- Finance

- September 23, 2024

The Teen’s Guide to Smart Investing: Why Start Investing Early?

In your opinion, is it advisable for teenagers to invest their allowances or part-time job earnings in order to accumulate wealth early on? Or should they concentrate more on saving for all their current necessities?

Investing might seem like it’s only for adults, but honestly, it’s never too early to start learning about and getting into the financial markets. Teens today can start their journey to a stable financial future any day.

Financial education should be a must-have in high schools to help teens get ready for smart investing. Since that’s not happening, we’re here to help out with that gap. While reading this blog you will get to know why teens should consider smart investing, how they can get started, and what they need to know to make informed decisions that could shape their financial destinies.

Why teens should care about smart investing?

Do you remember a time when you took a risk and it paid off? How did that event change the way you think about putting money into your future and yourself?

As a teen, you may be wondering why you should even think about saving when you’re busy with school, extracurricular activities, and maybe even a part-time job. Here are some good reasons to think about investing:

Your time is worth a lot

Being a kid gives you time that no adult, no matter how rich, can buy. You still have years to go before you even think about retirement, so your savings have a lot of time to grow. When it comes to money, this long-term view can really help you.

The magic of compound interest

You can use this power of compound interest if you start early. You’ll get a good returns on both your original investment and the gains from previous years. This can help your wealth grow very quickly over time.

Opportunity to learn

If you start saving when you’re a teen, you can learn about money in ways that many adults still find hard. When you’re in your 20s or 30s, you’ll have years of real-life experience that will help you make smart money moves for the rest of your life.

Financial independence

Starting saving early, can make you reach financial independence a lot faster. It can give you a lot more choices later on, whether you want to buy a house, start a business, or retire early.

Developing discipline

Consistent spending helps you become more disciplined with your money and form good money habits that will last a lifetime. That way, you learn to plan ahead and make smart decisions about your money.

Understanding investment options

If you are a new investor, you must know the fundamental ways your money can be invested. Most new investors need to acquaint themselves with the following forms of investments. Each comes with its own set of potential rewards and risks:

Stocks

Every time you buy a stock, you are investing in a company; you become a partial owner of a business. Many people find stocks fascinating since they are capable of earning high returns for the added risk involved. However, stock prices are not static; they are subject to changing depending on the performance of the company, the status of the market, natural disasters, or any event that happens globally.

Pros: Opportunity to get high revenues; you own shares in the companies of your choice.

Cons: higher risk, should involve some research, and should be monitored.

Mutual funds and ETFs (Exchange-Traded Funds)

Holding these investment vehicles allows many investors to pool in their funds to purchase a variety of stocks, bonds, or other securities. They are run by qualified fund managers and provide immediate diversification to investors’ portfolios.

Pros: Managed by professionals, diversified, and less risky than investing in single stocks.

Cons: They allow you to pay for management fees and may give you less direct control over specific investments.

Bonds

These are credit facilities that you extend to a company or government. The borrower undertakes to repay the sum of money borrowed plus the agreed amount of interest at the agreed time. Bonds are relatively safer than stocks and, at the same time, most often yield lower rates of return.

Pros: Stable cash inflows and less risky when compared to stock investment.

Cons: Small potential returns that vary according to the changes in the interest rate.

Government securities

These are debt instruments that are floated in the market by the Reserve Bank of India on behalf of the Government of India. They are generally regarded as bearing very little risk.

Pros: Extremely low risks, with certain and assured returns.

Cons: The return on investment that is achieved from fixed-income securities is lower compared to other investment sectors.

Public Provident Fund (PPF)

This is a savings scheme for long-term financial planning instituted by the government of India. It extends tax exemptions under Section 80C of the Income Tax Act.

Pros: Savings without taxes, state guarantees.

Cons: Sufficient lock-in period (15 years), moderate level of returns in comparison to equity.

Fixed Deposits (FDs)

These are the very safe instruments of investment being provided by the banks in which one can invest a certain sum for a fixed tenure for a certain rate of interest that is agreed beforehand.

Pros: High returns for sure, low risks.

Cons: A lower return as compared to market-linked investments; interest earned is also taxable.

National Savings Certificate (NSC)

This is a financial plan that is defined by generating a fixed income scheme, fully guaranteed by the Indian government.

Pros: Anticipated profits, tax exemptions that come with Section 80C of the Indian taxation laws.

Cons: Lesser profits in comparability to market-susceptible investments.

Real Estate Investment Trusts (REITs)

These let you invest heavily in real estate without physically acquiring stakes in properties. REITs invest directly in real estate and invest principally in income-generating properties; they distribute most of their taxable income as dividends to shareholders.

Pros: Awareness of real estate business, possibility to receive high dividends.

Cons: High interest rate sensitivity, possibilities of high fees.

The power of starting early: a real-life illustration of the notion above is.

Let’s check out a real-world example that shows why it’s good to start investing young in India:

Picture two friends, Aarav and Priya. Aarav kicks off his investment journey by putting in ₹ 1,000 every month when he’s 18, while Priya decides to wait until she’s 25. If we assume they both see an average annual return of 12% (which is a solid expectation for Indian stock markets), here’s how their investments would stack up by the time they hit 60:

- Aarav (starting at 18): ₹ 3,02,71,645

- Priya (starting at 25): ₹ 1,24,27,805

Even though Aarav only invested for 7 more years than Priya, that extra time in the market made his final amount more than double. This really emphasizes the amazing impact of compound interest and how time in the market matters.

Now, let’s level it up a bit. If Aarav bumped up his monthly contribution by just₹ 500 each year (so he’d invest ₹1,500/month at 19, ₹ 2,000/month at 20, and so on), by age 60, he’d end up with an incredible₹ 8,98,60,492. This proves that even small increases in your investments over time can lead to stunning outcomes.

