- Finance

- July 5, 2024

Learn the Indian Tax System and Taxation in India

It goes without saying that every person has at least some knowledge about what a tax is, even if he or she does not understand this concept completely. But why is it important to understand the integrity of this process? You need to know where your hard-earned money, which you pay to the government, is going. Is it really helping the development of the country, or is it simply going in the wrong direction? To find answers, you must first understand the concept of taxation policies in India. And for that, you have this blog, as today we will discuss taxes and how they are structured.

What do You Understand by a Tax?

In simple terms, a tax is the money collected by the government from the people of a country and used for its development. There are three levels of government in India, which makes the indian tax system very well defined. They include the central government, state governments, and the local municipalities.

Central excise duty, income tax, and service tax are some of the taxes that are levied by India’s central government. On the other hand, income from farming is subject to state levies, as well as state alcohol duty, professional tax, land revenue, and stamp duty. Last of all, the local bodies demand Octroi charges, property taxes, and other taxes on services such as water and drainage.

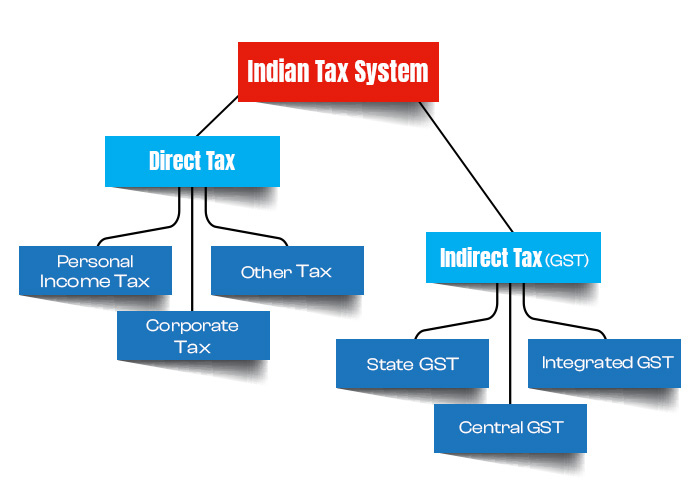

Types of Taxes

Commonly, there are two types of taxes in India. One is the direct tax, and the other is the indirect tax. The direct tax category includes capital gain tax, income tax, gift tax, etc., while indirect tax involves goods and services tax, value-added tax, service tax, and more.

Let’s understand them individually.

What is Direct Tax?

People and corporations both pay direct taxes. In India, these taxes are administered by the Central Board of Direct Taxes (CBDT) under the Department of Revenue, Ministry of Finance. Everyone is required to pay this each year, from April 1st to March 31st. According to the Income Tax Act of 1961, if your total annual income exceeds the minimal exemption limit, you are eligible to pay income taxes. You can also get tax incentives available under several parts of the Act.

Types of Direct Tax

The main types of direct taxes are:

Income Tax

Income tax is the most common form of direct tax in India, applicable to individuals, Hindu Undivided Families (HUFs), companies, and other entities.

- It is levied on the total income earned during a financial year

- Tax rates vary based on income slabs and taxpayer category

- Includes various deductions and exemptions under different sections of the Income Tax Act

Note: Try learning how to calculate your income tax to know more about it.

Example: Rahul, a salaried employee earning ₹8,00,000 per annum, falls under the 20% tax slab. After claiming deductions under Sections 80C and 80D, his taxable income reduces, lowering his overall tax liability.

Corporate Tax

This tax is levied on the profits earned by companies operating in India.

- Applicable to domestic and foreign companies

- Rates vary based on company turnover and other factors

- Subject to surcharge and cess

Example: ABC Ltd., a domestic company with an annual turnover of ₹250 crores, is taxed at 25% (plus applicable surcharge and cess) on its profits.

Capital Gains Tax

This tax is imposed on the profits or gains arising from the transfer of a capital asset.

- Divided into short-term (held for up to 36 months) and long-term (held for more than 36 months), capital gains

- Different rates apply based on the type of asset and holding period

Example: Priya sells shares she held for two years, making a profit of ₹1,00,000. This is treated as a short-term capital gain and taxed at 15%.

