- Finance

- June 25, 2024

Take Control of Your Finances: Budgeting Strategies for All Income Levels

It is important to note that income is not static, and each person earns differently even within a fiscal year. Thus, controlling money can also be, in equal measure, dependent on the specific situation at hand. For example, an individual who earns a lot of money may have more freedom to use the money for his or her needs than an individual who earns a tiny amount. However, both occupational status positions are similar in that they require resource control and rationing, as well as setting aside a small amount for savings.

So, if you’re looking for budgeting strategies to follow, you’ve come to the right place. Today, in this blog, we will discuss financial solutions for all income levels and learn how to budget and save money for your personal growth.

Budgeting Strategies for Different Income Levels

What specific strategies do you currently use for managing your finances? Do you have a clear vision of your savings goal? How well do you stick to your financial plan? One key approach is to budget based on income. Let’s discuss and explore ways to improve your financial well-being.

Budget for Low- Income People

People with low incomes often face a multitude of financial challenges. They have to double-think every time they buy something. Occasionally, they fail to meet even their basic needs. Therefore, budgeting for this section of people becomes compulsory. But how can you do so? Begin by identifying all of the ways you make money. Include everything: your primary job wage, extra money from part-time jobs, and even a small income from side hustles.

Once you know how much money you have in your hand at the end of the month, you can easily allocate all the expenses and know how much you can save and spend. Focus more on fulfilling urgent needs. Don’t spend on unnecessary things. Keep a lump-sum amount for your future fund.

Budget for Irregular Incomes

Irregularities in income are a very difficult challenge for people to go through. This is the problem of freelancers or employees receiving late salaries. Here, managing the money becomes a difficult task. So, how do we solve this problem?

Start by determining your average monthly income using either the lowest amount you earned in the past year or by calculating the average of your monthly earnings over the last year. Choose the method that best reflects your financial situation. Once you have your average monthly income, list all your regular expenses, including fixed costs like internet bills, variable expenses like electricity, and leisure costs such as streaming subscriptions. Don’t forget to include debt repayments in your expense list. The key is to account for every rupee you spend.

Next, subtract your total expenses from your average monthly income. If you have a surplus, allocate it towards savings, investments, or additional debt repayments. However, if your expenses exceed your income, you’ll need to reassess your spending habits and find ways to reduce costs or increase your earnings.

This might involve cutting back on non-essential expenses or seeking additional income sources. By following these steps, you can create a realistic budget that helps you manage your fluctuating income effectively and achieve your financial goals.

Budget for Comparatively High Income

Life is a little easier here, as they don’t have to deal with the same problems that the above two categories face. However, with great wealth comes great responsibility. Budgeting is crucial for them, as improper money management can lead to significant consequences.

Investments are the best way to grow your money. As such, it’s no surprise that individuals often consider investing as part of their financial strategy. With the potential for significant returns, people should keep a portion of their income specifically for long-term investment purposes. Since the opportunities for saving more here are very high, they can think about keeping aside a substantial amount for their retirement as well. This will secure your future, so you don’t have to think about any sort of emergency. Additionally, using online budgeting tools can help you manage and improve your investments effectively.

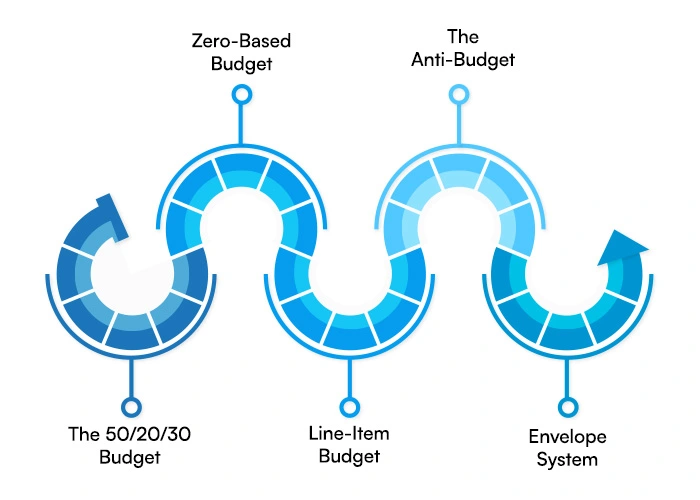

5 Must-Know Strategies for Managing your Money

The 50/20/30 Budget

The 50/20/30 budget is a simple and effective financial planning strategy that can be adapted by anyone looking to save. This approach divides your after-tax income into three main categories:

50% for Needs: This covers essential expenses like rent or mortgage, groceries, utilities, and transportation.

