults is a more complex and multifaceted scenario than for children or teenagers, as there are complex needs and desires that do not fit into the immediate present. There are specific strategies best achieved in this age that involve boosting pension contributions, eliminating existing debts, and creating an emergency fund. It is also critical to factor in insurance and prepare for property relief in case of any occurrence.

- Maximize contributions to retirement accounts

- Create and maintain an emergency fund covering 3-6 months of expenses

- Pay down high-interest debt while continuing to save

- Diversify investments to balance risk and potential returns

- Review and optimize insurance coverage (life, health, disability)

- Start estate planning to protect assets and provide for dependents

Example: Rahul, 45, earns ₹7,00,000 annually. He contributes 15% of his salary to his Public Provident Fund (PPF), taking full advantage of his employer’s 5% match. He also allocates ₹50,000 monthly to pay off his credit card debt while simultaneously adding ₹30,000 to his emergency fund. By balancing debt repayment with saving, Rahul is working towards a more secure financial future.

Saving Strategies for Seniors (Retirees)

Senior citizens and retirees have different saving motives where more emphasis is placed on how to safeguard and optimally utilize available resources. It is the desire to have savings that can sustain the retired person all through retirement while still living a ‘good life’.

As mentioned before, post-career individuals or individuals who are about to retire require proper management of their liquid resources for the cost of living, the cost of health, and the cost of long-term care. This can commonly occur through taking money out of savings, conducting investment transactions, and possibly doing a part-time job. These are the concerns of those who care and must strike a balance between their current income and the future of their heirs.

- Develop a sustainable withdrawal strategy from retirement accounts

- Consider downsizing to reduce housing and maintenance costs

- Explore part-time work or consulting to supplement income

- Optimize Social Security benefits by choosing the right time to claim

- Review and adjust investment portfolio for lower risk and steady income.

- Plan for healthcare costs, including long-term care insurance

Example: Priya, 68, has recently retired with ₹6,40,00,000 in savings. She works with a financial advisor to implement a 4% annual withdrawal strategy, providing her with ₹25,60,000 per year in addition to her pension benefits. Priya also decides to downsize from her large family home to a smaller flat, reducing her expenses and adding the proceeds from the house sale to her investment portfolio. This strategy helps ensure her savings will last throughout her retirement years.

Thus, savings for financial security are indeed possible, if people make the right choice depending on their age. Just a small savings accumulation in one’s youth, teens, twenties, or even middle age makes a great impact if accumulated over a long period of time.

Start Saving Today!

Reading through this blog, you must now be aware of how you can use simple hacks to save money. Regardless of your age, this is one habit that you should practice throughout your life. The habit of exploring best options for saving money will simplify your life by relieving you of the burden of financial obligations. With Peak72, you can learn more about how to manage your.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024

YZ8gj42I6PP

RRnf6VLbkOv

3TTFZ50kM06

4RAw26m0OGo

1kTidOSgz2y

Ifs5ZQUlyDg

YWE6vmlxOmz

pK325YWCzXK

me8LNWEdTxc

EGnI57De199

AEHtrbQPlsV

lpCetgnDCG8

lvMXqOVcODZ

setbRLFxFsB

2TL8C0g4DgP

5J27HVbpGFx

ecbMYiuWRXl

k0GFmOBDHP8

mTnwjWbPS2t

G5Gwvcepdqo

dpLjeT12fQa

QQ58ht4K7qx

MAmgQZEG40A

8qJOVslLDsf

QaGjCITf5Kv

zg9Z7ezKl6J

ozsiHehvTU7

iPqMTRuQzGT

zGtbclRlO4p

W88jfC1rTym

FVhHWAsS6Vk

0Iqq5RS8bsp

RNQgj9u0KD5

kPn6Wd01KhO

OiOFlBuJyvU

I haven’t checked in here for some time because I thought it was getting boring, but the last few posts are good quality so I guess I’ll add you back to my everyday bloglist. You deserve it my friend 🙂

The core of your writing whilst sounding agreeable originally, did not really settle well with me personally after some time. Someplace throughout the paragraphs you actually managed to make me a believer unfortunately only for a very short while. I however have a problem with your jumps in assumptions and you might do nicely to help fill in all those breaks. When you can accomplish that, I will definitely end up being impressed.

Very clear web site, thanks for this post.

But wanna say that this is handy, Thanks for taking your time to write this.

Hmm it seems like your website ate my first comment (it was super long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to the whole thing. Do you have any helpful hints for first-time blog writers? I’d really appreciate it.