Securities Transaction Tax (STT)

STT is levied on transactions involving securities listed on recognized stock exchanges in India.

- Applicable to the purchase and sale of equity shares, derivatives, and units of equity-oriented mutual funds

- Rates vary based on the type of transaction

Example: When Amit buys shares worth ₹1,00,000 on the National Stock Exchange, he pays 0.1% (₹100) as STT.

Gift Tax

While there’s no separate gift tax in India now, gifts above a certain value are taxable under the Income Tax Act.

- Gifts exceeding ₹50,000 in a financial year are taxable

- Certain exceptions apply, such as gifts from relatives

Example: Meera receives a gift of ₹1,00,000 from a friend. This amount, being more than ₹50,000, will be added to her taxable income.

What is Indirect Tax?

The indirect tax is a tax imposed on the consumption of goods and services. It does not directly apply to a person’s income. Instead, he or she must pay the tax based on the price of the products or services purchased by the seller. The person paying the tax to the government and the person compelled to pay the tax are thus two separate people.

Types of Indirect Tax

The main types of indirect taxes are:

Goods and Services Tax (GST)

GST is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. It has largely replaced many indirect taxes in India.

- Implemented on July 1, 2017

- Comprises CGST (Central GST), SGST (State GST), UTGST (Union Territory GST), and IGST (Integrated GST)

- Different tax rates: 0%, 5%, 12%, 18%, and 28%

Example: When you buy a smartphone for ₹20,000, it typically includes 18% GST. The actual price of the phone is about ₹16,949, and ₹3,051 is the GST amount.

Customs Duty

This tax is levied on goods imported into India and, in some cases, on exported goods.

- Includes basic customs duty, additional customs duty, and other special duties

- Rates vary based on the type of goods and country of origin

Example: If you import a luxury watch worth ₹1,00,000, you might have to pay around 38.5% as customs duty, which amounts to ₹38,500.

Excise Duty

While most excise duties were subsumed under GST, they still apply to certain goods like petroleum products and alcohol.

- Levied on the production of goods, not on sales

- Rates vary based on the type of product

Example: When you buy petrol, a significant portion of the price (around ₹20-30 per liter) goes towards excise duty.

Value Added Tax (VAT)

VAT has largely been replaced by GST, but it still applies to a few items, like petroleum products, in some states.

- Levied at each stage of production and distribution

- Rates vary by state and product

Example: In states where alcohol is subject to VAT instead of GST, you might pay around 20-25% VAT on your purchase.

How to Reduce Tax on Salary

It is difficult for many individuals to cope with large slashes in salary, and thus, they are always on the lookout for ways to cut their spending. In this section, we will provide some of the possible ways one can minimize the amount of salary tax.

- Pay the premiums for your health insurance.

- Request a reduction in the amount of interest you pay on your home loan.

- Get a reduction in the amount of your rent.

- Make a contribution to the National Pension System

- Use the limit of 1.5 lakh under Section 80C

Quick Steps to Filing Taxes

- Gather the documents

- Read your Income Tax Return form

- Complete the online filing process, login, and register

- Navigate to the “e-File” page

- Select the assessment year and status

- Choose the Indian Tax Return form

- Fill out the ITR form

- Confirm the information that has been pre-filled in

- Submit or e-verify

So, are you Paying the Taxes on Time?

Being the largest source of income for the government, the importance of tax is not overrated. However, the Indian tendency to know things only at the surface level becomes a problem at times. Therefore, this blog might have helped you understand taxes in India and learn about the structure of the taxation system. This overview will either prepare you to evaluate your taxes, if you are a payer, or to begin your tax payment journey, if you are about to start.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

You are my aspiration, I possess few blogs and very sporadically run out from post :). “No opera plot can be sensible, for people do not sing when they are feeling sensible.” by W. H. Auden.

Utterly pent subject matter, Really enjoyed looking through.

Hello There. I found your blog using msn. This is an extremely well written article. I’ll be sure to bookmark it and come back to read more of your useful information. Thanks for the post. I will definitely comeback.

I’m not sure why but this website is loading extremely slow for me. Is anyone else having this problem or is it a issue on my end? I’ll check back later on and see if the problem still exists.