20% for savings: Allocate this portion to building an emergency fund, investing in mutual funds, or contributing to retirement plans like PPF or NPS.

30% for Wants: This category includes discretionary spending on entertainment, dining out, shopping, or hobbies.

By following this budget, you can ensure a balance between meeting necessary expenses, saving for the future, and enjoying life’s pleasures while maintaining financial stability.

Zero-Based Budget

The zero-based budget is a comprehensive financial planning method that can be effectively applied. This approach requires you to allocate every rupee of your income to specific expenses, savings, or financial goals, ensuring that your income minus expenses equals zero.

Start by listing all your income sources, then categorize your expenses, including essentials like rent, groceries, and utilities, as well as discretionary spending like entertainment and shopping. Don’t forget to include savings for emergencies, investments, and long-term goals like children’s education or retirement.

This method helps you gain complete control over your finances, eliminate unnecessary spending, and prioritize your financial objectives, leading to better money management and financial stability.

Line-Item Budget

A line-item budget is a detailed financial planning method well-suited for people of all income levels. It involves listing every expense category as a separate line item, providing a comprehensive overview of your spending.

Start by categorizing expenses, such as:

- Housing (rent/EMI, maintenance)

- Utilities (electricity, water, gas)

- Groceries and household items

- Transportation (fuel, public transport)

- Personal care (grooming, healthcare)

- Education (school fees, tuition)

- Entertainment and dining out

- Savings and investments (PPF, mutual funds)

This budget helps you track spending in each category, identify areas where you might be overspending, and make informed decisions about where to cut back or allocate more funds. It’s particularly useful for families looking to optimize their monthly expenses.

The Anti-Budget

The anti-budget is a neat-and-tidy approach to managing money, which might entice all the people who do not enjoy the stringency of the conventional budgeting system. Instead of meticulously tracking every expense, this strategy focuses on two key steps:

Pay yourself first: Set aside a fixed percentage (e.g., 20–30%) of your income for savings and investments as soon as you receive it. This could include contributions to PPF, mutual funds, or fixed deposits.

Spend the rest freely: Use the remaining amount for all your expenses without strict categorization.

This method encourages consistent saving while allowing flexibility in spending. It’s ideal for those who find traditional budgeting tedious but still want to ensure financial stability and growth.

Envelope System

The envelope system is a practical budgeting method that can be easily adapted. Here’s how it works:

- Categorize your expenses (e.g., groceries, utilities, entertainment).

- Create envelopes for each category.

- When you receive your salary, withdraw cash and distribute it among the envelopes according to your budget.

- Use only the cash from the relevant envelope for each expense. This system helps control spending by providing a tangible limit for each category. For example, allocate ₹5000 for groceries in one envelope, ₹2000 for entertainment in another. Once an envelope is empty, you’ve reached your limit for that category.

It’s particularly effective for managing discretionary expenses and avoiding overspending.

Money Management Tips for Beginners

General Tips

- Review on a regular basis

- Set up automatic savings and bill payments

- Take advantage of free entertainment

- Keep track of everything

Low Income

- Pay attention to existing needs

- Seek out assistance

- Participate in the gig economy

Mid Income

- Reduce your debt

- Make investments for the future

- Make preparations for larger expenses

High Income

- Make the most of your retirement savings

- Invest for growth

- Give to charitable organizations

Take Charge of Your Bank Account!

Remember, success requires finding and sticking to a reliable system. Just reading the strategies won’t help you; implementing them will. Spend wisely according to your income, as society’s influence might not work here. Applying a budgeting strategy that is applicable for a person earning ₹30,00,000 per year and owning a house would not be the same as applying a budget for a fresher who just started their job. A clear vision of your savings goal can only protect you from future financial dangers.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024

Great post on money management tips. It’s impressive how you break down budgeting in such a practical way. Quick question: do you have any suggestions on how to stay motivated during long-term savings plans? Sometimes sticking to a budget feels tough. Thanks!

Eszter

At this time it sounds like Drupal is the best blogging platform available right now. (from what I’ve read) Is that what you are using on your blog?

I really like your writing style, superb information, thankyou for putting up : D.