- Finance

- June 24, 2024

Turn Pennies into Profits: Learn the Power of Compound Interest

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Albert Einstein

The following quote best sums up the meaning and crucial role of compound interest, which Einstein described as remarkable. We all learned about compound interest in school, but we never truly grasped its power until now, when we are making money for ourselves and want our money to double. It is important in all situations and for everyone—whether it’s teenagers learning the formulas or adults practically applying them. So, now that we’ve convinced ourselves of the importance of compound interest, let’s delve deeper into the details, but first, we’ll start with the fundamentals, such as defining compound interest.

What is Compound Interest?

Compound interest is interest that is applied to both the initial principle of an investment or loan and any accrued interest from previous periods. In other words, compound interest occurs when you earn or pay interest on your interest. It can work in your favour when you are an investor or saver, as it amplifies your returns and helps your money grow faster. However, it can also work against you if you are a borrower, as it can significantly increase the total amount you owe over time, making it more difficult to pay off your debts.

How does Compound Interest Work?

Compound interest is calculated by multiplying the initial loan amount, or principal, by one plus the annual interest rate raised to the power of the number of compounding periods, then subtracting the principal.

Let’s understand how to calculate compound interest in the simplest way possible.

Imagine you have invested Rs 1,000 in a savings account that offers an annual interest rate of 10%. How much will your investment be worth after 5 years?

To determine the value of an investment after 5 years with an annual interest rate of 10%, we can use the formula for compound interest:

Where

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial amount of money).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the number of years the money is invested for.

For this scenario

- P=₹1,000P = ₹1,000P=₹1,000

- r=0.10r = 0.10r=0.10

- n=1n = 1n=1 (since the interest is compounded annually)

- t=5t = 5t=5

Putting in these values, we get

Therefore, after 5 years, your investment will be worth approximately Rs 1,610.51.

The Power of Compound Interest

Compound interest is a force that can turn even small investments into substantial wealth over time. The calculation we just went through illustrates the magic of compounding in action. With an initial investment of just Rs 1,000 and a modest annual interest rate of 10%, the power of compounding transforms that modest sum into Rs 1,610.51 after five years.

This growth may not seem extraordinary at first glance but consider the implications over longer periods. If you let that investment continue to compound at the same rate for another five years, it would grow to Rs 2,594.12. And after 20 years, that initial Rs 1,000 investment would have amplified into Rs 6,727.50 – nearly a seven-fold increase!

The true power of compound interest lies in its ability to accelerate growth exponentially over time. It’s a snowball effect that starts slowly but gathers momentum as it rolls along. The earlier you start investing, the more time your money has to compound and grow, ultimately leading to remarkable wealth accumulation.

Whether you’re saving for retirement, a child’s education, or any other long-term goal, understanding and harnessing the power of compound interest can be a game-changer. By making consistent contributions and allowing the compounding process to work, even modest investments can potentially grow into substantial sums over the years.

How often does Your Money Grow?

An account receives interest additions at specific intervals, known as compounding periods. You can compound interest annually, semi-annually, quarterly, monthly, daily, continuously, or on any other basis.

An account may accumulate interest daily, but it won’t receive credit until once a month. The account doesn’t start earning further interest until it credits the interest, adding it to the existing balance. During the process, financial instruments typically use standard compounding frequency plans.

Calculating Compound Interest

Compounded interest calculation by hand can be labour-intensive because interest on the principal and interest amounts must be calculated annually.

To find out how much compound interest you will earn on your investment, use an online calculator known as a compound interest calculator. It also shows the maturity value of your investment.

By using it, you can do compound interest calculations automatically. All you have to do is enter the invested amount, rate of return, and duration into the calculator to determine the maturity value.

