- Finance, games

- August 13, 2024

Financial Myths Debunked; What you Know About Finances and Money

What financial myths have you believed in the past? How has debunking it changed your approach to personal finance?

Financial literacy is a major concern in India, and there are very few people who have in-depth knowledge about finance. Furthermore, the lack of understanding and familiarity with basic financial information is particularly concerning. As a result of this havoc, what is worse is the knowledge circulated among them. The spreading of incorrect information and the propagation of myths rather than facts leads to wrong decision-making. So, what is important here? Of course, to give and get correct information from relevant sources so that everybody, be it a teenager, an adult, or maybe the elderly, does not have to struggle with their finances.

According to a 2022 comprehensive study by the National Council of Applied Economic Research (NCAER), approximately 75% of Indian adults have made at least one major financial decision based on incorrect information or misconceptions in the past year.

From this, we have concluded that an article is necessary to dispel the myths propagated by unknown sources and individuals. Therefore, this blog caters to those who are struggling with financial decisions and those who have encountered similar challenges in the past. For your convenience, we will try to dispel all the old or even new myths. So, stick to this blog and make your decisions with perfection.

Let’s Debunk Some Myths for you!

The existence of myths in the financial market is a fact. And what becomes important is to clean them. This will prevent future mistakes and help in take advantage of all government schemes.

Myth 1: Investing in real estate is always the safest and best investment.

Reality: It is possible for real estate to be a good business, but it may not always be the safest or best choice. Changes in the economy influence real estate markets, and home prices don’t always go up. Additionally, buying real estate usually requires a large sum of money that might not be easy to turn into cash.

Consider this: According to a report by Knight Frank India, residential property prices in many major Indian cities have seen sluggish growth in recent years, with some areas even experiencing price corrections.

Question: Is diversification important in investment strategy?

Answer: Absolutely! Diversification across the various asset classes allows for the distribution of risk and possible higher returns. Such types of securities as stocks, bonds, mutual funds, and real estate could be useful to balance out the portfolio.

Myth 2: You need a large income to start investing and become financially independent.

Reality: This myth can be quite damaging and discouraging for those who want to start investing early. It’s quite possible to begin investing with small amounts. Several mutual funds in India offer the convenience of investing as little as ₹500 per month through Systematic Investment Plans (SIPs).

“The best time to plant a tree was 20 years ago. The second-best time is now.” This old saying applies perfectly to investing. Starting early, even with small amounts, can lead to significant wealth accumulation over time due to the power of compounding.

Myth 3: Credit cards are always bad and lead to debt.

Reality: If you don’t use your credit cards wisely, they can put you in debt, but if you do, they can be very helpful when it comes to money. There are several good reasons to use credit cards. They can help build a credit score, offer rewards, and provide a financial cushion in emergencies.

But what is the key to using credit cards wisely? It’s important to use credit cards responsibly by paying off the entire balance every month, keeping your credit utilization below 30%, and selecting cards that suit your spending patterns and financial objectives.

Myth 4: The best way to save money is to keep it in a savings account.

Reality: Although savings accounts are generally considered safe, they typically provide low interest rates that may not be able to keep pace with inflation. Most Indian savings accounts offer interest rates between 2.70 and 3.50 percent as of 2023. But it’s important to remember that inflation rates have been higher in the past.

To truly grow your wealth, consider options like:

- High-yield savings accounts

- Fixed deposits

- Public Provident Fund (PPF)

- Equity-linked savings schemes (ELSS)

These options can offer better returns while still maintaining a degree of safety.

Myth 5: You don’t need to start personal finance and budgeting until you have a high-paying job.

Reality: People should begin the process of creating a budget and dealing with their income as soon as they start earning money, even if it is little. If you start good money habits early on, they will help you in the long run.