Keep in mind, these are just examples, and actual returns can differ. It’s always a smart move to speak with a financial advisor and do your homework before diving into any investment decisions.

Balancing risk and reward: what steps can you take today to start working towards it?

You got to know that every investment comes with some risk. Typically, the chance for bigger returns means higher risk too. As a younger investor, you might be more okay with risk since you have time to bounce back from any quick losses. But finding a balance that feels right for you is super important.

Here are some handy tips to keep risk in check:

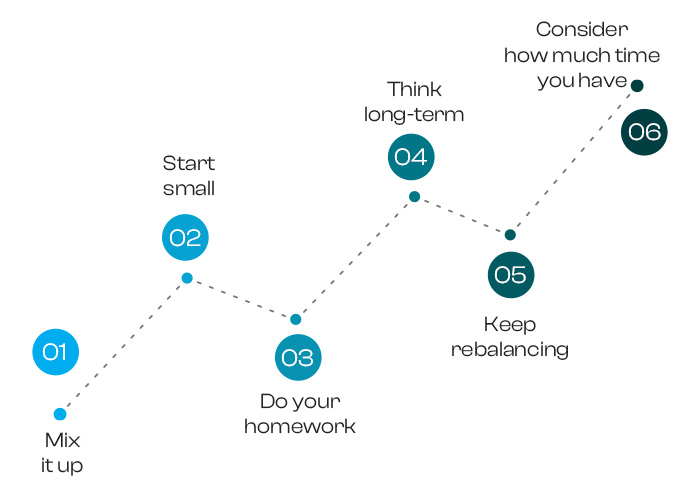

Mix it up

Don’t keep all your eggs together. Spread your cash over various types of assets, sectors, and even different places. This way, if one investment doesn’t do great, it won’t hit you too hard.

Start small

No need to break the bank to start investing. Lots of brokerages let you buy tiny share of stocks or ETFs, so you can get going with just a few bucks.

Do your homework

Before you throw money at a company, get to know its business, money situation, and growth chances. Check out things like sales growth, profit margins, debt amounts, and what makes it stand out against competitors.

Think long-term

Don’t freak out over short-term changes in the market. Historically, the stock market has mostly gone up over longer periods, even with those short-term bumps.

Keep rebalancing

As some of your investments grow faster than others, your mix can get a bit off. Regularly check in and tweak your investments to keep the level of risk where you want it.

Consider how much time you have

Usually, you can handle more risk if you have more time before you need cash. You might want to switch your investments to better ones as the time to use them draws near.

Building your investment strategy: lessons to learn from the approach to smart investing

Creating a solid investment strategy is key for hitting those long-term goals. Here are some tips to help you build your own game plan:

Figure out your goals

What are you saving for? College? A new ride? Retirement? Your objectives will shape your investing decisions and how long you’ll be in the game.

Know your risk-management tolerance

How much market ups and downs can you take before freaking out? Be real with yourself – there’s no sense in going for a high-risk strategy if it’s just going to give you sleepless nights.

Decide on your asset allocation

Considering your goals and how brave you feel with risk, figure out how to spread your investments across stocks, bonds, and other types of assets.

Pick your investments

Within each asset class, choose exactly what you want to invest in. This could be individual stocks, mutual funds, ETFs, or a mix of these.

Set up a regular investment schedule

Decide how much cash you can put in regularly and stick with it. Even tiny amounts can snowball over time.

Keep an eye on things

Check your investments regularly, but don’t get too caught up in daily ups and downs. Change your strategy if your goals or life situation shifts.

Watch out for these common mistakes

- When you start your investing adventure, keep an eye out for these typical blunders:

- Watch out for claims of making money overnight. Real investing usually takes time.

- Don’t throw your money into something just because it’s popular or someone urged you to. Always do your own homework.

- Big fees can seriously nibble away at your profits over time. Keep an eye on those expense ratios and trading fees.

- Letting fear and greed take the wheel can lead to bad choices. Stay cool and stick to your game plan.

- Don’t pour all your cash into one stock or area, even if it looks super promising.

- Keep in mind how taxes could impact your returns, especially as your income grows.

Your financial journey begins today

Investing as a young person isn’t just about making cash—it’s also about paving the way for long-term success and picking up some important life skills.

Your first investment, no matter how tiny, could kick off a lifelong journey toward financial smarts and stability. It’s totally fine to start small and then bump up your investments as you learn and feel more confident with the whole thing.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance, games

- September 20, 2024

Heya i am for the first time here. I found this board and I find It truly useful & it helped me out much. I hope to give something back and help others like you helped me.

I really appreciate this post. I?¦ve been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

Whereas the area race of the 1950s and 1960s was an thrilling time to be alive, humanity has by no means lived by means of a extra quick-paced period of house exploration and human spaceflight.

I’m really enjoying the theme/design of your website. Do you ever run into any web browser compatibility issues? A small number of my blog audience have complained about my site not operating correctly in Explorer but looks great in Chrome. Do you have any recommendations to help fix this issue?

Hi! Do you know if they make any plugins to assist with Search

Engine Optimization? I’m trying to get my site to rank for some targeted keywords but I’m not seeing very good results.

If you know of any please share. Thank you! You can read

similar art here: Blankets

Hi, i read your blog from time to time and i own a similar one and i was just curious if you get a lot of spam remarks? If so how do you stop it, any plugin or anything you can suggest? I get so much lately it’s driving me mad so any assistance is very much appreciated.

6cu5uo

sbyru3

primer-8

Nice post. It’s very well organized and quite informative. Stick with it.