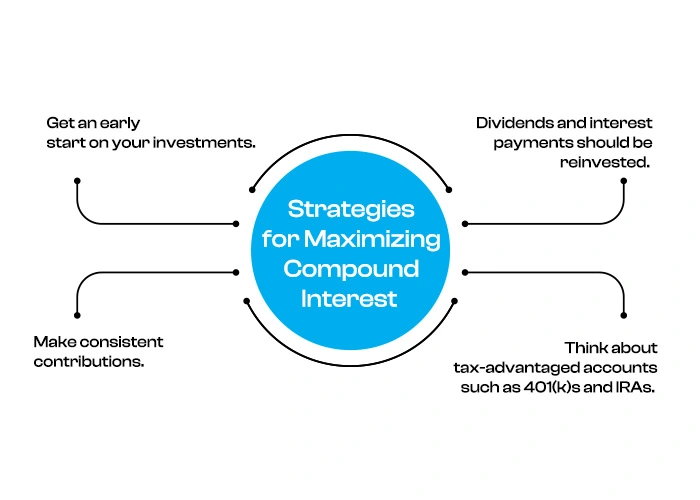

Strategies for Maximizing Compound Interest

-

Get an early start on your investments.

Starting early allows more time for your investments to compound and grow exponentially. For example, if you invest Rs 8,00,000 at age 25 and earn 8% annually, it will grow to over Rs 1,73,60,000 by age 65. However, if you wait until age 35 to invest the same amount, it will only grow to around Rs 80,00,000 by age 65.

-

Make consistent contributions.

Making regular, consistent contributions can significantly boost the power of compounding. For instance, if you invest Rs 40,000 per month starting at age 25, earning 8% annually, you’ll have over Rs 12,00,00,000 by age 65, even though you’ve only contributed around Rs 1,92,00,000 from your own pocket.

-

Dividends and interest payments should be reinvested.

Reinvesting your dividends and interest payments instead of taking them as income allows those funds to compound and grow over time. According to calculations, reinvesting dividends can potentially increase your overall returns by as much as 40% over the long run.

-

Think about tax-advantaged accounts such as 401(k)s and IRAs.

Investing in tax-advantaged accounts like 401(k)s and IRAs can turbocharge the effects of compounding by allowing your money to grow tax-deferred or potentially tax-free. For example, contributing Rs 4,80,000 annually to a Roth IRA from age 25 to 65 could result in over Rs 8,00,00,000 at retirement, assuming an 8% annual return.

Pros and Cons of Compound Interest

Weighing the pros and cons of anything is equally important. So before making any financial decisions, let’s consider the potential benefits and drawbacks of compound interest.

Pros

Compound interest can be mutually beneficial for building up wealth through savings and investments. Indeed, it benefits you more as your returns multiple, resulting in ever-increasing returns on your investment over time.

Furthermore, it mitigates wealth erosion factors such as inflation, which depreciate wealth, by maintaining its value through mutual cancellation. In addition, by making a rounded-up payment on all loans and creditors, compounding can once again work in your favour as you pay less on the total due interest.

Cons

On the flip side, interest costs could also be detrimental to consumers who pay only the applicable interest on high-interest loans or credit card debts. In the same vein, if you only pay the bare minimum, the balance may increase rapidly and send you into a ‘debt cycle.’

Finally, unless invested in a tax-sheltered annuity, all compound interest returns are taxable. It can be more complex than simple interest, often necessitating the use of an online calculator.

The Final Verdict

The principle of compound interest is a very important aspect of any given economy, so any individual must understand and apply it correctly. Constant and steady investments made over a long period also help in amassing significant amounts of money since such investments involve a reinvestment of profits earned compounded annually.

Be the first to review “Message Financial Board Game Cancel Reply

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024

I gotta bookmark this web site it seems handy very useful

I am usually to running a blog and i really recognize your content. The article has really peaks my interest. I’m going to bookmark your site and keep checking for brand spanking new information.

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

I absolutely love your blog and find most of your post’s to be just what I’m looking for. can you offer guest writers to write content to suit your needs? I wouldn’t mind composing a post or elaborating on some of the subjects you write related to here. Again, awesome web site!