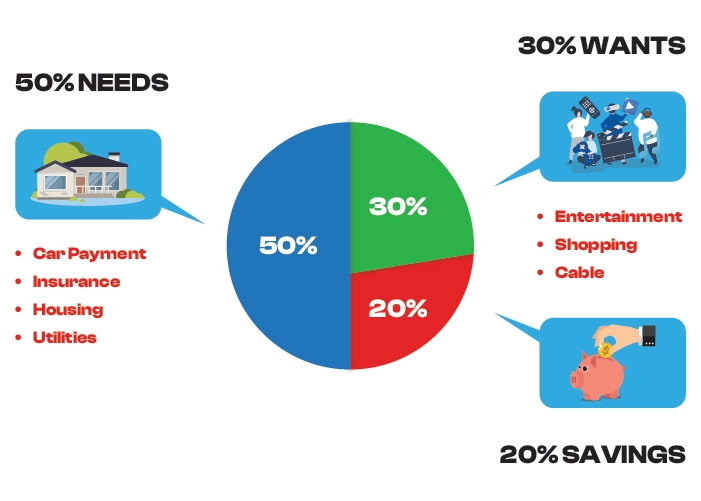

Use the 50/30/20 rule as a starting point:

- 50% of income for needs

- 30% for wants

- 20% for savings and debt repayment

Adjust these percentages based on your personal situation and financial goals.

Myth 6: You need specialized knowledge to start investing in the stock market.

Reality: Anyone can start investing in stocks, even if they don’t know a lot about them or have little knowledge. For people who are new to investing in stocks, mutual funds, especially index funds, can be a great way to get into the market without having to pick individual stocks.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett. This quote makes the point that discipline and patience are more important than complicated tactics when it comes to investing.

Question: How can someone with limited knowledge start investing in the stock market?

Answer: A good place to start is with index funds or mutual funds that have a lot of different investments. Focus on learning at your own pace and from reliable sources for a while. Getting help from a trained financial planner might also be a good idea.

Myth 7: Retirement planning can wait until your 40s or 50s.

Reality: This may be one of the costliest myths. Starting planning at an early age is not very complex in making a big corpus for the post-retirement life. Over time, the amount of compounding ensures that small and continuous investments that are made early in a person’s life, usually in the 20s and 30s, yield large returns.

For instance, if you start investing ₹5,000 monthly at age 25 with an average annual return of 12%, you could have over ₹3 crore by age 60. If you start at 35, you’d need to invest about ₹15,000 monthly to reach the same goal.

It becomes important for any person who wishes to create wealth and break free from the vice-like grip of poverty to properly analyze and disprove these myths. Remember that personal finance is not all about how to increase the amount of money you receive but about the proper management of the money you receive.

As you go through your financial journey, keep these myths out of your mind. Always learn more about personal finance, keep up with the latest economic news, and be ready to get help from a professional when you need it. No matter what their present situation is, anyone can build a strong financial foundation for themselves if they learn the right things and take the right steps.

Best Way to Save Money (Quick Look)

- Pay attention to how much you spend

- Make a financial plan

- Your savings should be automated

- Spend less on things that you don’t need

- Pay off your debts

Dump that Myth in the Dustbin!

In short, making a wrong decision can lead to significant stress, and recovering from that situation can be even more challenging. The myths discussed in this blog post will assist you in making an informed choice. Remember, financial stability is one of the most basic needs of today’s time, and that can never happen if you do not have even a basic understanding of the financial world.

To avoid falling into a debt trap or to enjoy the benefits provided by the government, you must understand the ABC of finance. While reading this blog, you may have encountered various myths that people mistakenly believed were true. Therefore, the significance of this work becomes clear. Share this blog with everyone who needs it, and for more information, go to Peak72finance.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024

PqA5ulVMlKh

Some times its a pain in the ass to read what website owners wrote but this internet site is really user friendly! .

That is very interesting, You’re a very professional blogger. I’ve joined your rss feed and stay up for in search of more of your fantastic post. Also, I have shared your web site in my social networks!