- Event

- April 3, 2024

Mastering the Buffett Way: Investment Strategies from the Oracle of Omaha

Warren Buffett, a titan of the financial world, has built an enviable fortune exceeding $90 billion through astute investments. His journey from a young entrepreneur in Omaha, Nebraska, to the chairman of Berkshire Hathaway, one of the globe’s most valuable companies, offers invaluable lessons for anyone looking to emulate his investing success. Let’s explore the principles and strategies that have guided Buffett’s investments and how they can be applied by aspiring investors.

The Early Years of a Financial Prodigy

Born in 1930, Buffett’s knack for business emerged early. He was industriously making money by installing a pinball machine in a local barber shop during his teenage years, soon expanding his venture with more machines and businesses. His encounter with Benjamin Graham’s “The Intelligent Investor” at 19 shaped his investment philosophy profoundly. Buffett’s dedication led him to Columbia University, Graham’s teaching ground, setting the stage for his investment career. By 1956, Buffett was ready to chart his own course, laying the foundation for what would become Berkshire Hathaway.

Understanding Buffett’s Investment Ethos

Buffett’s approach is deeply rooted in the value investing principle, focusing on companies undervalued by the market but possessing strong fundamentals. He emphasizes long-term holdings, often “forever,” steering clear of speculative short-term trading. This philosophy challenges the efficient-market hypothesis, which argues that stock prices always reflect all available information. Instead, Buffett demonstrates through his record the potential to identify undervalued stocks.

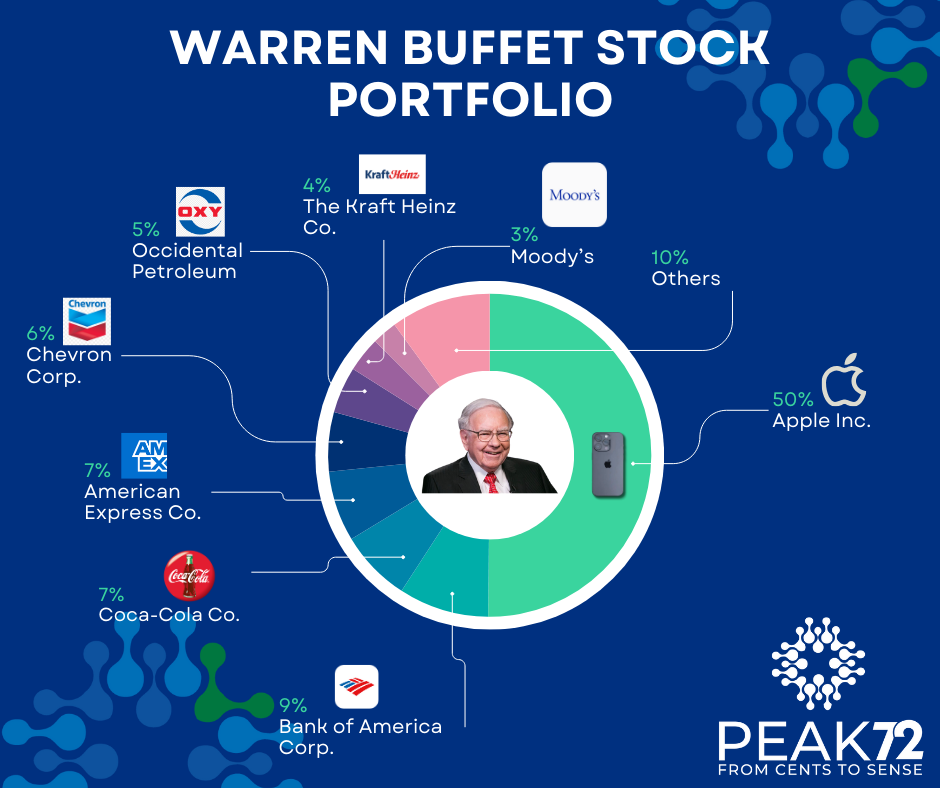

Buffet’s Portfolio

The Art of Identifying Investment Opportunities

“Investment students need only two well-taught courses –– How to Value a Business, and How to Think About Market Prices.”

– Warren Buffett

How does Buffett find investment opportunities? To find good companies, you should rigorously evaluate them through an understanding of their business and market. Buffett stresses knowing your “circle of competence”: the area in which you make good decisions. For example, he won’t invest in the technology sector because he doesn’t think he’s able to make good decisions about which companies will exist in 20 years. Your area of expertise might be small and that’s fine: what really matters is that you stick to investment decisions in that area.

“What counts for most people in investing is not how much they know, but rather how realistically they define what they don’t know.”

– Warren Buffett

And how does he value a company? Buffett uses a definition of valuation adapted from the American economist John Burr Williams. In Buffett’s words:

“The value of any stock, bond or business today is determined by the cash inflows and outflows — discounted at an appropriate interest rate — that can be expected to occur during the remaining life of the asset.”

– Warren Buffett

He looks for companies with great prospects for future earnings – though establishing that isn’t easy.

How does he do it? There are a few factors Buffett uses to judge a company’s future. If the company has performed consistently well with high profit margins and minimal debt then that bodes well. He also looks for companies with defensible competitive advantages – he calls them “moats” – as these keep a company afloat ten, twenty, or even fifty years from now (with Buffett’s nigh-on permanent investing horizon, that’s particularly important). The other main thing he looks at is the company’s management – more on that in the next session.

So if he finds a good company, he invests? Not always. Market prices are equally important. Once he calculates a company’s value, he wants to buy shares at a price significantly less than that value. He requires a “margin of safety” gap between the actual value and trading value to justify the risk of owning the company. If the company is trading just 1% below its value, it might not be worth the risk. For Buffett, no deal is better than a bad deal.

Because he’s looking for irrationally low prices, Buffett is a big fan of two traditional terrors: falling prices and high volatility. Falling prices create opportunities for bargain buying. And volatility means prices are flying around so there’s a greater chance the wrong price is attached to the stock.

“A wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses.”

– Warren Buffett

Buffett’s ideal manager

How does he find good managers? Buffett wants a manager with the mindset of an owner. He needs them to be looking out for shareholders, not themselves, and to think with long-term horizons. When he acquires a company, the managers are told to treat the company as if it’s their only asset, one that they have to hold onto for a hundred years.

Buffett looks for signals that indicate managerial qualities. If a company’s accounting is somewhat suspect or overly complicated, that’s a bad sign.

“When managements take the low road in aspects that are visible, it is likely they are following a similar path behind the scenes.”

– Warren Buffett

The same goes for a manager’s public statements: Buffett values clear and candid discussion of a company over insubstantial corporate jargon. He thinks it indicates trustworthiness:

“Unintelligible footnotes usually indicate untrustworthy management. If you can’t understand a footnote or other managerial explanation, it’s usually because the CEO doesn’t want you to.”

– Warren Buffett

His managers should be realistic in their goals for the company, too. He thinks CEOs shouldn’t predict growth rates, and he suspects those who regularly boast about their earnings success. It’s very hard to achieve consistent high growth and companies that claim to be achieving it may be hurting parts of their business to hit ambitious targets.

“Managers that always promise to ‘make the numbers’ will at some point be tempted to make up the numbers.”

– Warren Buffett

Practical Investment Advice from Buffett

Buffett advises against holding large cash reserves due to inflation’s erosive effect. He champions low-fee index funds for most investors, citing their potential to capture market growth over time. However, for those willing to do the legwork, selecting a handful of businesses that one thoroughly understands and believes in can be more rewarding. He argues for concentrated investments in these chosen few, emphasizing quality over quantity and the importance of a long-term investment horizon.

Emulating Buffett’s Path

Buffett’s success is not just about picking stocks; it’s about adopting a mindset that prioritizes fundamental value, patience, and an ethical approach to business. By understanding his principles and carefully applying them, investors can navigate the market with greater confidence and potential for success.

“I cannot understand why an investor…elects to put money into a business that is his 20th favorite rather than simply adding that money to his top choices—the businesses he understands best and that present the least risk, along with the greatest profit potential.”

– Warren Buffett

The essence of Warren Buffett’s wisdom, drawn from decades of successful investing, illustrates that while the market may be complex, the principles of sound investment remain straightforward. Investors who adopt a disciplined, value-focused approach, paying close attention to the fundamentals of the companies they invest in, can aspire to not just financial success but also to achieve a deeper understanding of what it means to invest wisely.

RELATED POSTS

- Finance

- September 30, 2024

- Finance

- September 26, 2024

- Finance

- September 23, 2024